Demo video: HR Accounting

What It Does

The HR Accounting module, developed by Viindoo, is a comprehensive solution built on the Odoo platform. It enables businesses to tightly integrate accounting and HR. This module helps manage departmental costs, employee payments, and automated financial allocations, ensuring accuracy and transparency in financial data.

Key Features

- Configure information to manage costs by department

- Expense Account:

- Assign a default expense account to each department to record costs such as salaries, operations, or other related expenses.

- Classify expenses by department to facilitate financial reporting and budget control.

- Analytic Account:

- Automatically create an analytic account when a new department is created.

- Sync the analytic account name with the department name for detailed cost tracking.

- Department Data Synchronization:

- Automatically update the analytic account name when the department name changes.

- Ensure each analytic account is linked to only one department to avoid errors.

- Set up advance accounts and manage employee payments

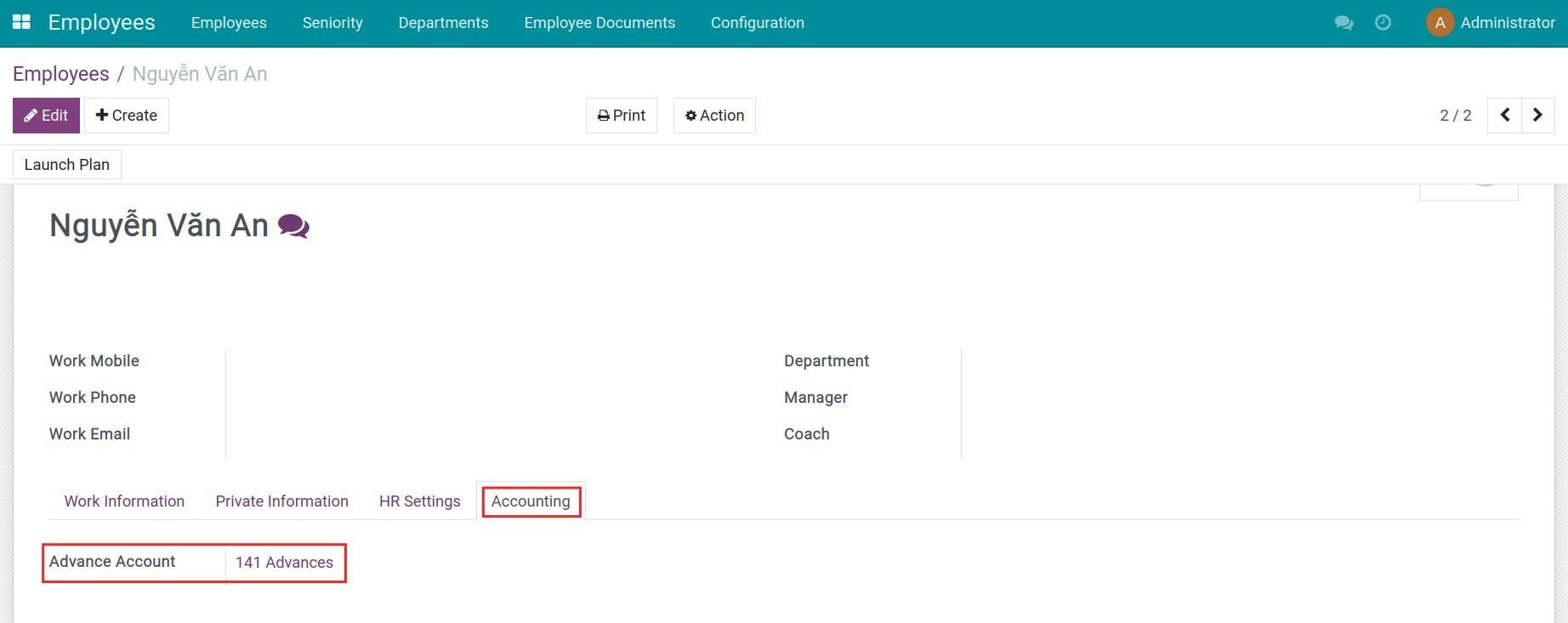

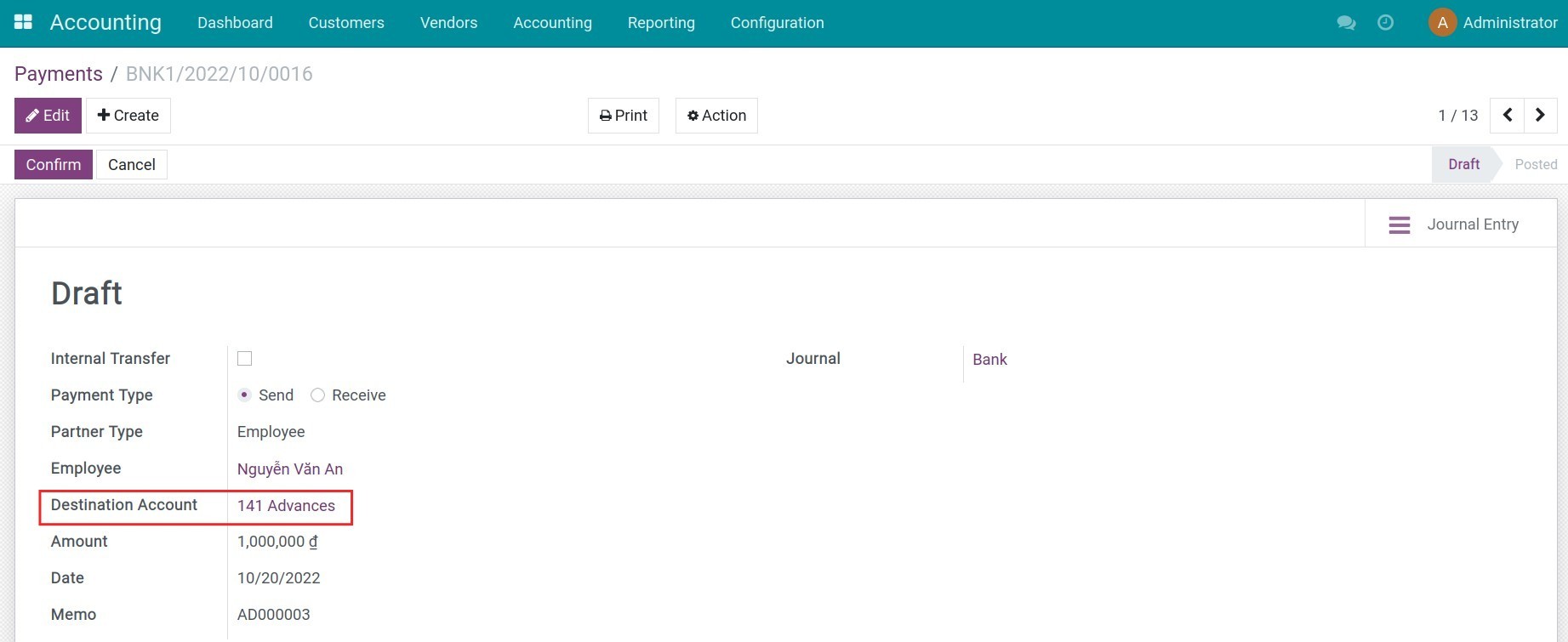

- Advance Account:

- Assign a personal advance account to each employee to track and manage prepayments.

