Demo video: Payroll

The Payroll module streamlines the payroll management process by automating salary computations and integrating seamlessly with other HR modules. Designed to handle complex payroll structures, this module simplifies salary rule configuration, tax calculations, and payroll contribution management. It supports organizations of all sizes, helping to ensure accurate and efficient payroll processing while reducing manual effort and human error.

Problems

- Payroll work in enterprises often takes a lot of time due to:

- A large number of employees.

- Apply many different salary modes, different calculation formulas for different positions.

- To synthesize data for monthly salary calculation, enterprises need to spend a lot of personnel to monitor and analyse data from departments and workshops, etc.

- Enterprises work in flexible shifts: the working form of each employee is different in the number of breaks, the number of overtime shifts, commissions, discounts, etc. making salary calculation complicated, confusing for the payroll department.

- The enduring time to analyze and calculate salary leads to the consequence of updating the general data of the enterprise, affecting the financial, production and business planning.

- It's difficult to analyze the detail of costs related to salary by department, by project or by some other purpose.

- The accuracy of the data depends a lot on the carefulness and presentation skills of the payroll personnel.

- To build salary cost analysis reports for each department, each purpose over a long period of time is quite time-consuming, and it is not easy to get updated data right when the need arises.

Solution

This module is developed to resolve the above points. So, it can be integrated with the data of several modules such as Attendances, Time Off, Contract, HR Payroll Accounting, etc. to calculate salary scientifically and transparently.

Key Features

This module allows:

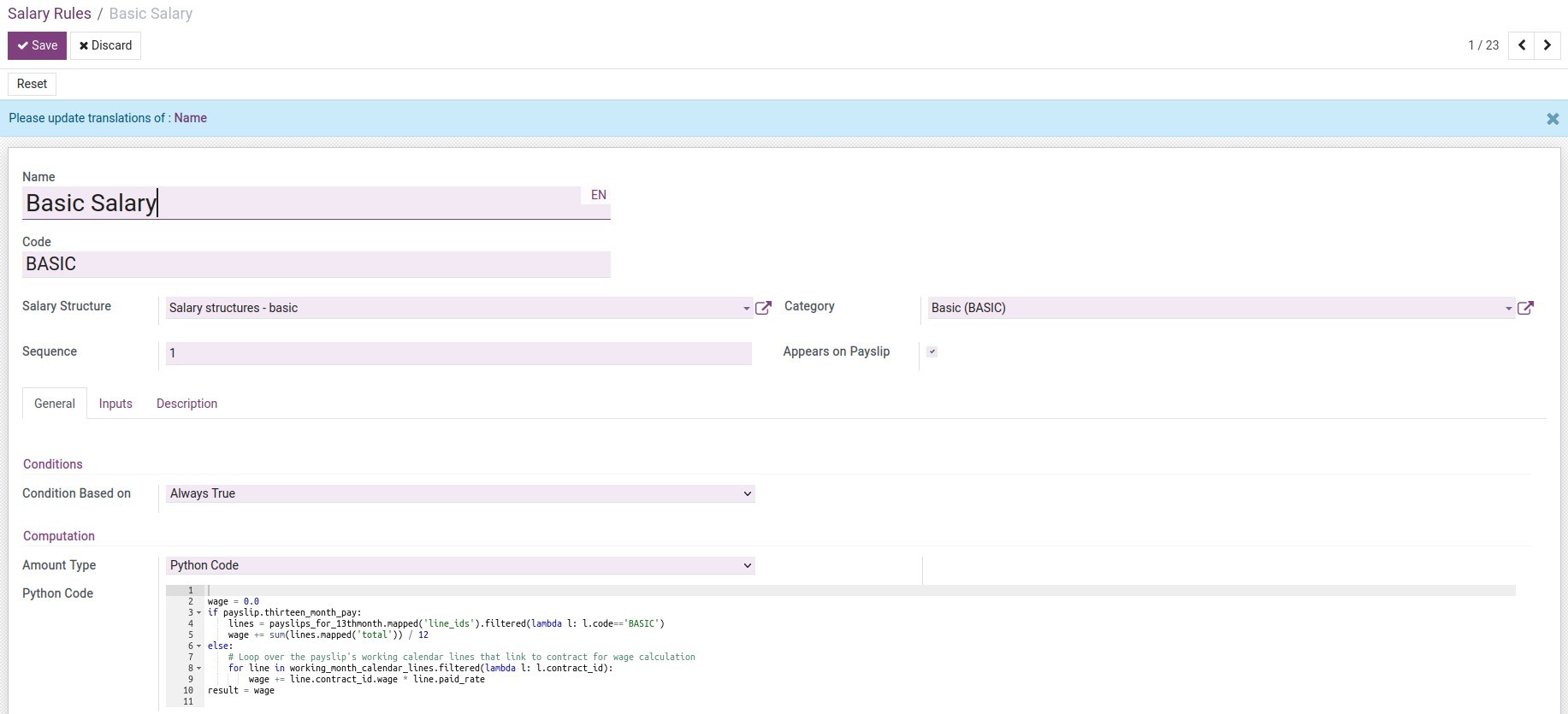

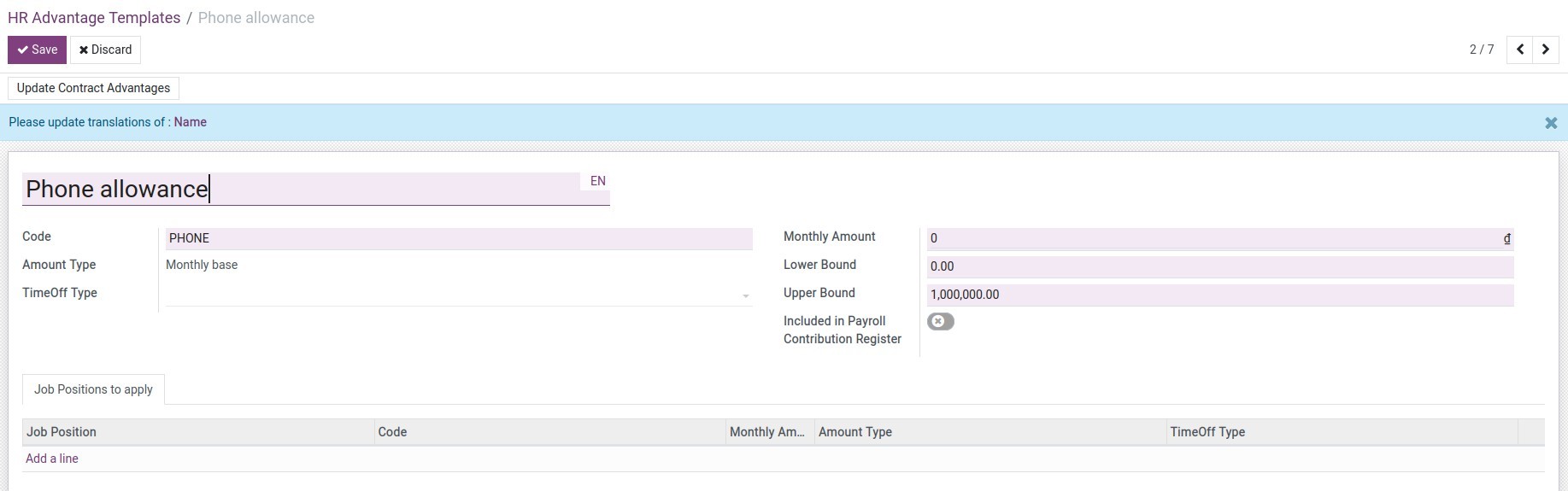

- Manage salary cycle, salary structures, salary rules, employee advantages; Provide the set of basic salary rules and employee advantage templates for salary computation.

