Demo video: Vietnam - Payroll

What it does

Payroll management is one of the most important jobs for businesses. However, it takes a lot of time and effort. This payroll management software is built with the purpose of minimizing costs, and risks and optimizing the payroll management of enterprises. The "Vietnam Payroll" module allows users to set up some salary information according to Vietnamese standards, including:

- Payroll Contribution Type;

- Salary Rules;

- Personal Tax Rules.

Key features

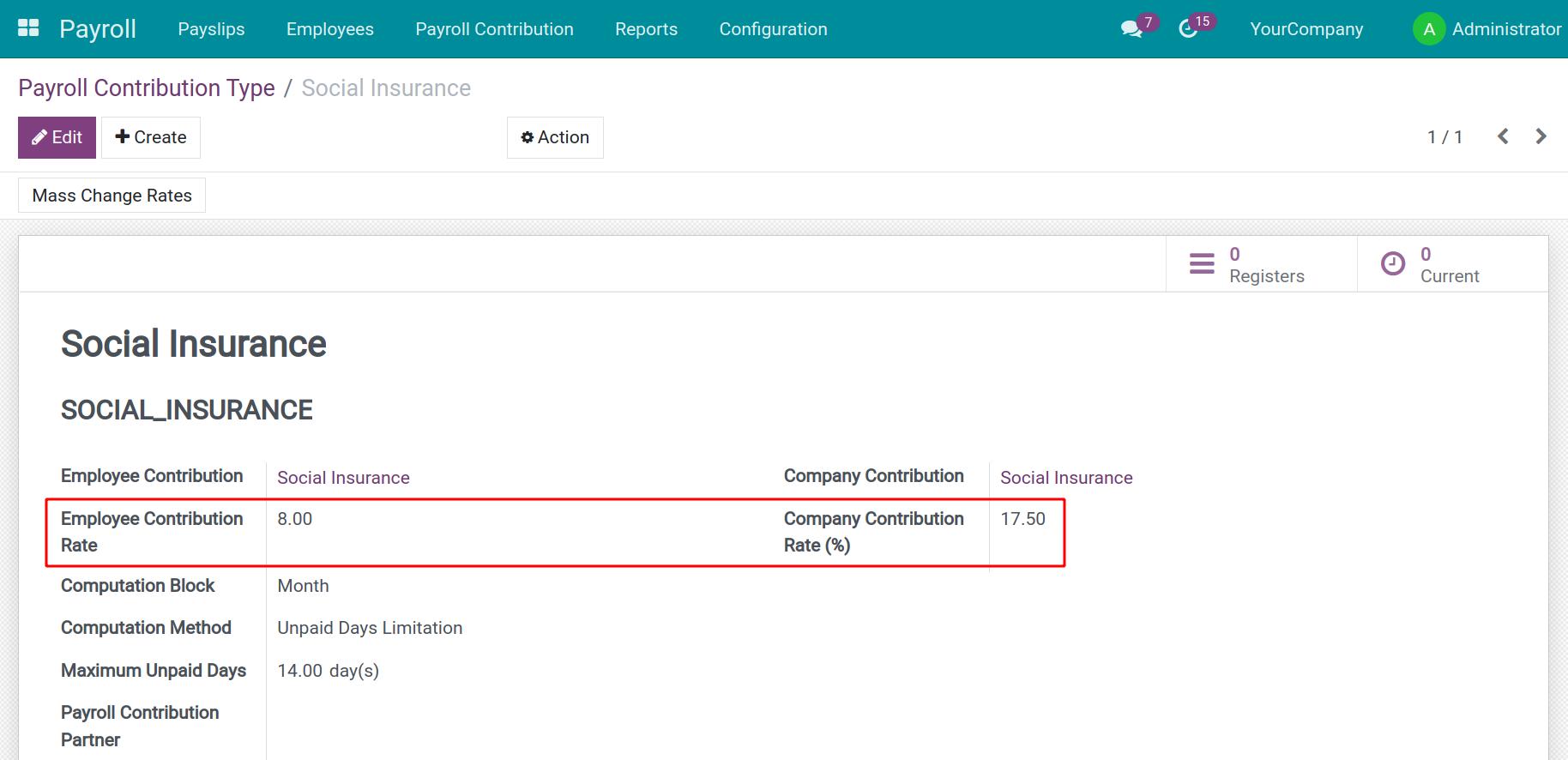

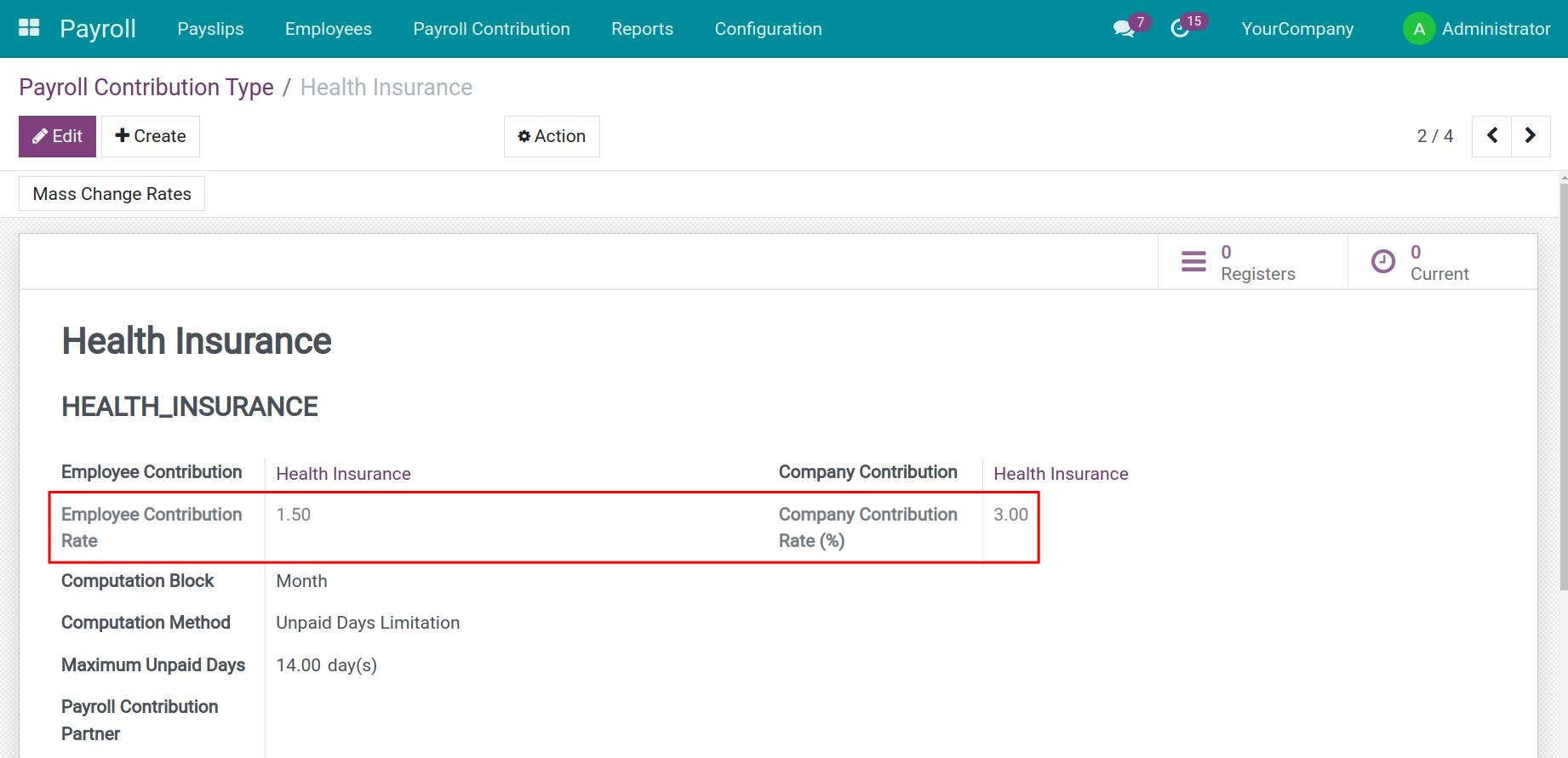

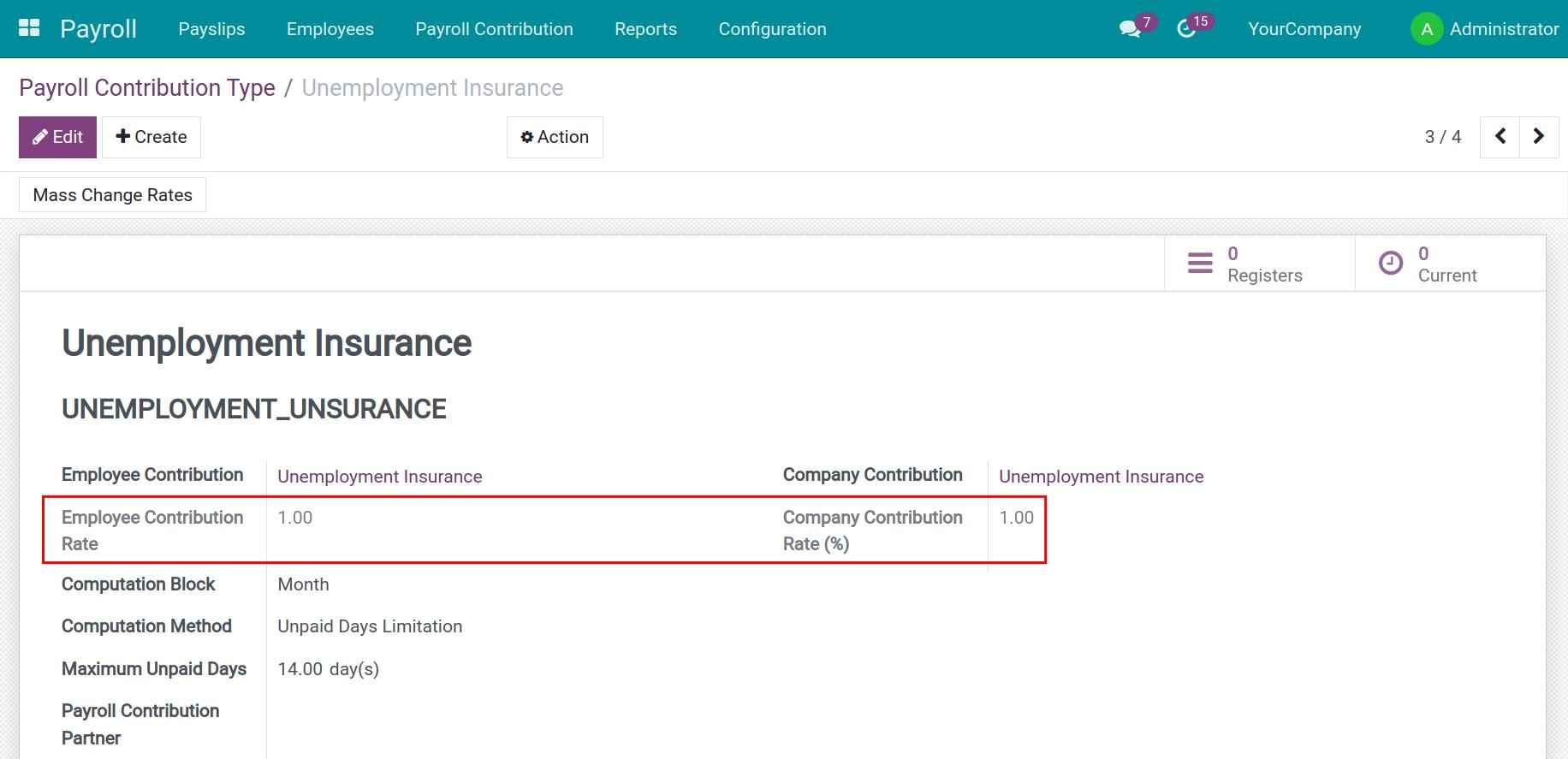

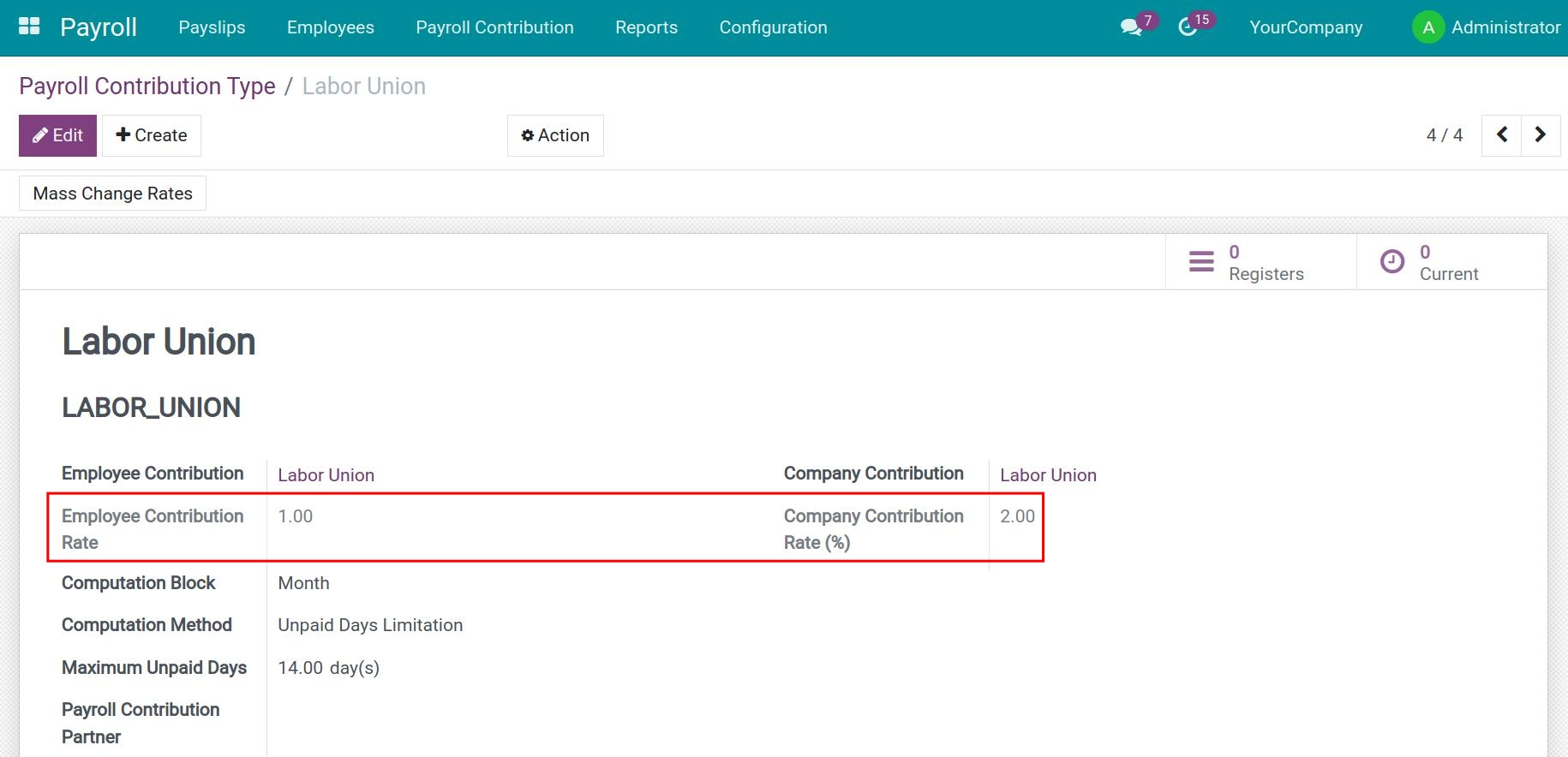

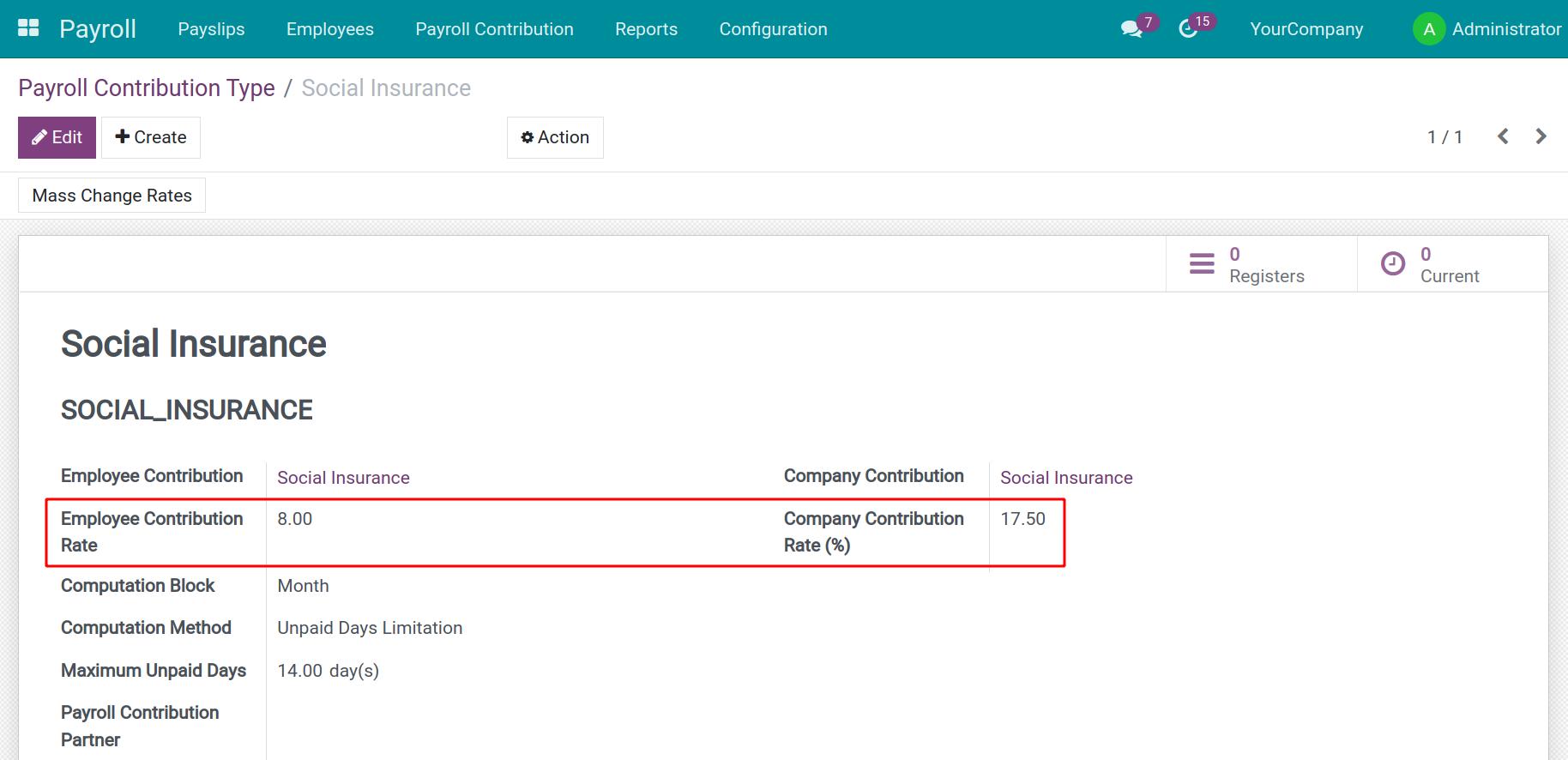

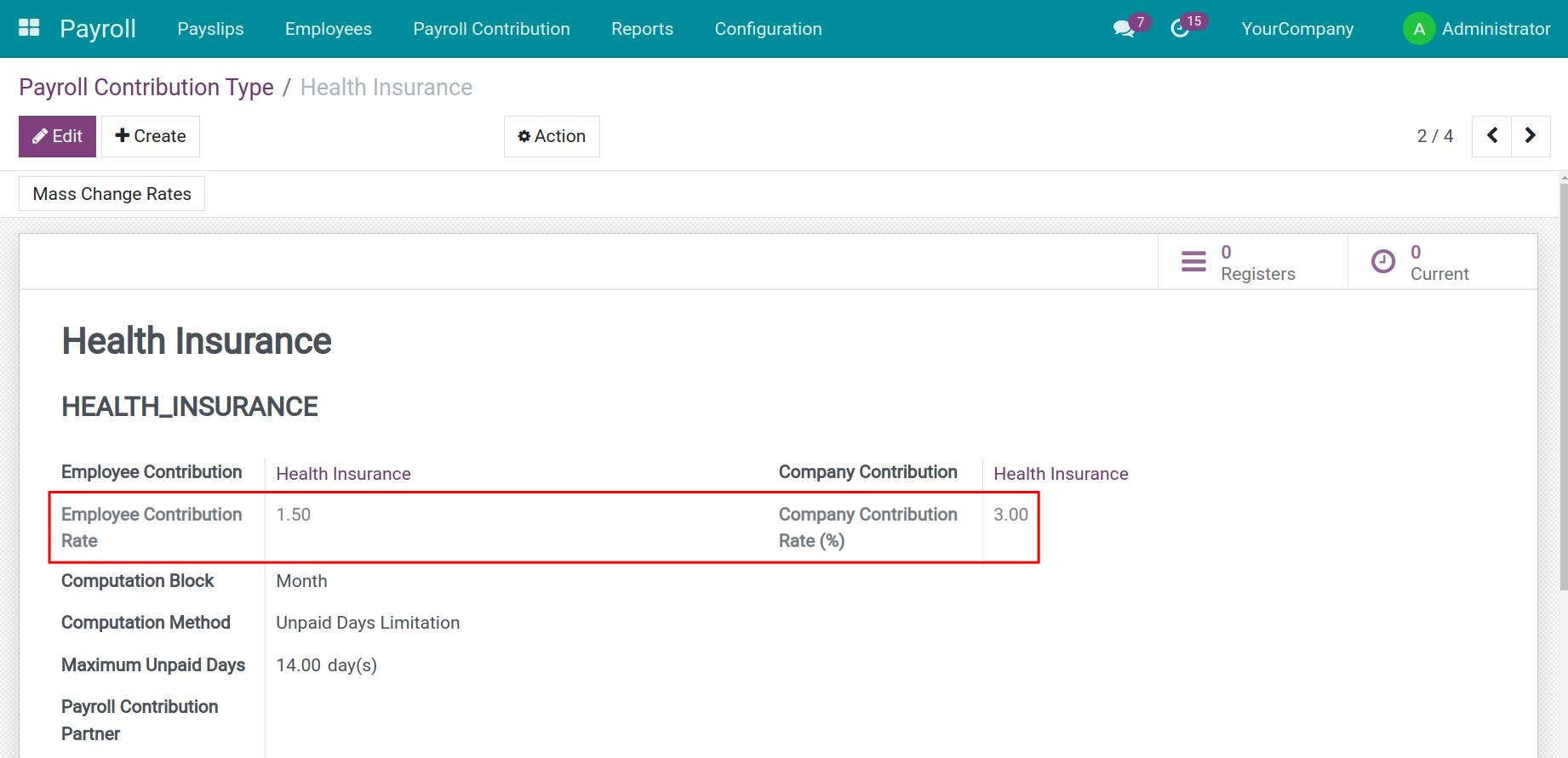

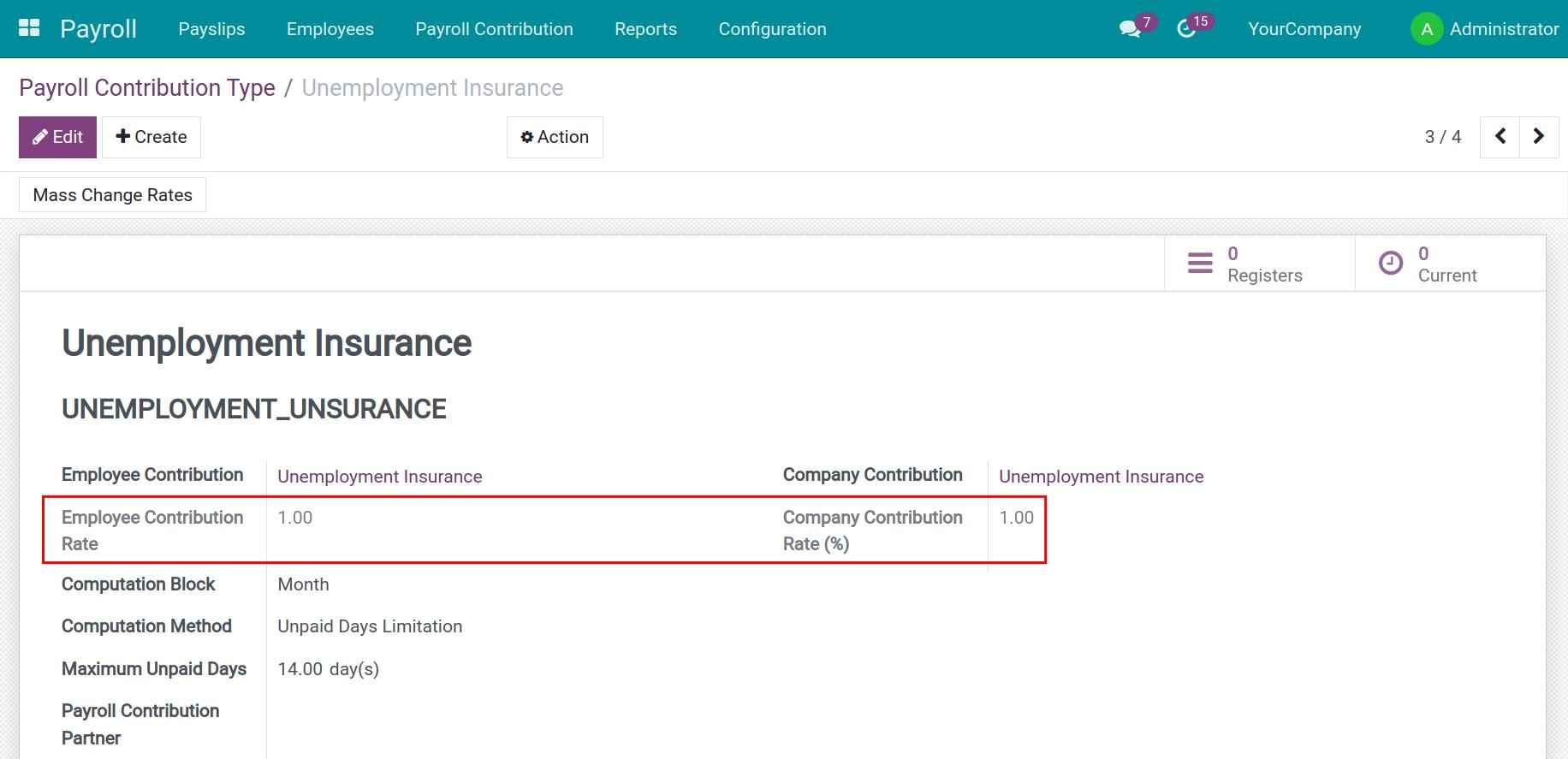

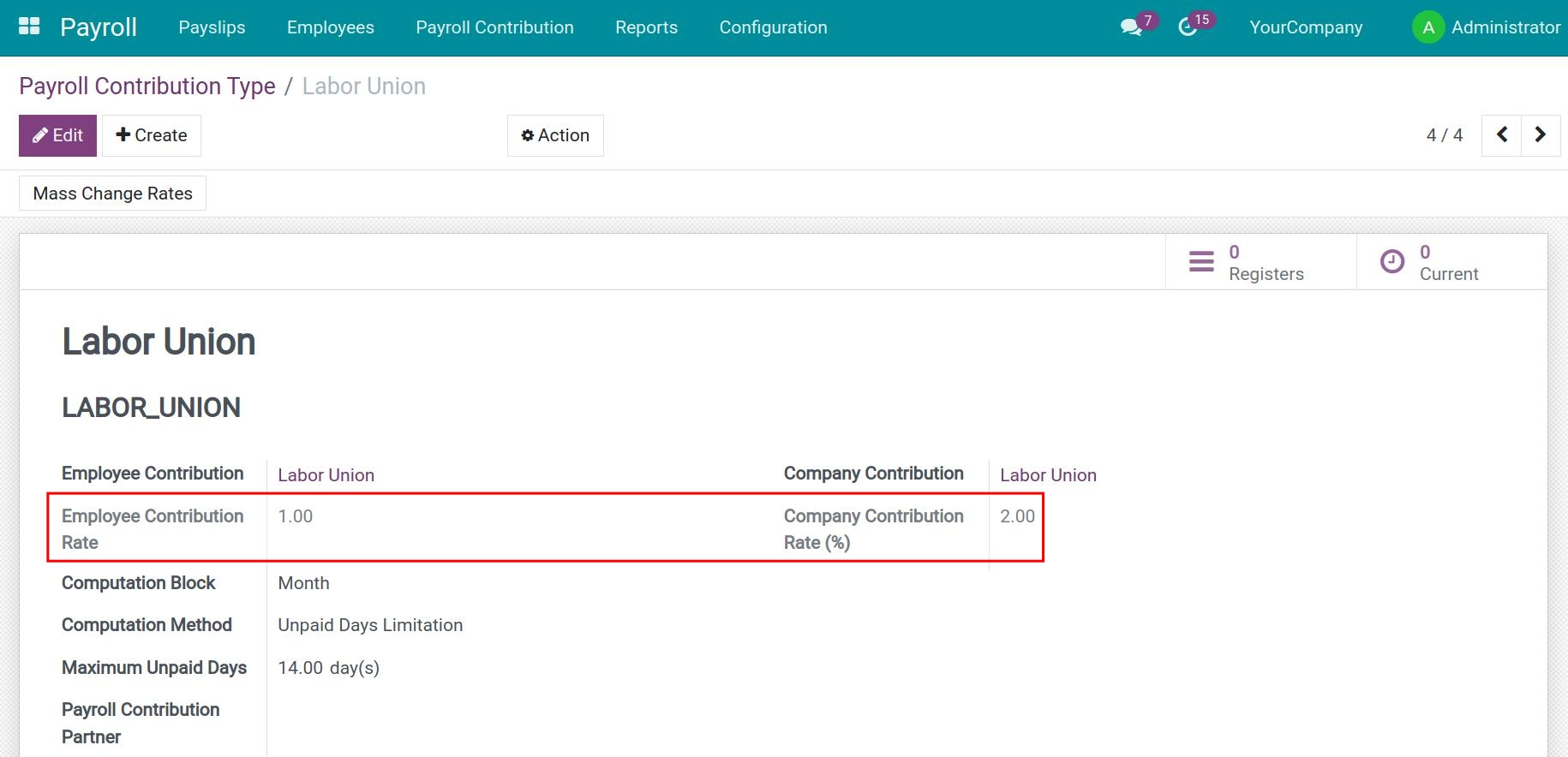

- Update contribution rates for Payroll Contribution according to Vietnam's regulations (For Vietnamese companies). For example, some common types of salary contributions are:

- Social Insurance;