- Ensure effective management of receivables from employees.

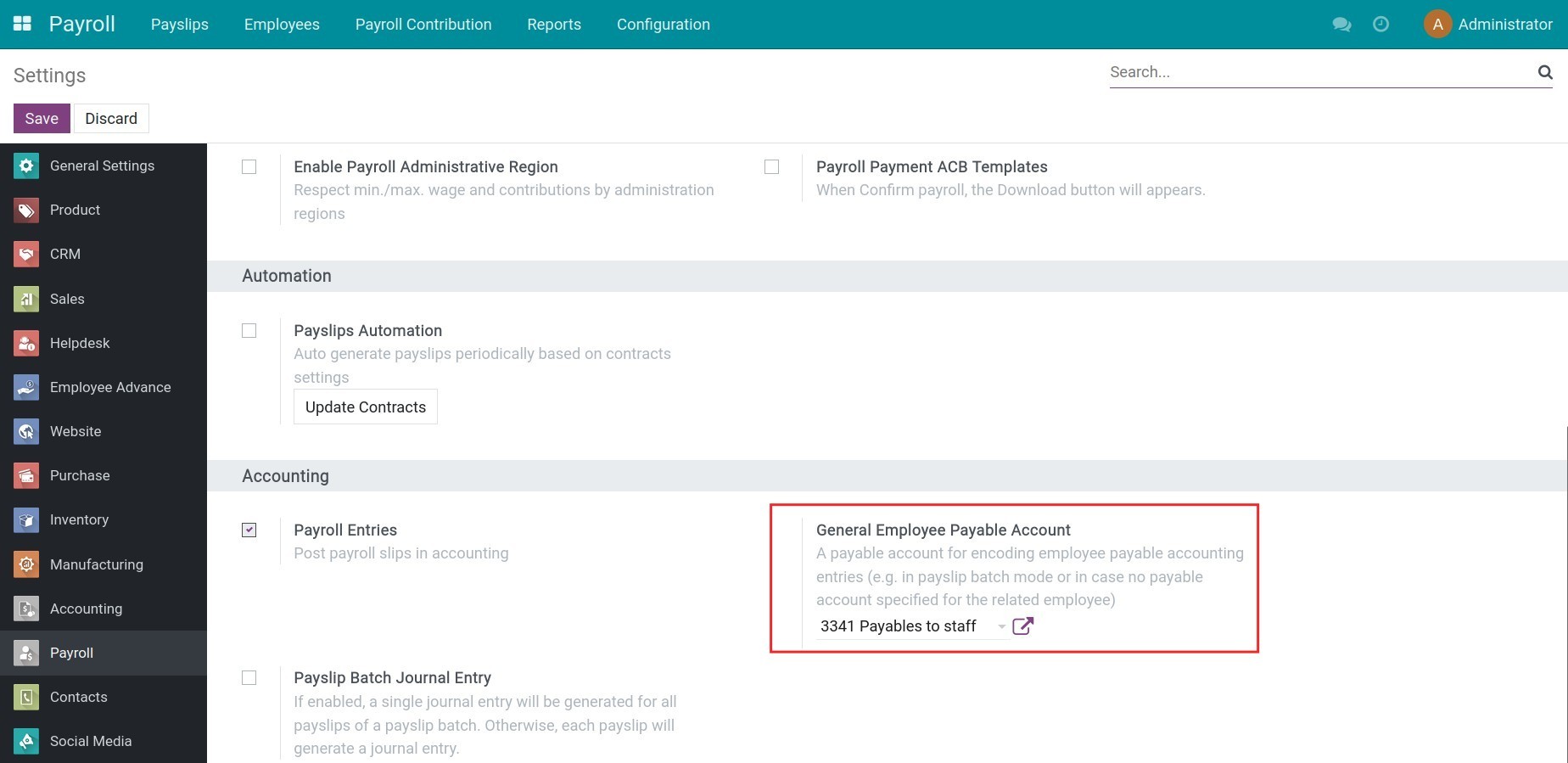

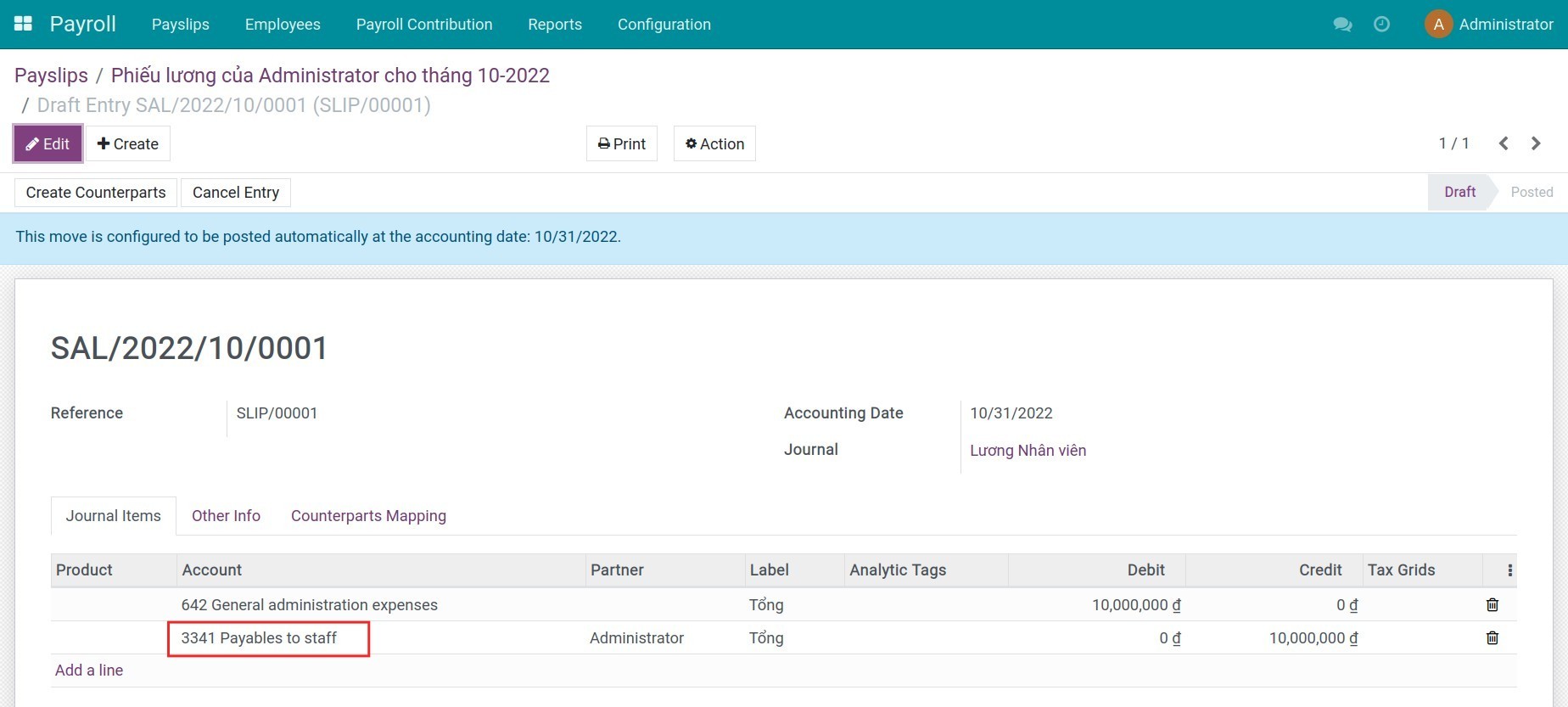

- Payable Account:

- Configure a payable account for employees to handle payments such as salaries, bonuses, or allowances.