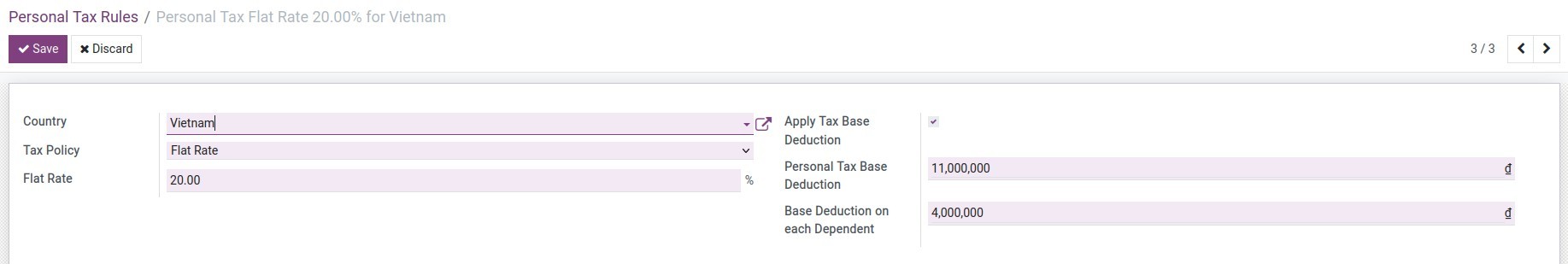

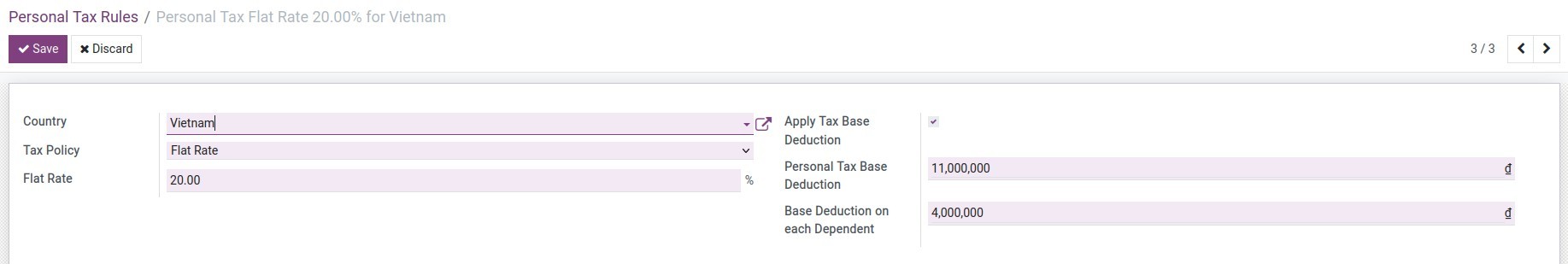

- Manage Personal Tax Rules.