- Health Insurance;

- Unemployment Insurance;

- Labor Union.

- Create available Personal Tax Rules according to Vietnam's regulations.

- Automatically attach Personal Tax Rules according to Vietnam's regulations when creating new contracts for Vietnamese employees.

- Adjusting the formulas of some Salary Rules according to Vietnamese standards.

Business Value

- Ensure Legal Compliance:

- Automatically updates contribution rates and personal tax rules in line with Vietnam's latest regulations.

- Reduces the risk of non-compliance with payroll-related laws and policies.

- Save Time and Resources:

- Automates payroll processes, including tax and contribution calculations.

- Minimizes manual errors and administrative overhead.

- Optimize Financial Planning:

- Provides accurate salary and tax calculations to ensure better financial management.

- Facilitates budget planning with comprehensive payroll rules.

Who Should Use This Module

- Vietnamese Enterprises:

- Ideal for businesses operating in Vietnam requiring localized payroll solutions.

- Suitable for companies with employees subject to Vietnamese labor laws.

- HR and Payroll Teams:

- Designed for HR professionals looking to simplify and optimize payroll processes.

- Helps payroll teams handle large volumes of salary calculations and compliance tasks.

- SMEs and Large Corporations:

- Ensures payroll compliance and efficiency for organizations of all sizes.

Supported Editions

- Community Edition

Installation

- Navigate to Apps.

- Search with keyword l10n_vn_viin_hr_payroll.

- Press Install.

Instruction

Instruction video: Vietnam - Payroll

General configurations

Update contribution rates for payroll contributions according to Vietnam regulations for companies located in Vietnam territory.

After installing the application, payroll management software will provide default configurations for payroll contribution registers. Go to Payroll ‣ Payroll Contribution ‣ Payroll Contribution Type, the system will provide some contribution type records with the rate according to Vietnam policy, including:

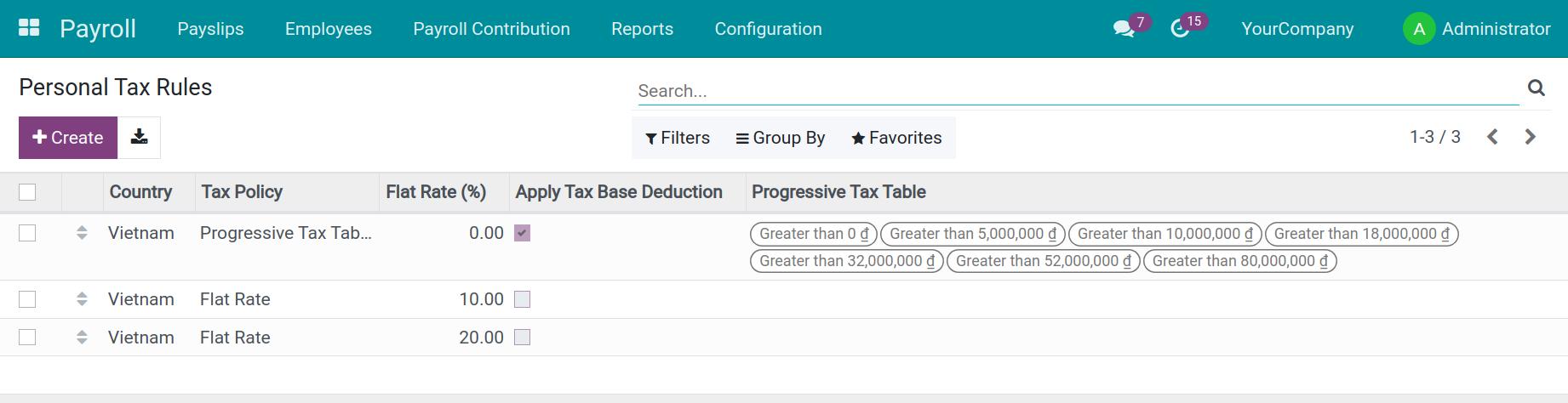

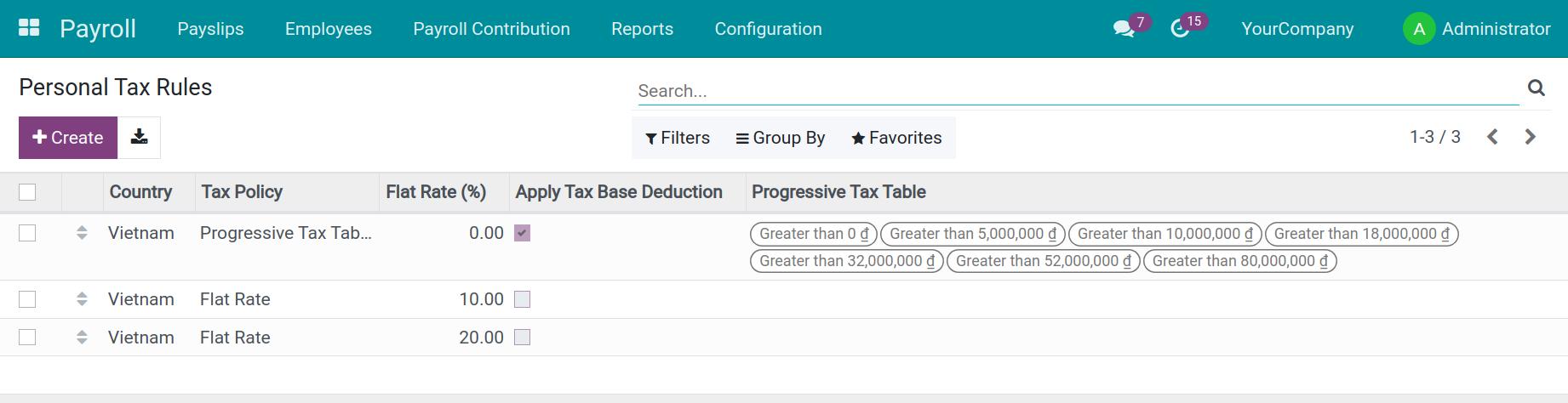

Create default Personal Tax Rules according to Vietnamese regulations.

To access personal tax rules in the Payroll app, go to Payroll ‣ Configuration ‣ Personal Tax Rules, there are 2 pre-set personal tax rules:

- Progressive Tax Table for Vietnam applies to most cases of Personal Income tax.

- Personal Tax Flat Rate applies to special cases (eg: non-resident individuals, resident individuals who do not sign the labor contract).