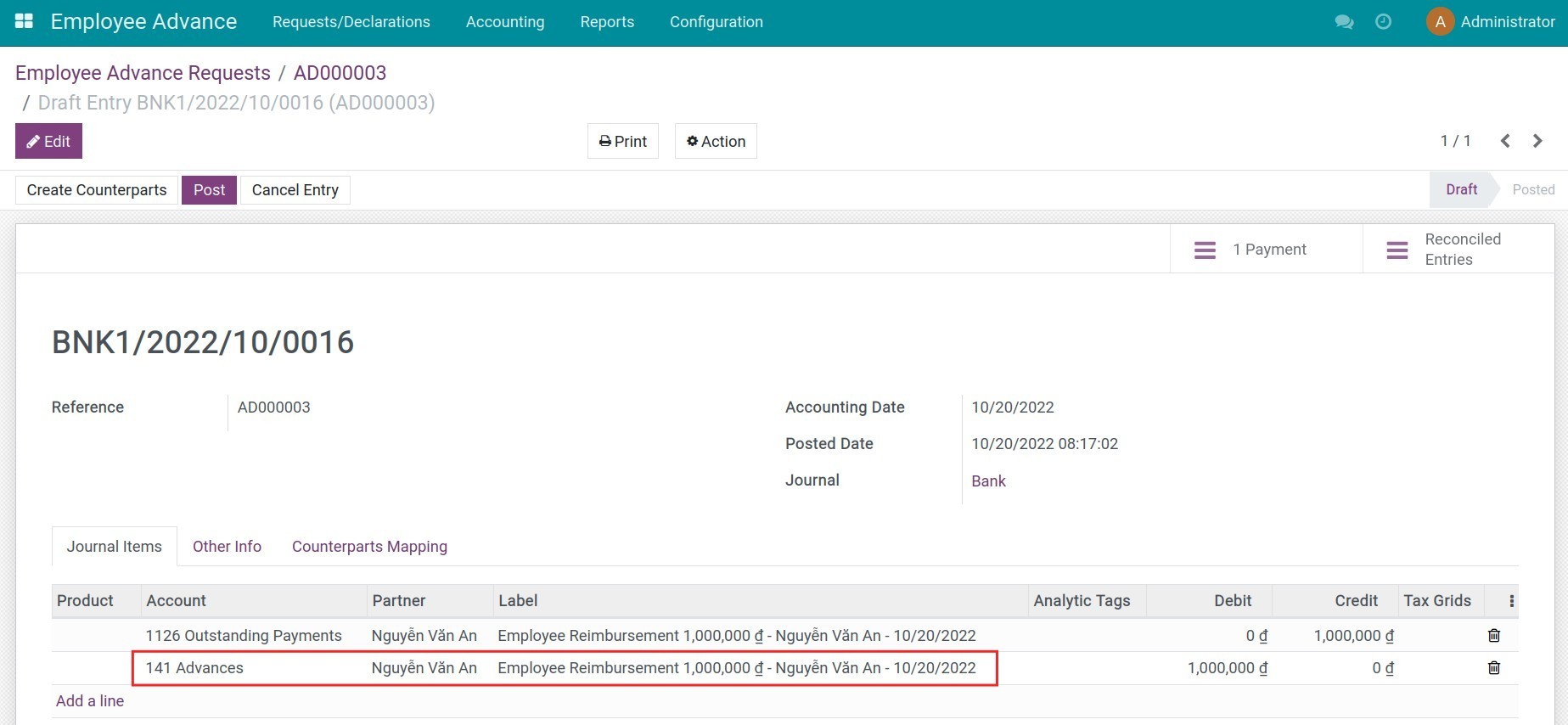

- Employee Payments:

- Add a new partner type "Employee" in the accounting module to enable direct payments to employees.

- Automatically select the appropriate counterpart account (receivable or payable) during transactions.

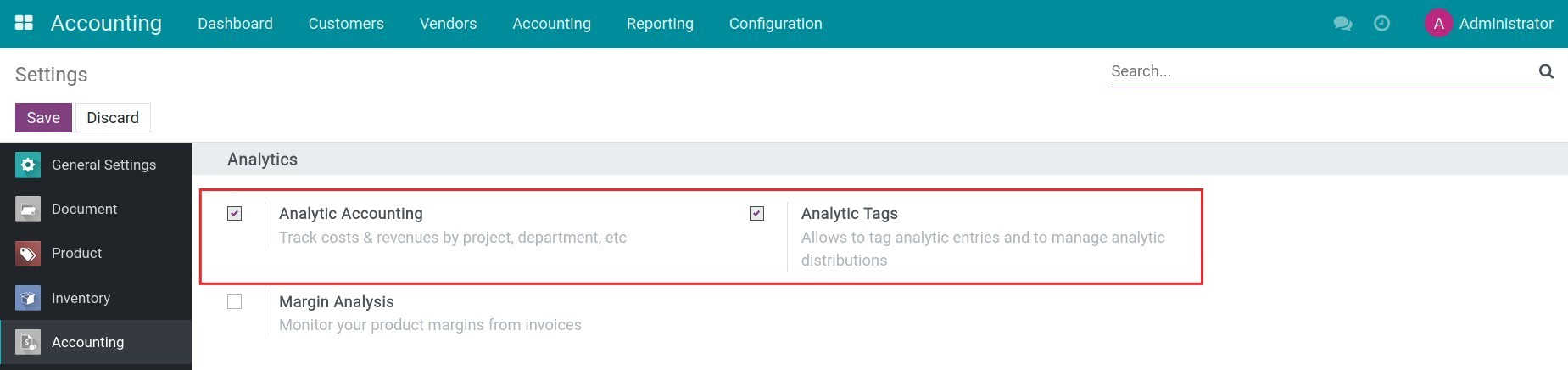

- Configure a common analytic accounting plan for departments

- Provide an option to configure a default Analytic Accounting Plan in the general settings of the Accounting application.

- This plan is automatically applied when creating analytic accounts linked to departments.

- Automated calculation of managerial accounting allocation ratios

- Automate the calculation of allocation ratios based on predefined allocation models.

- Ensure costs are accurately and reasonably allocated across departments.

Benefits

- Automation: Reduce manual work by automating account creation and cost allocation.

- Accuracy: Ensure financial data is recorded and allocated correctly.

Who should use this module

This module is suitable for medium and large businesses, especially organizations with complex financial management processes. It is an ideal solution for businesses that need:

- Detailed management of departmental costs and budgets.