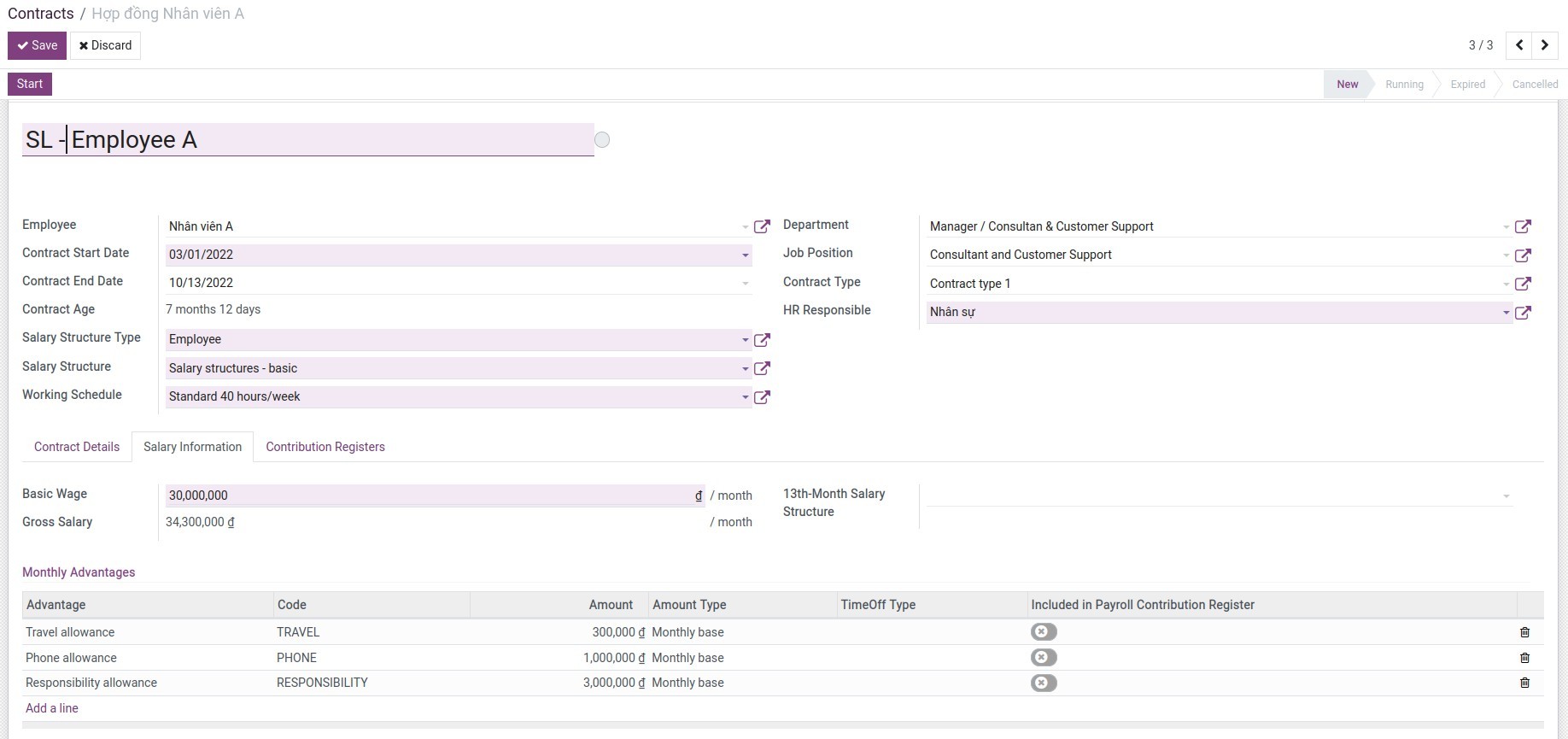

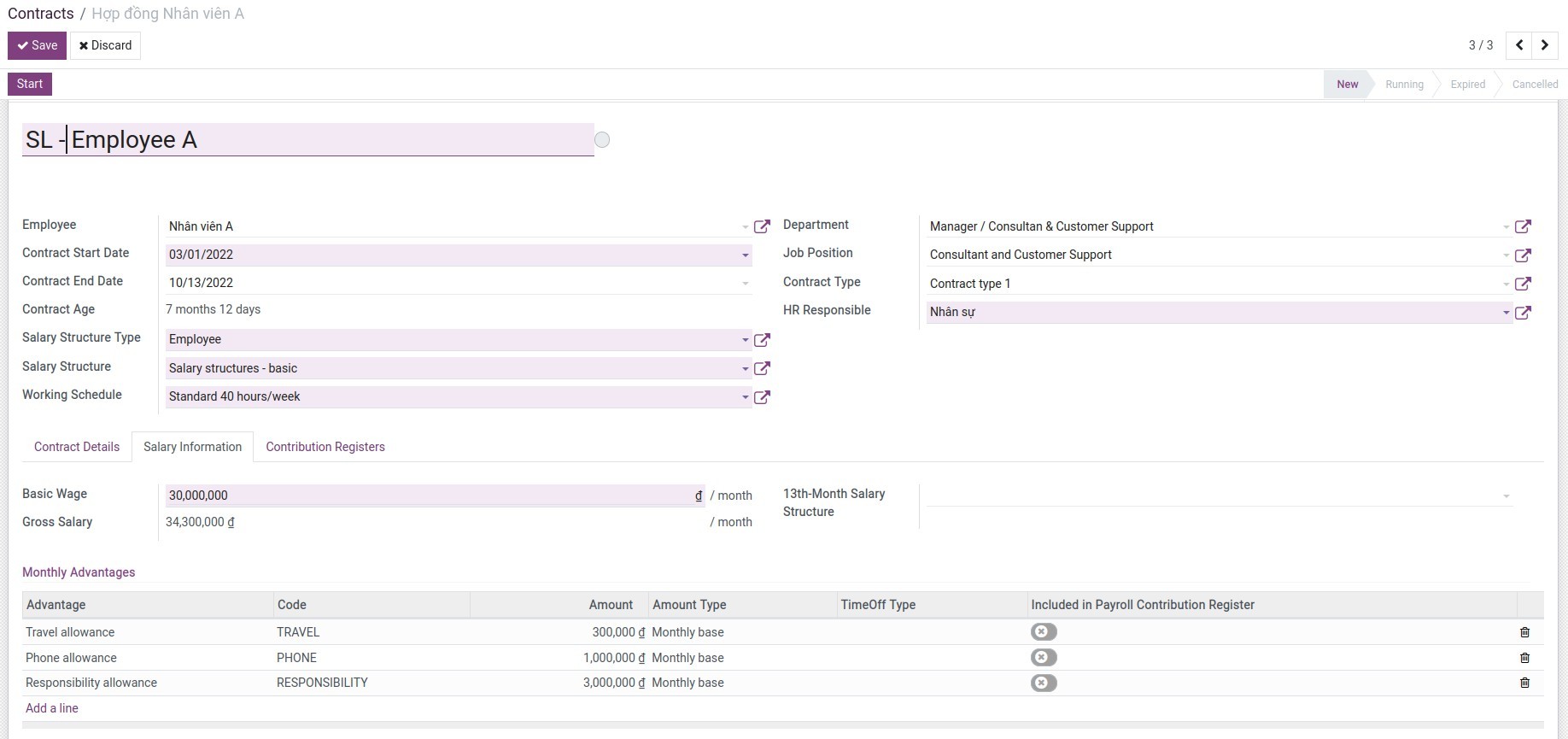

- Manage the salary information on the employee contract:

- Allow to set up Salary Computation Mode, Personal Tax Policy, Tax Rule on contract types to apply with employee contracts.

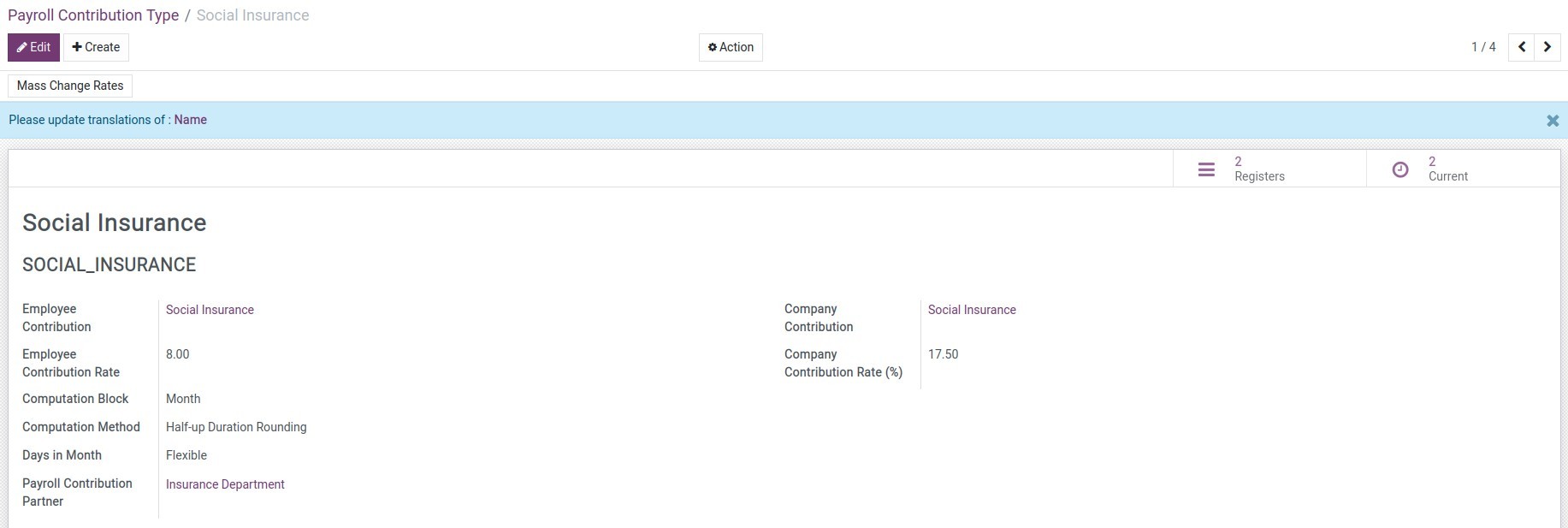

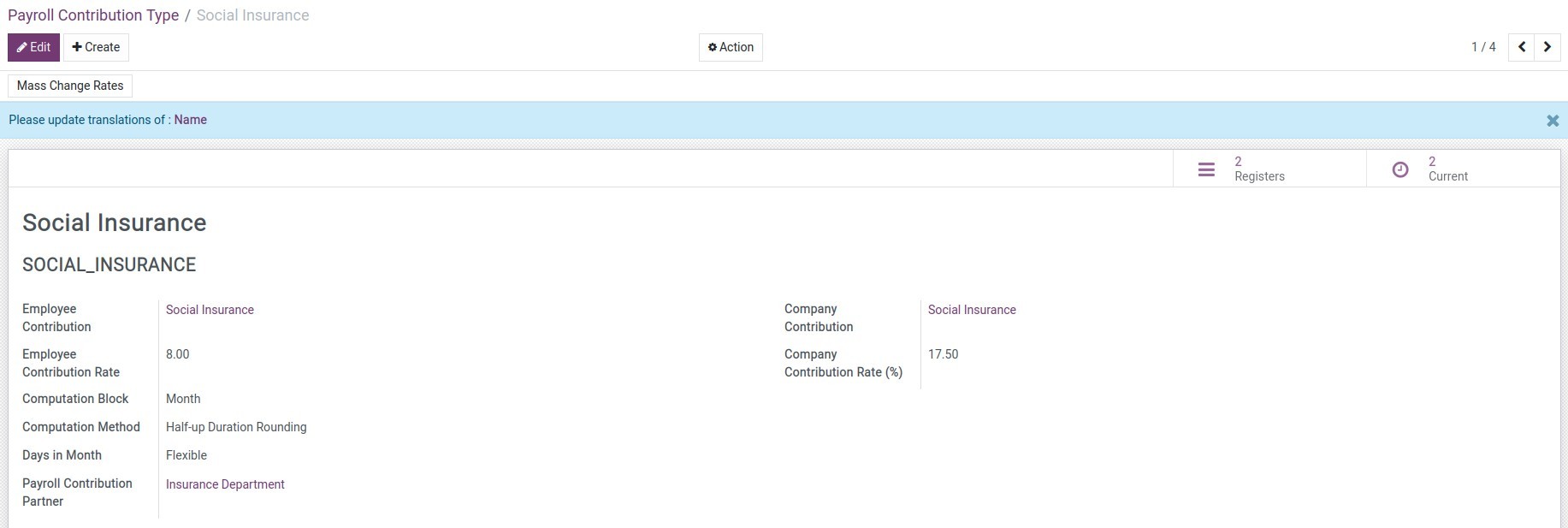

- Allow to set up Payroll contribution registers (Social insurance, Health insurance, Unemployment insurance, Labor union) on employee contracts.

- Alloy to set up Wages & Allowances on employee contracts.