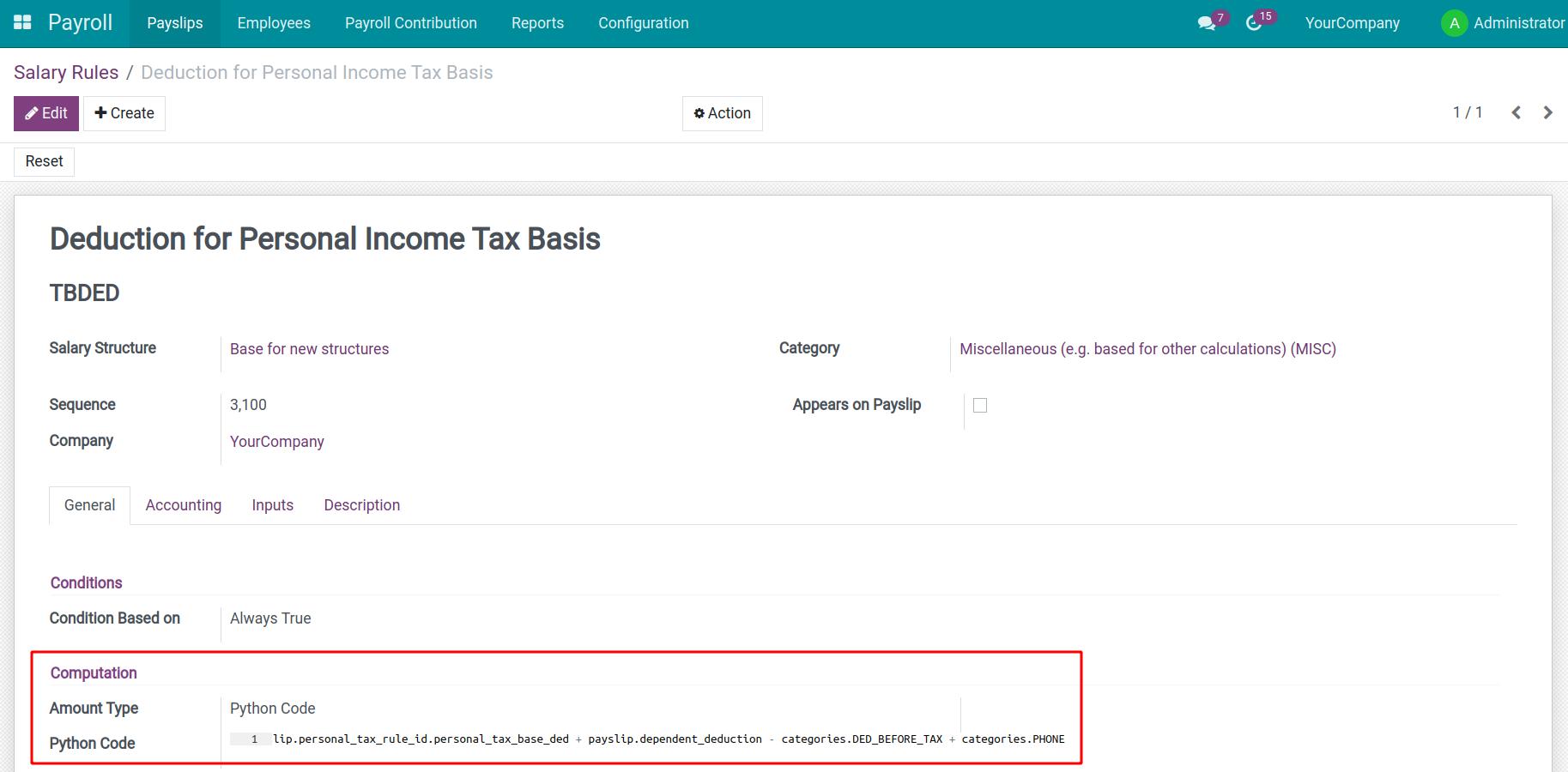

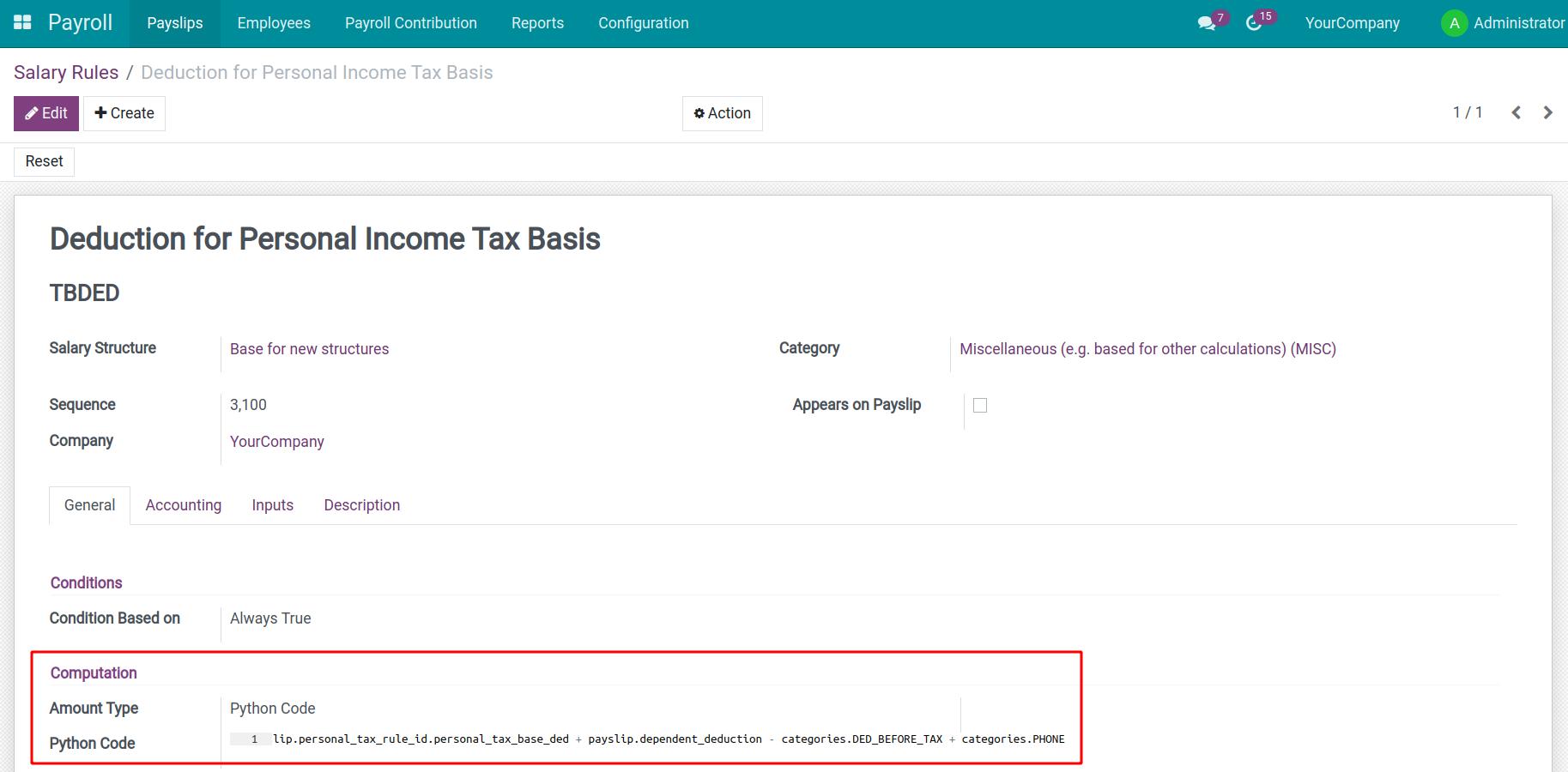

Adjust the formulas of some Salary Rules according to Vietnamese standards.

Go to Payroll ‣ Configuration ‣ Salary Rules, at the General tab, the system has pre-set formulas for each calculation condition.

Usage

After installing the application, the system will provide default information according to Vietnamese regulations such as contribution rate, salary rules for Personal Tax Rules, etc. This settings will serve for automatic salary calculation when combined with the following applications:

Note: It is necessary to set up your company in the Vietnam territory before performing other operations.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.