- Efficient handling of employee advances and payments.

- Automated and transparent financial allocation and management.

Supported versions

- Community Edition

- Enterprise Edition

Installation

- Navigate to Apps.

- Search with keyword viin_hr_account.

- Press Install.

Instructions

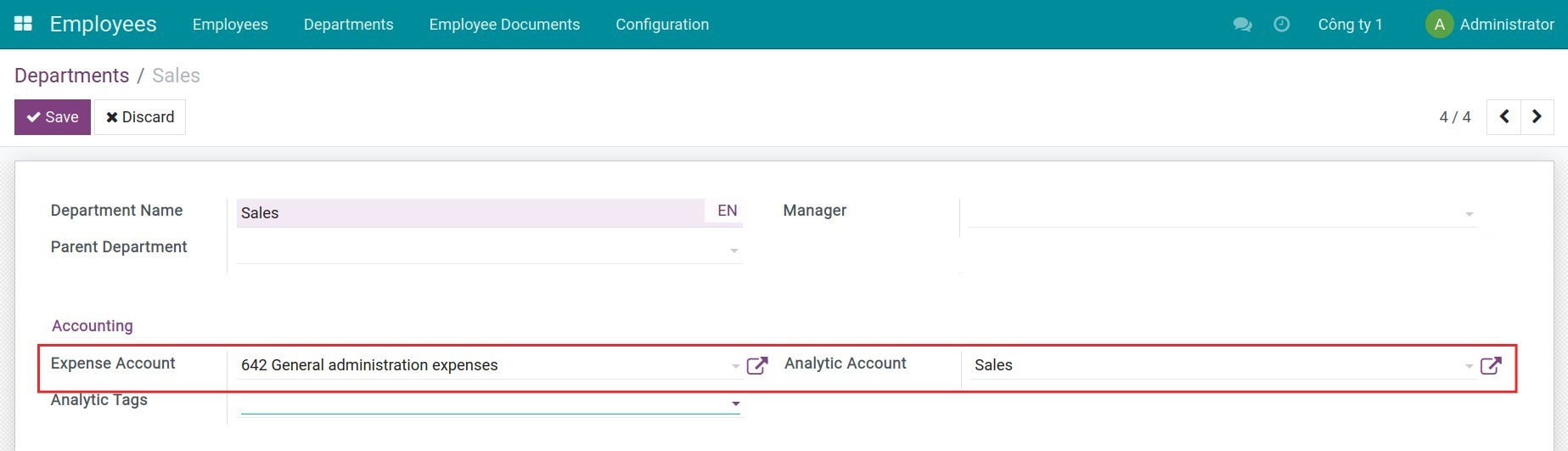

Configure expense account, analytic account in each department

1. Create a department and configure an analytic account

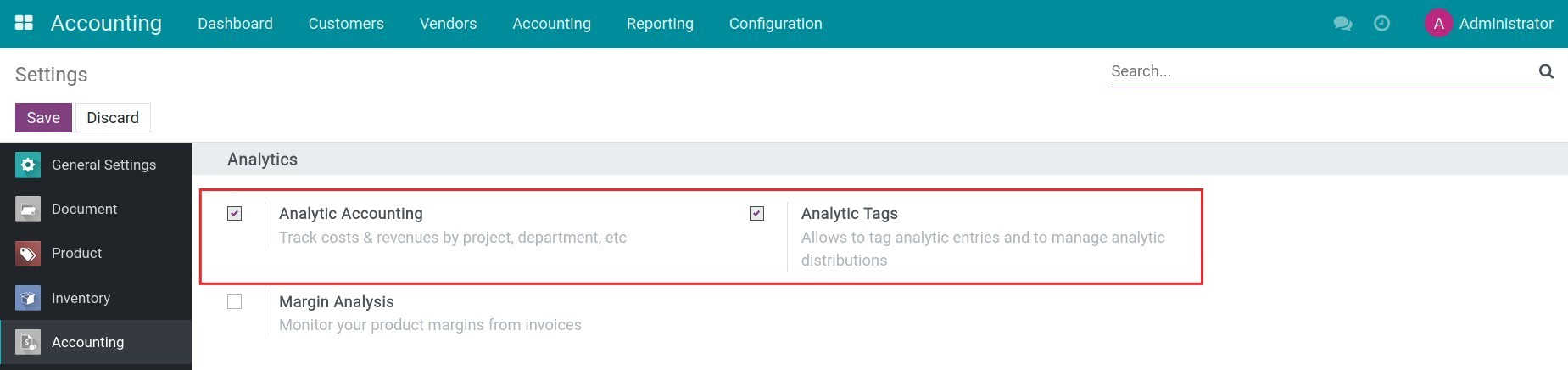

Navigate to Accounting > Configuration > Settings, activate the Analytic Accounting and Analytic Tags feature.

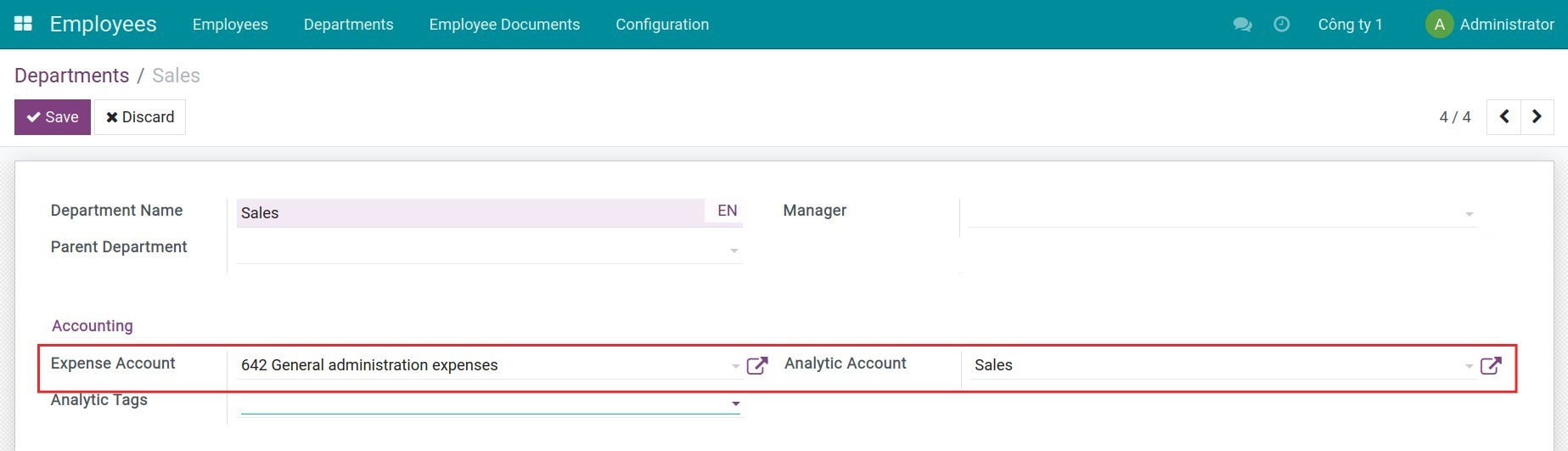

Navigate to Employees > Configuration > Departments, and press Create to generate a new department. From here, you can select an accounting to register the expenses of this department. Once done, press Save, and the respective analytic account of the department are also automatically created.