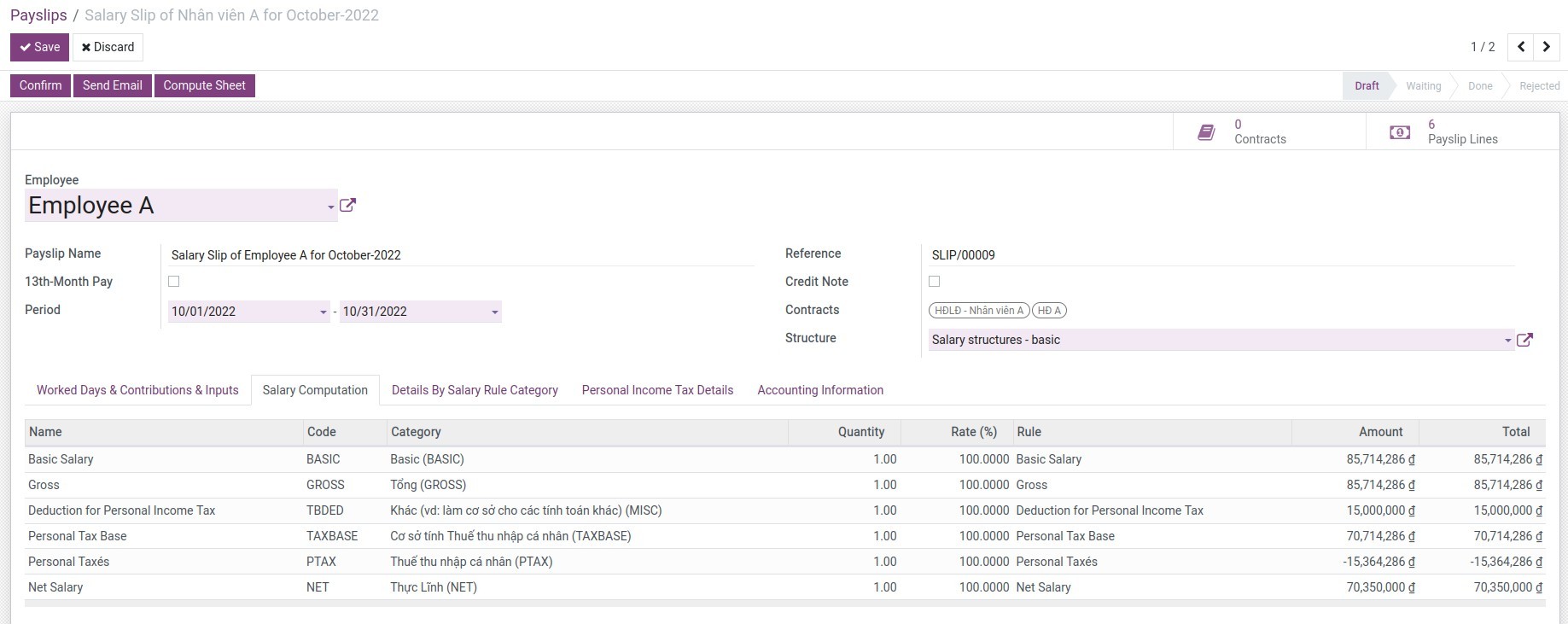

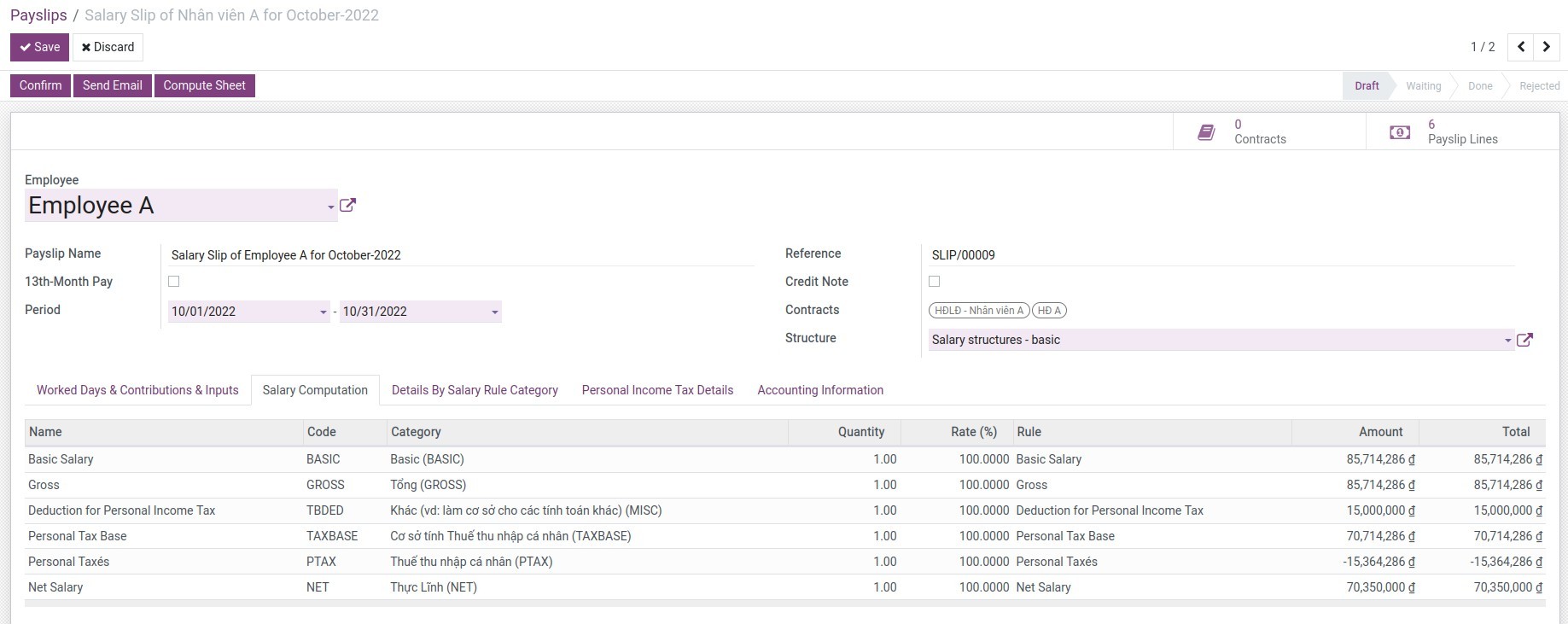

- Create Payslip and Payslips Batches

- With just a few clicks, users can create individual payslips for each employee, Payslips Batches for all employees in the company. The information about the contract, salary structure, working time, vacation time, insurance contributions, income tax, etc. are automatically updated on the payslip to serve as a basis for salary calculation.

- Attach a Payslip to an existing Payslips Batches.

- Employee's payslips will be calculated based on the Work Entries with types: Calendar, Timeoff, Overtime, Attedance, ...

- Integrate with other modules to get data into Payslip and Payslips Batches:

- Integrate with the Payroll Accounting module https://viindoo.com/apps/app/16.0/to_hr_payroll_account to create payroll accounting journal entries.