To learn how to use the analytic accounting feature in the Viindoo Accounting software, you can refer to the Analytic account in Viindoo article.

2. Create analytic tags by departments and the distribution percentage

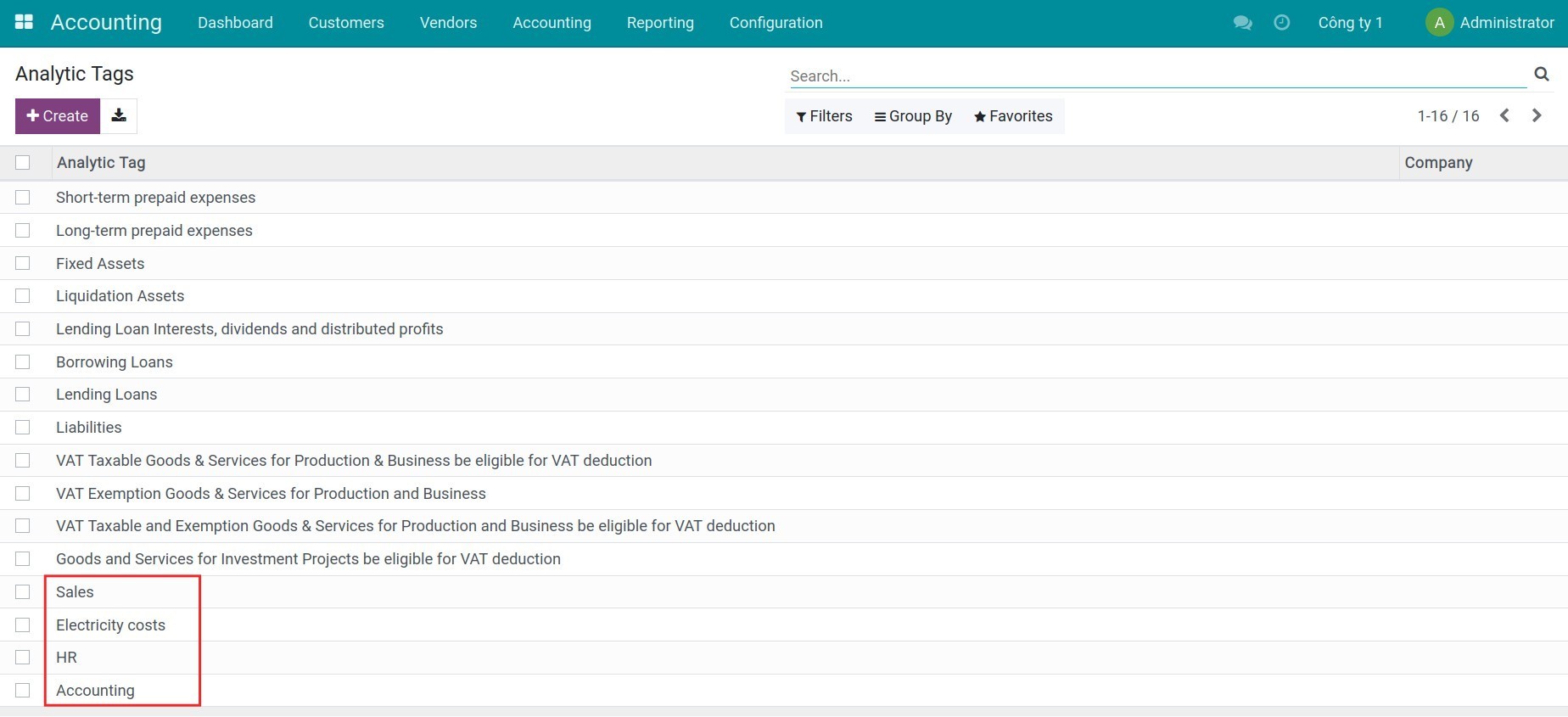

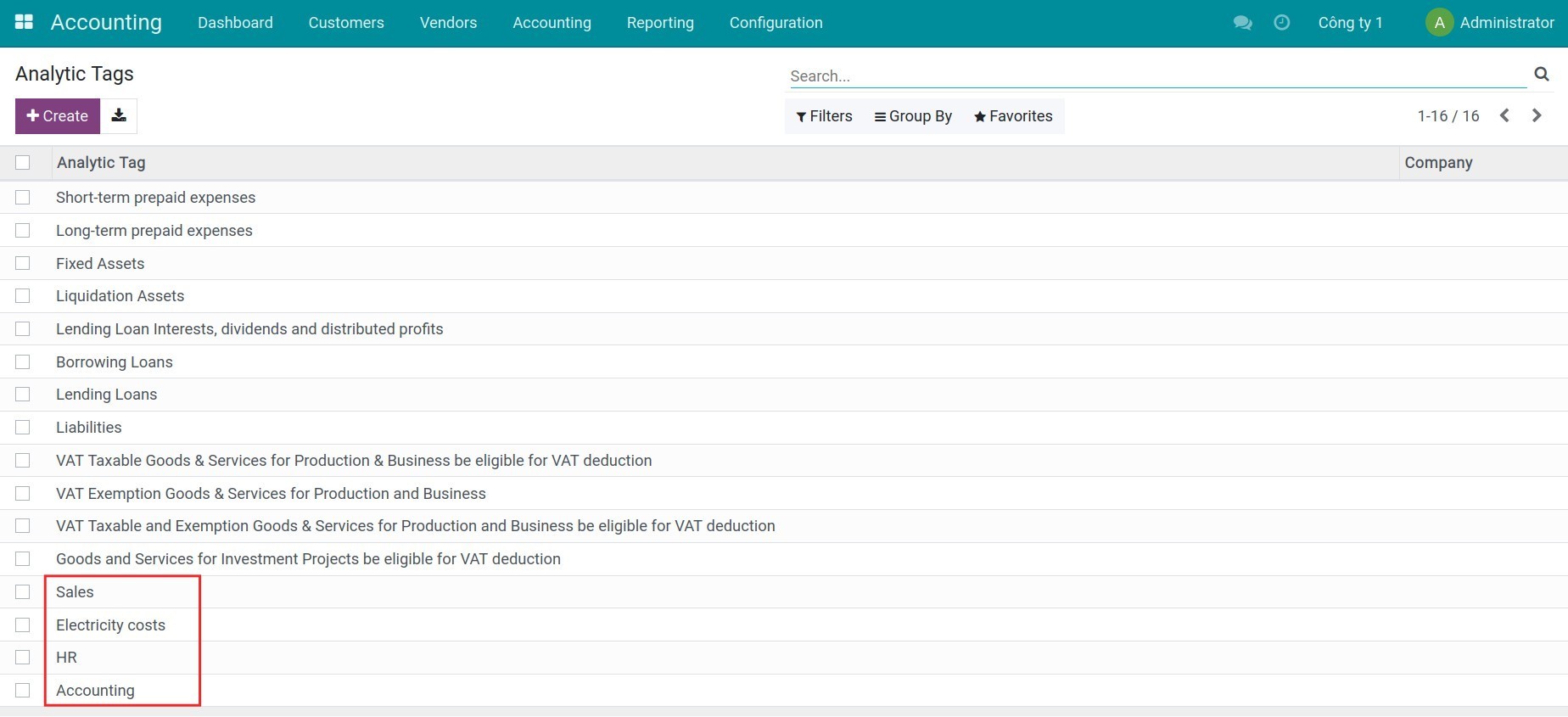

Navigate to Accounting > Configuration > Analytic Tags, press Create to create a new analytic tag. For example, if you want to analyze the revenues/expenses of the Accounting & HR department, you need to create the following analytic tags:

- Analytic tags for each department: Sales, Accounting, and HR;

- Shared analytic tag for both departments: Electricity costs (expenses that should be distributed to all departments).