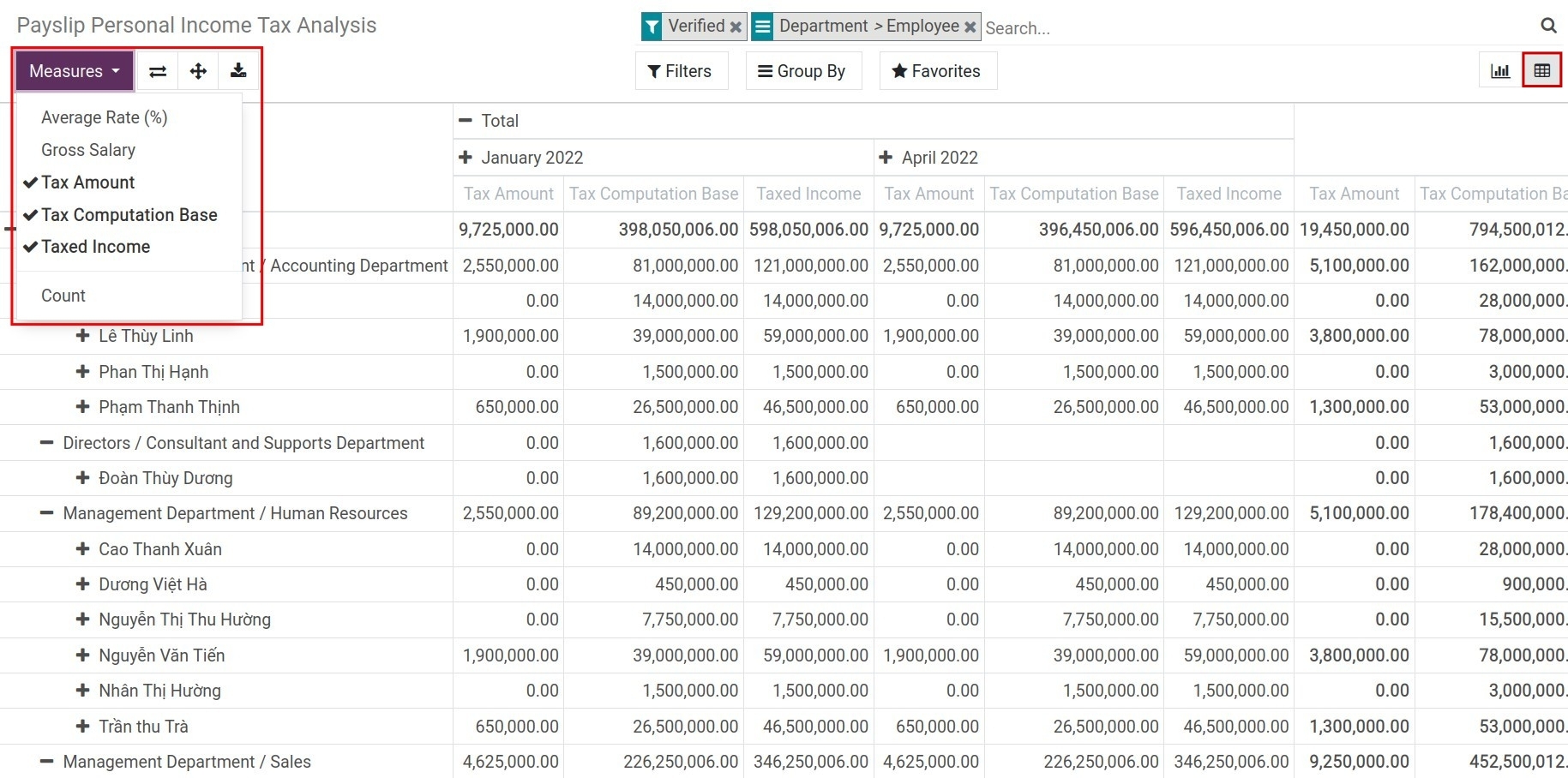

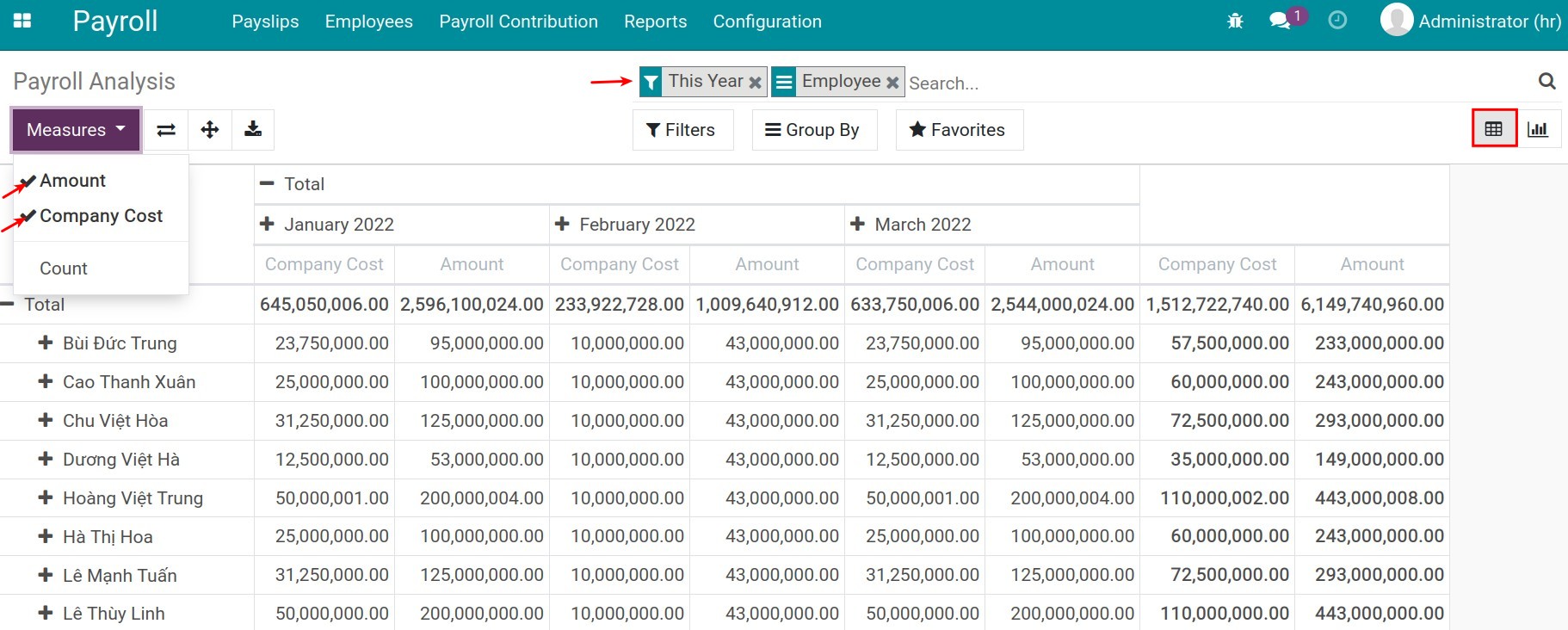

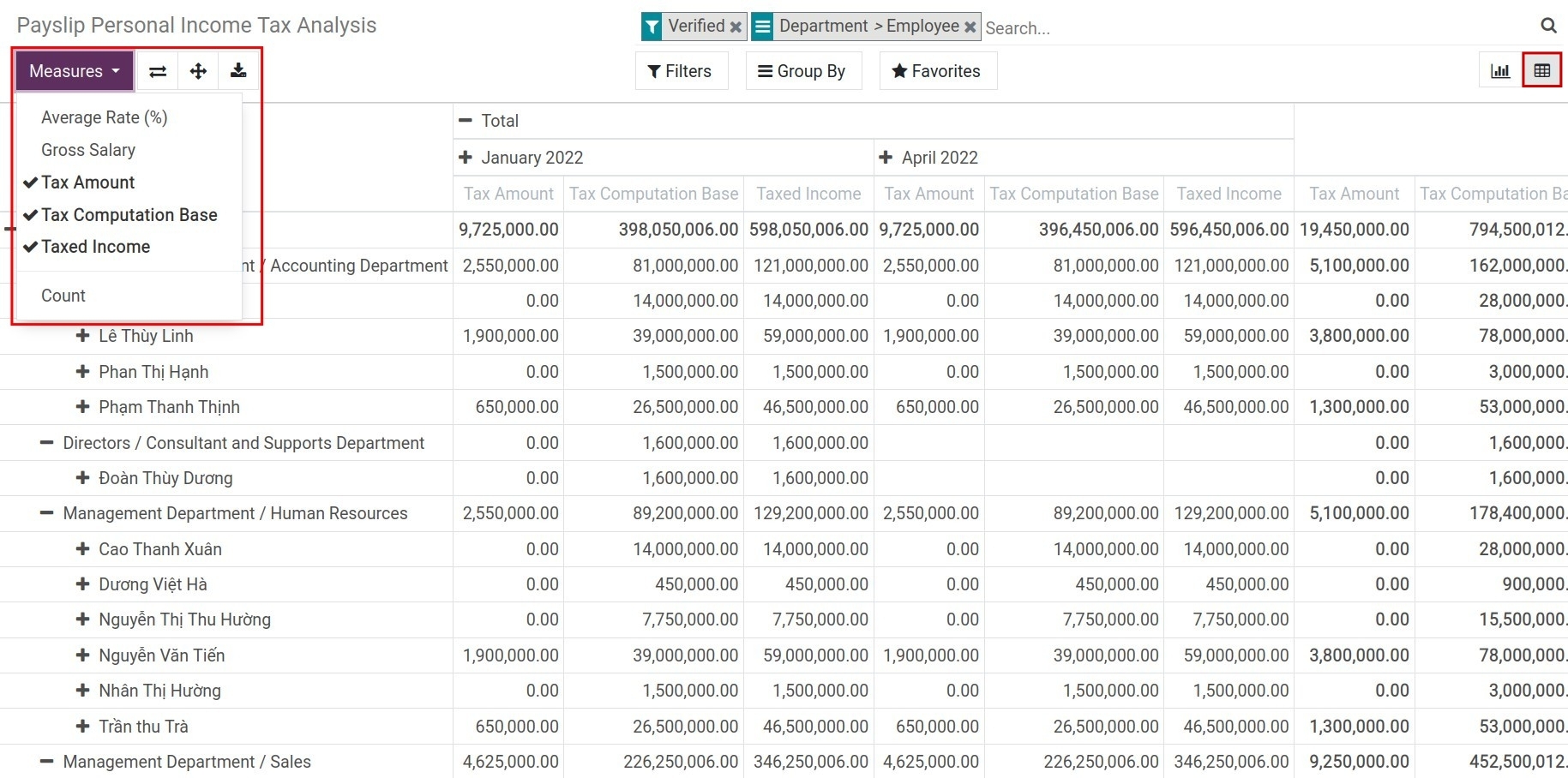

- Provide reports with visualized, multi-dimensional information:

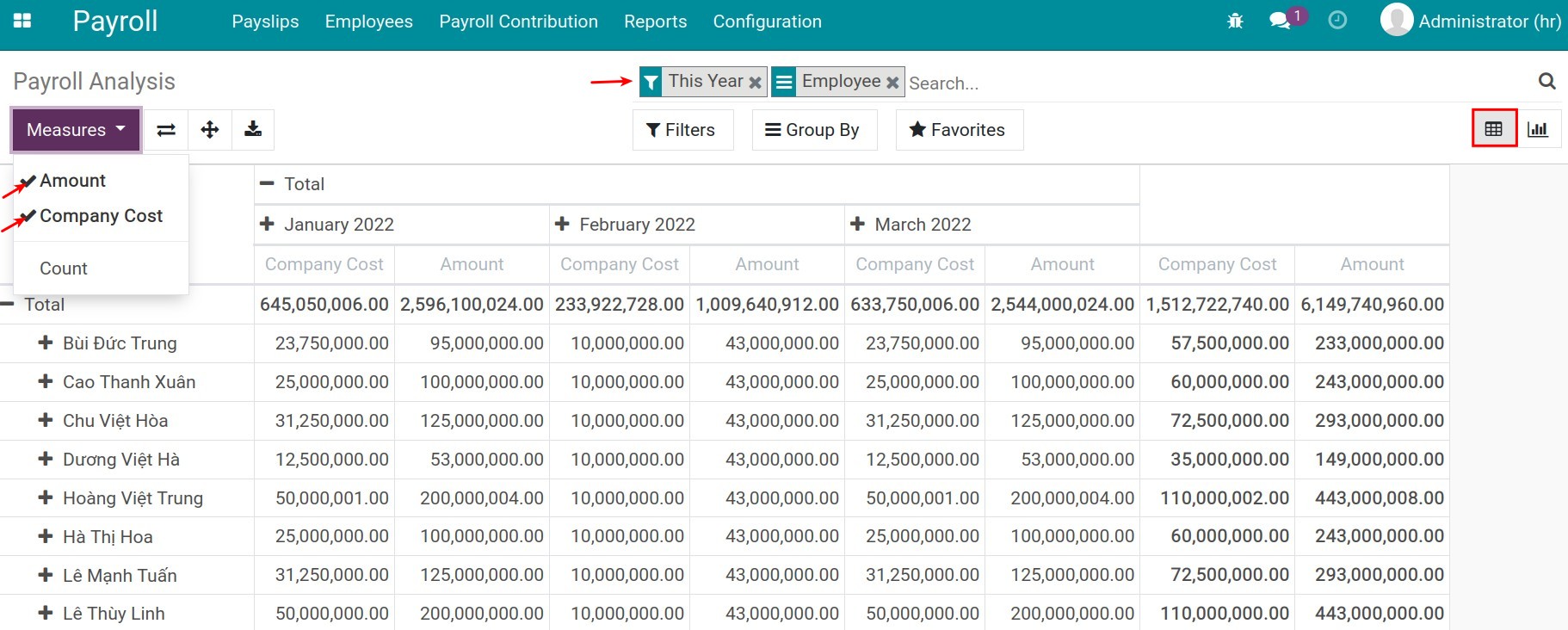

- Salary Analysis Report: Allow to view the report with the criteria included in the salary table and it is designed with the Pivot interface. This allows users to filter, group, or design their own report tables.

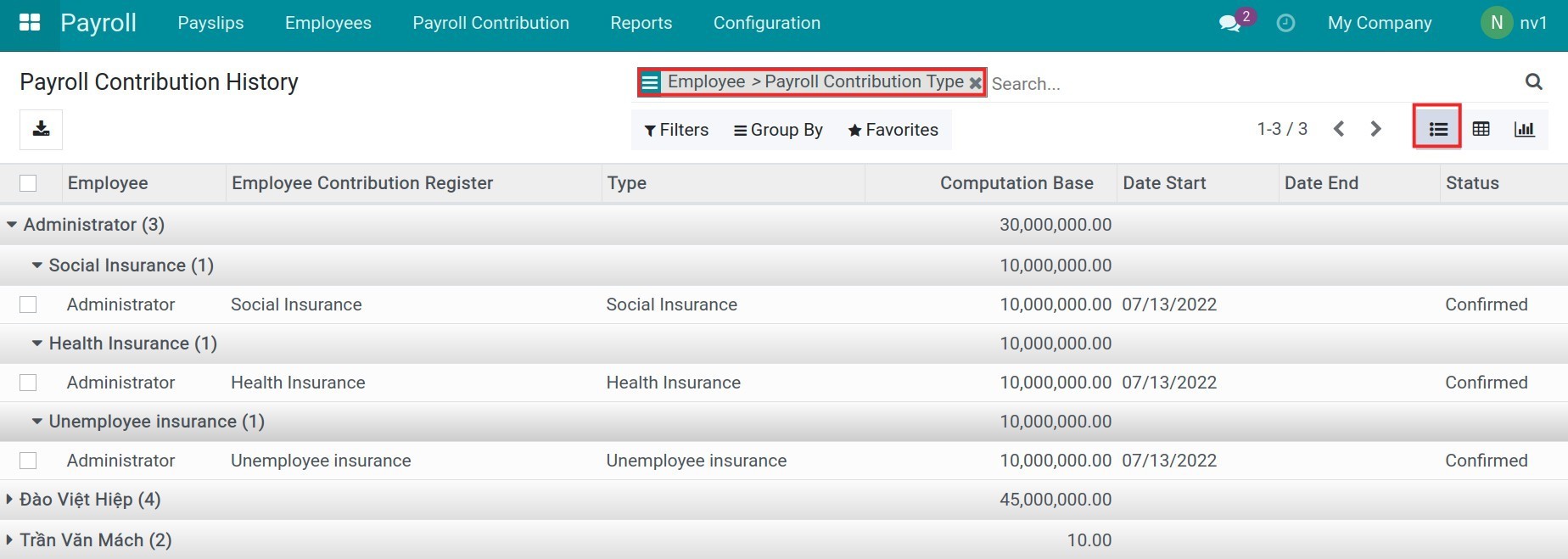

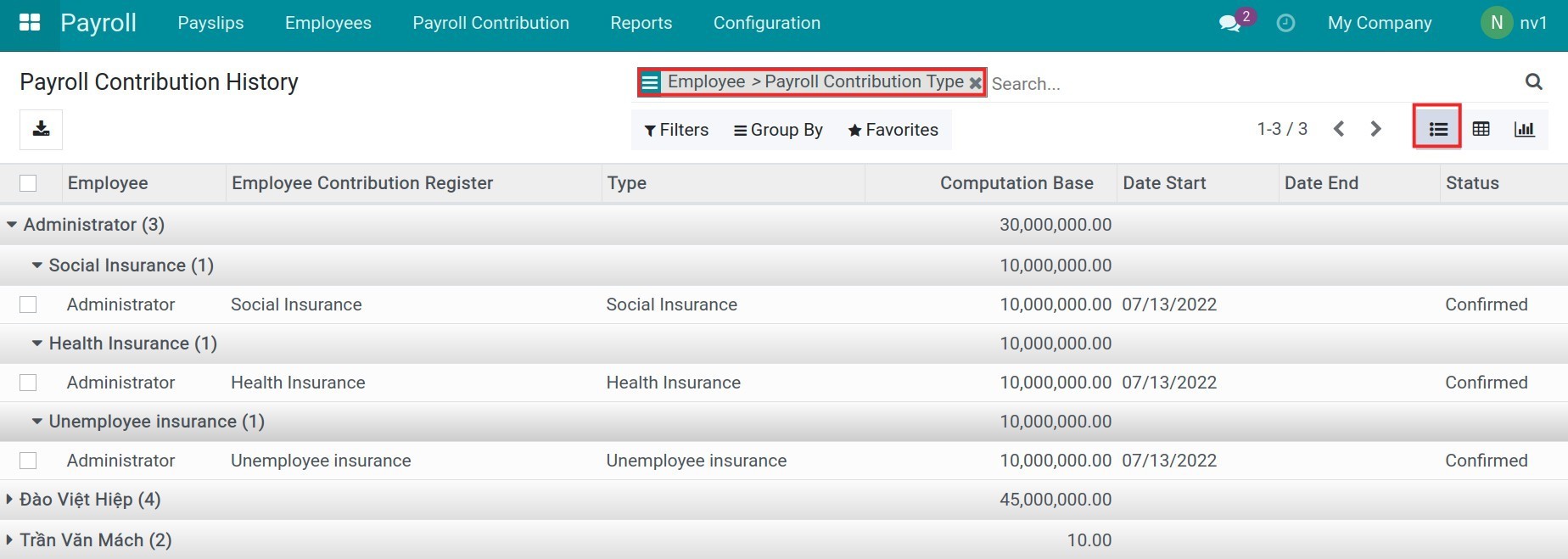

- Payroll Contribution History: Users can look up and manage employee contributions.

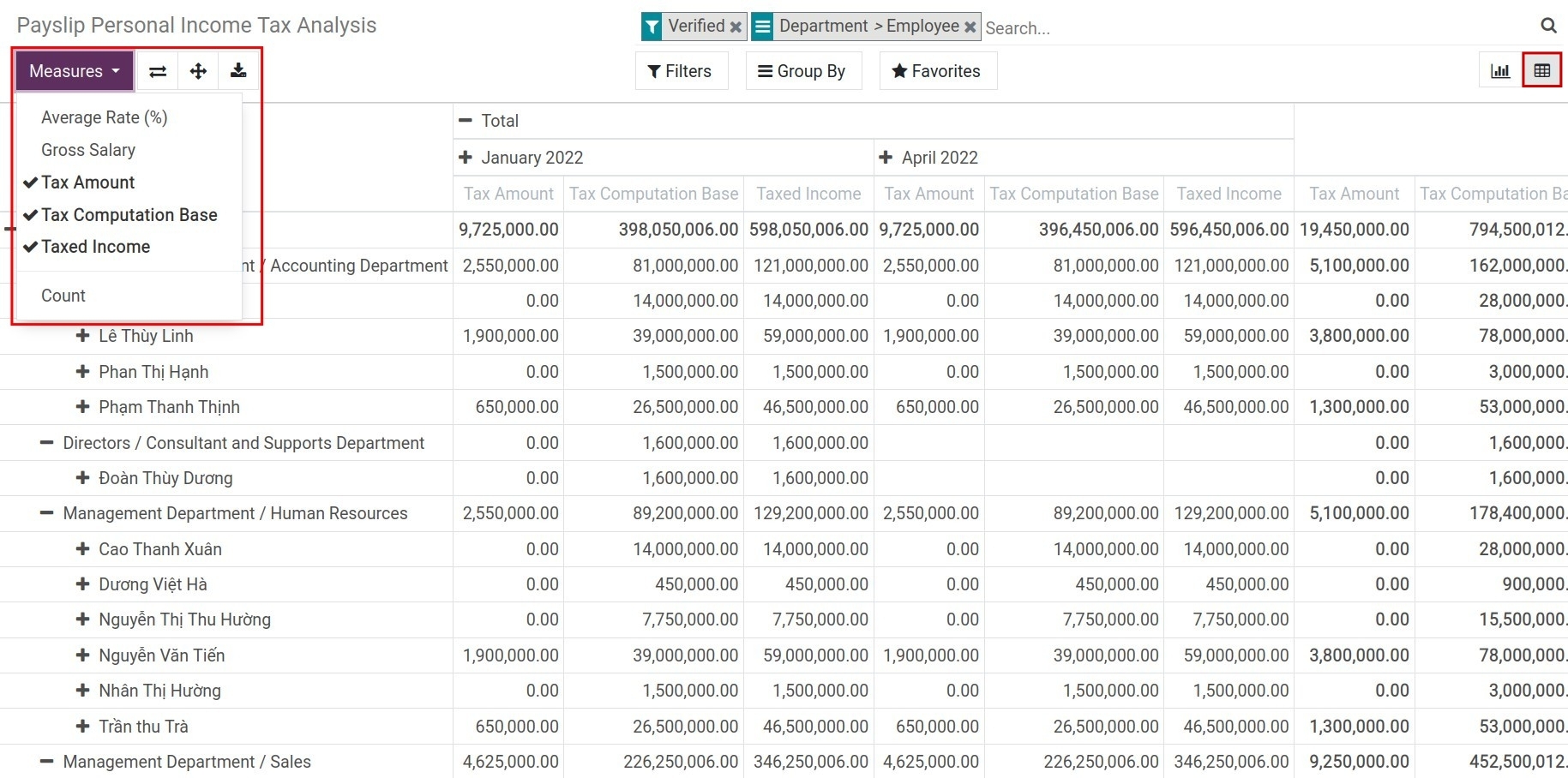

- Payslip Personal Income Tax Analysis: Multi-dimensional analysis with calculated values such as Tax amount, Tax computation base, Taxable income, etc.

- In case an employee has more than one contract and these contracts are in a different status New or Cancelled in the same salary cycle, the system will automatically calculate based on the matching contracts when creating payslips batches or payslips.

Business Value

- Efficiency and Time Savings: Automates the salary calculation process, significantly reducing the time and effort spent on payroll tasks.

- Transparency and Accuracy: Provides precise calculations and documentation for salaries, taxes, and contributions, minimizing errors.

- Integration with HR Processes: Seamlessly integrates with modules like Attendances, Time Off, and Expenses for holistic payroll management.

- Cost Analysis: Offers multidimensional reports for detailed salary cost breakdowns by department, project, or other criteria, enabling better financial planning and decision-making.

- Scalability: Adapts to enterprises with diverse payroll requirements, from flexible shifts to multiple contracts per employee.

Who Should Use This Module

This module is ideal for:

- Enterprises with large employee bases and diverse salary structures.

- Organizations requiring payroll integration with other HR systems like attendance, overtime, and expense management.

- Businesses looking for detailed salary cost analysis and financial reporting.

- HR departments aiming to reduce manual errors and improve payroll transparency.