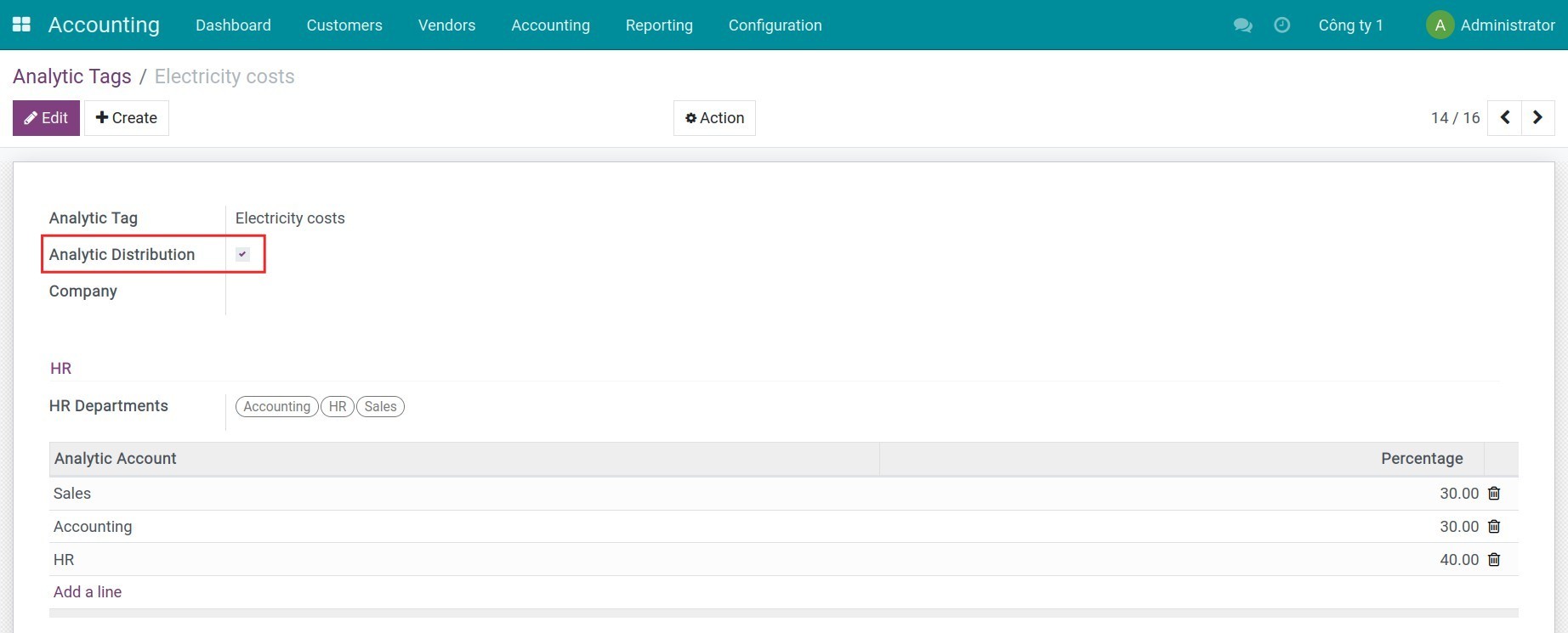

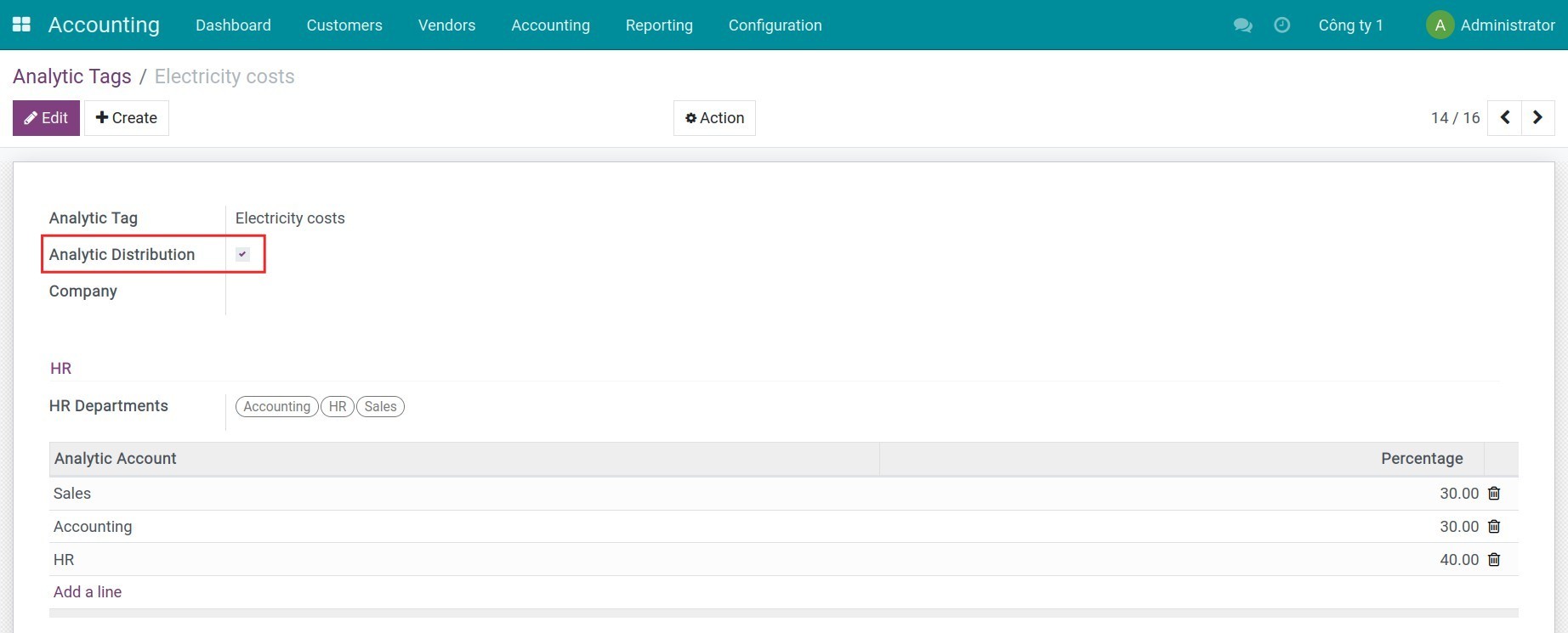

In the Electricity costs, enable the Analytic Distribution feature then indicate the percentage for each department.

3. Create revenues/expenses linked for respective department

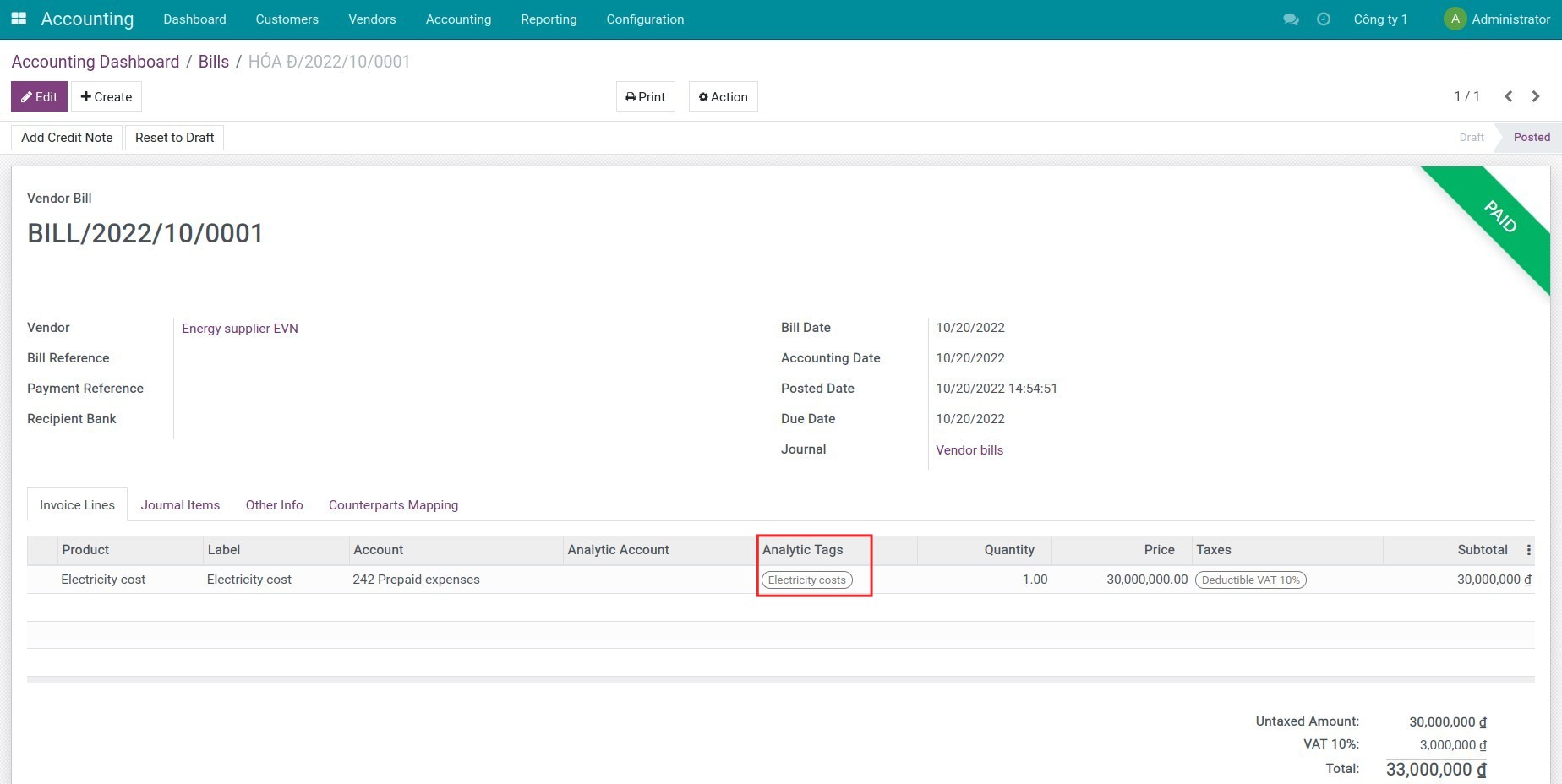

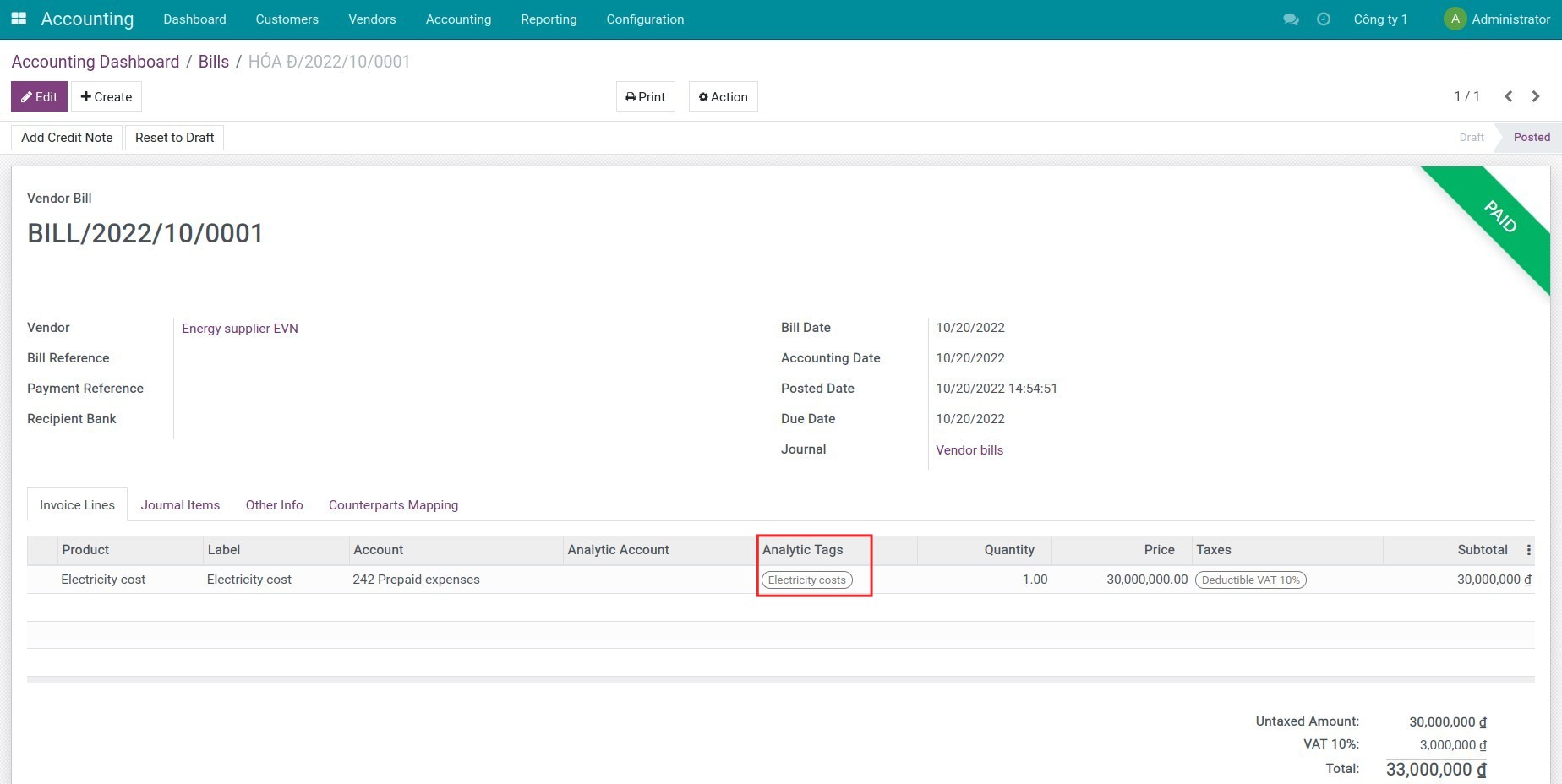

Create a vendor bill and add the shared analytic tag on the invoice line. Then confirm and record payments of this bill.

You can also do similar steps with the customer invoices.