- Companies in industries with complex working hours, flexible shifts, and diverse contractual arrangements.

Known Issues

- There is a restriction on negative days with the salary cycle. You can replace it by setting the positive day and the negative month.

- Warning: To avoid conflicts in the process of using Payroll application, you must uninstall Odoo's Payroll if you are using it.

Editions Supported

- Community Edition

Installation

- Navigate to Apps;

- Search with keyword to_hr_payroll;

- Press Install.

Instruction

Instruction video: Payroll

1. Initial configurations for payroll

- Salary cycle: The salary cycle of the business. The default will be from the beginning to the end of the current month. You can create a new one in case your company has a different Salary cycle. Example: Salary cycle from the 25th of this month to the next 25th.

- Salary Structure: A salary structure is a set of rules used to determine how much employees will be paid. The system allows the creation of many salary structures such as salary structure for the office department, salary structure for the production department, etc.

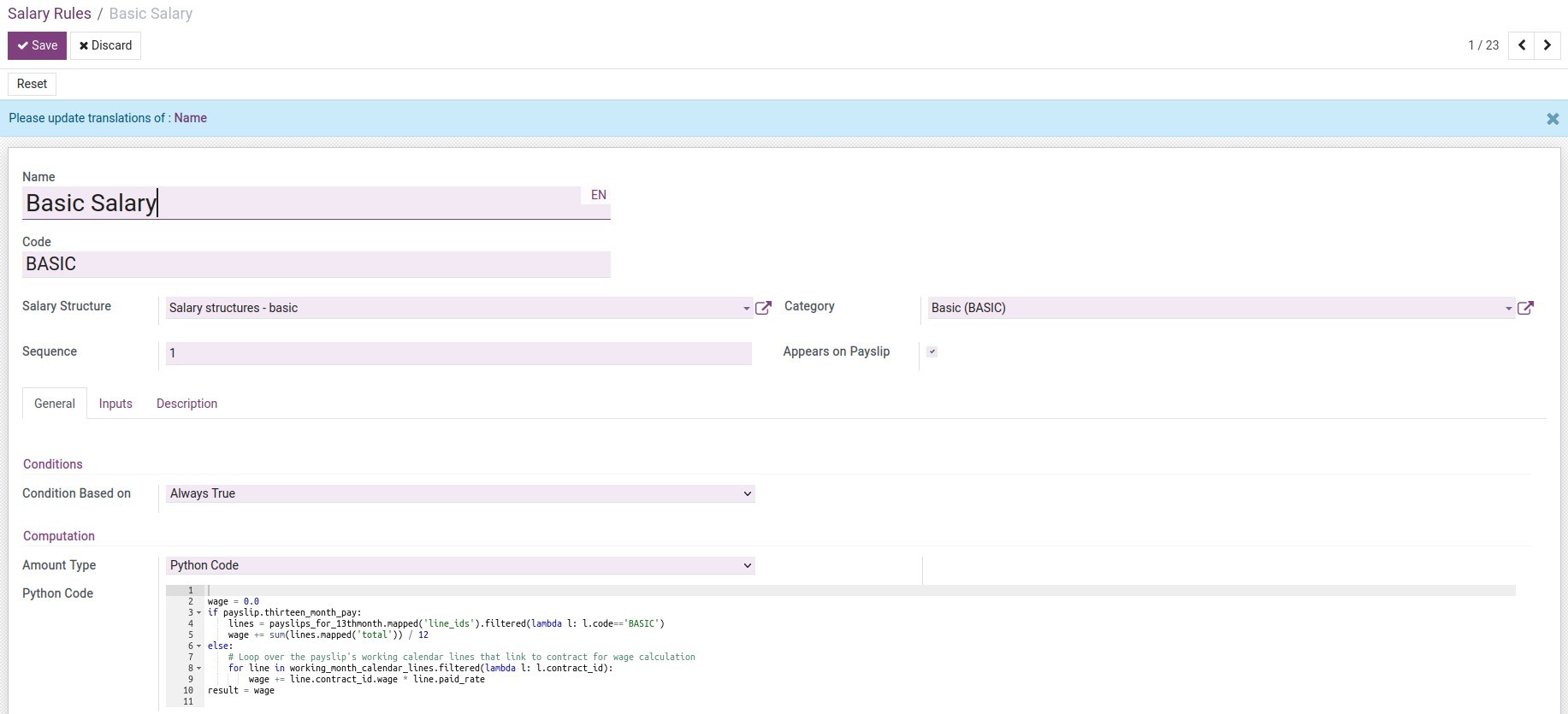

- Salary rule: Salary rules are also understood as calculation formulas for items on payslips. The system has automatically added a set of basic salary rules.

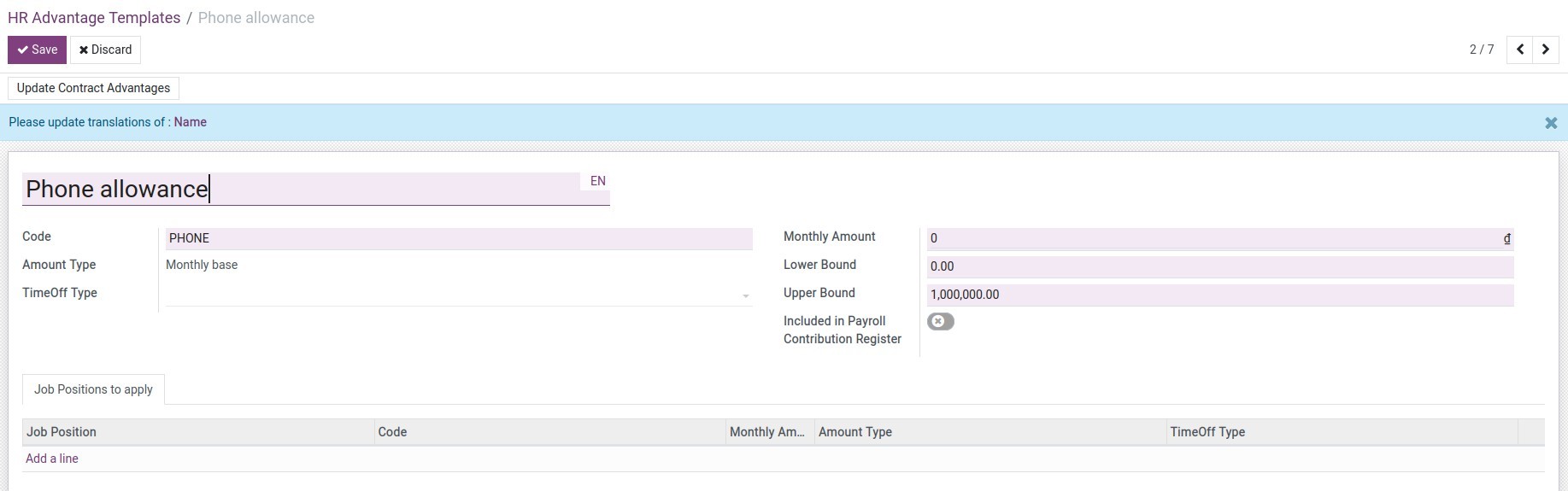

- HR Advantage Templates: Allowances for employees according to company policy. For example Harmful Subsidies, Hard Working Award, Performance Award, etc.

2. Set up information on employee contract

After completing the configuration in step 1, you need to set this information on the employee contract:

Go to Payroll ‣ Employees ‣ Contracts, create a new employee contract:

3. Create Payslips Batches & Payslips

Go to Payroll ‣ Payslips ‣ Payslips to create payslips for each employee:

Or go to Payroll ‣ Payslips ‣ Payslips Batches to create payslips batches for departments or the company:

4. View analysis report

Go to Payroll ‣ Reports ‣ Payroll Analysis to view payroll analysis report:.

Go to Payroll ‣ Reports ‣ Payroll Contribution History to see analysis of payroll contribution history::

Go to Payroll ‣ Reports ‣ Payslip Personal Income Tax Analysis to view Personal Income Tax Analysis Report:

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.