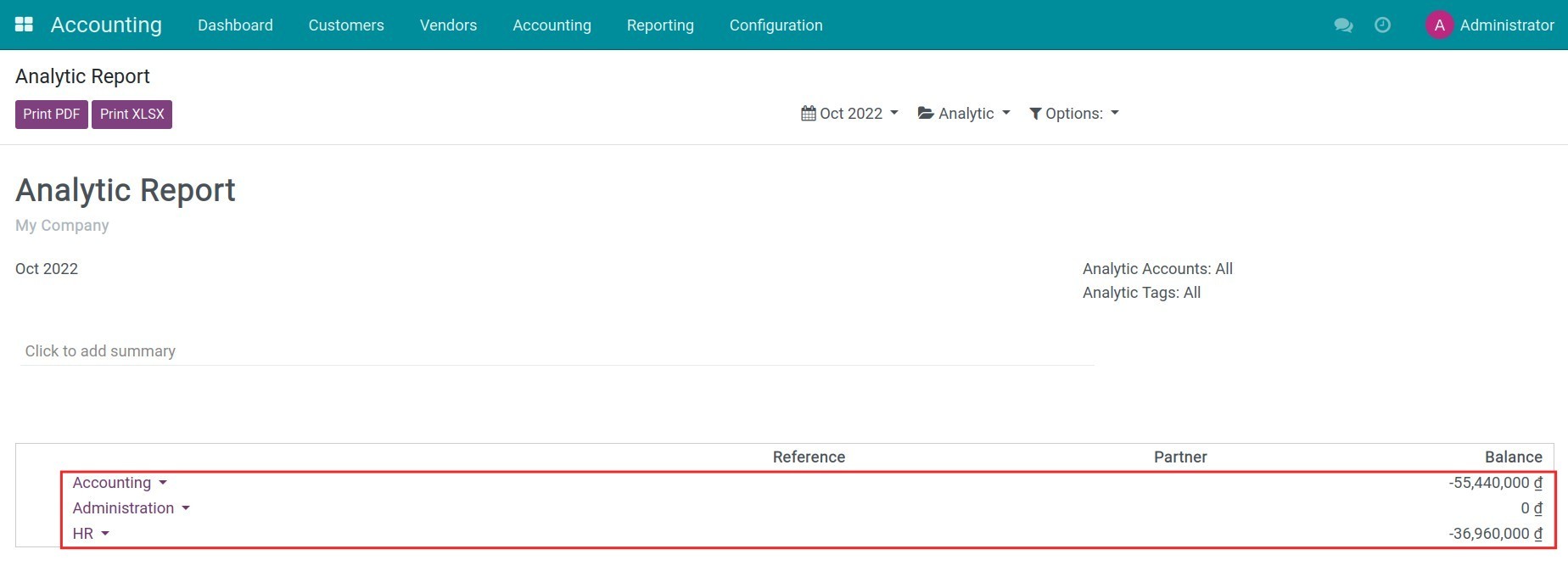

4. View revenues/expenses report by department

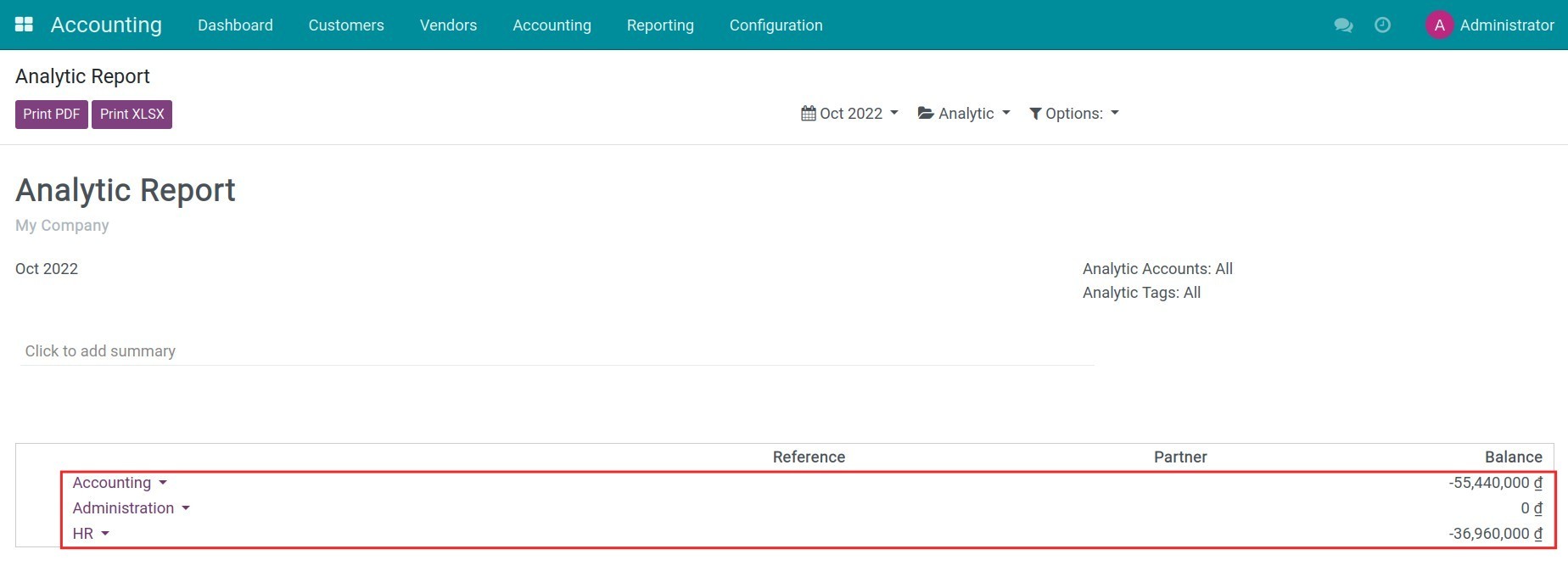

Navigate to Accounting > Reporting > Analytic Report to see each department's revenues/expenses.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.