Demo video: Vietnam - Payroll with Accounting

What it does

Payroll management is one of the important issues for every business. However, this work takes a lot of time and effort for separate cost accounting for each department. It is essential to have established accounting models for each salary rule. This module is designed based on the regulations on salary accounting according to Vietnamese Accounting Standards to help users simplify the initial system setup.

Key Features

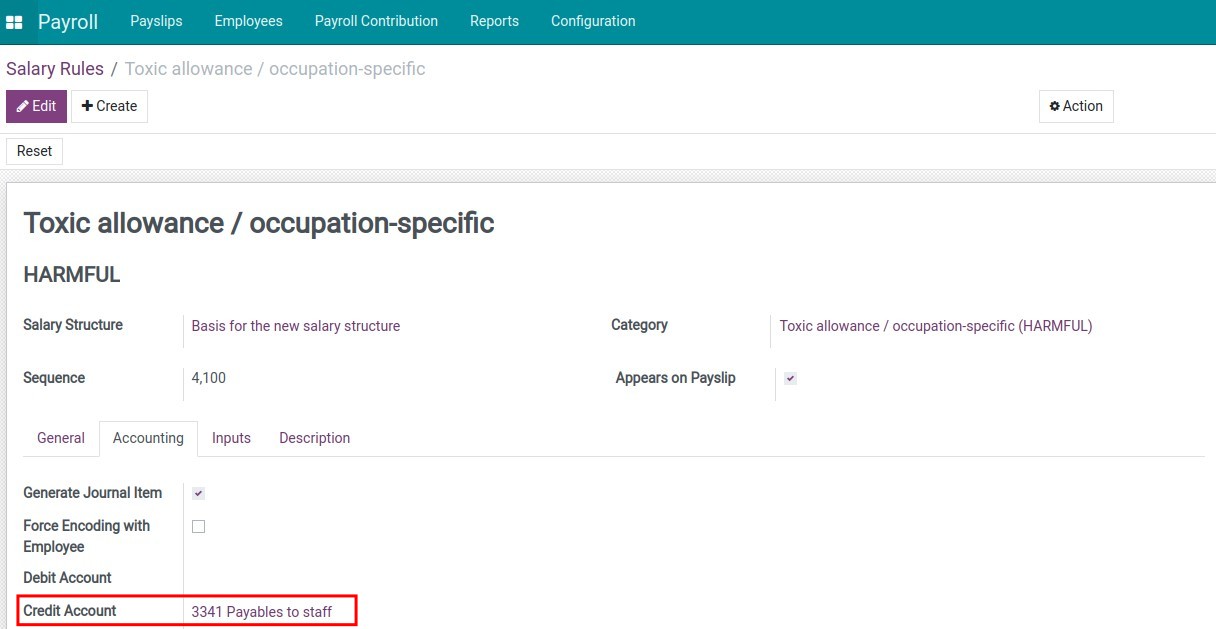

Configure accounting accounts on each salary rule according to Vietnamese Accounting Standards for automatic accounting of related journal items. For example:

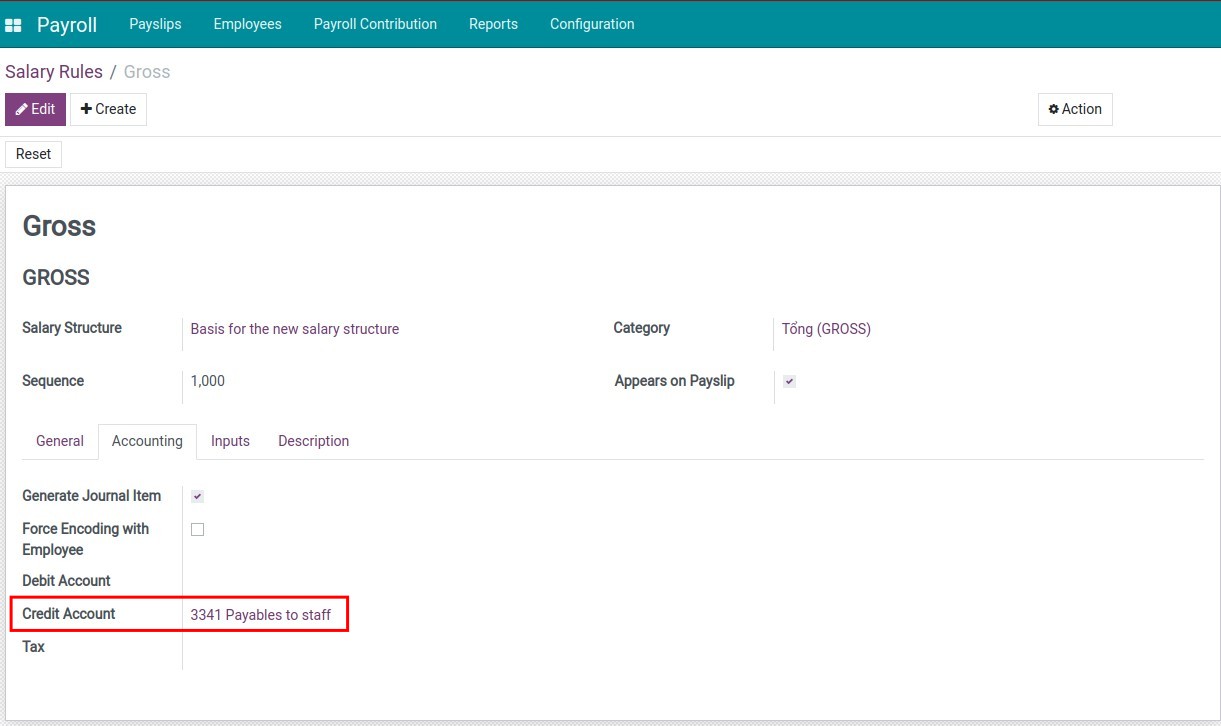

- Basic Wage for Office Employee:

- Debit Account: 642

- Credit Account: 3341

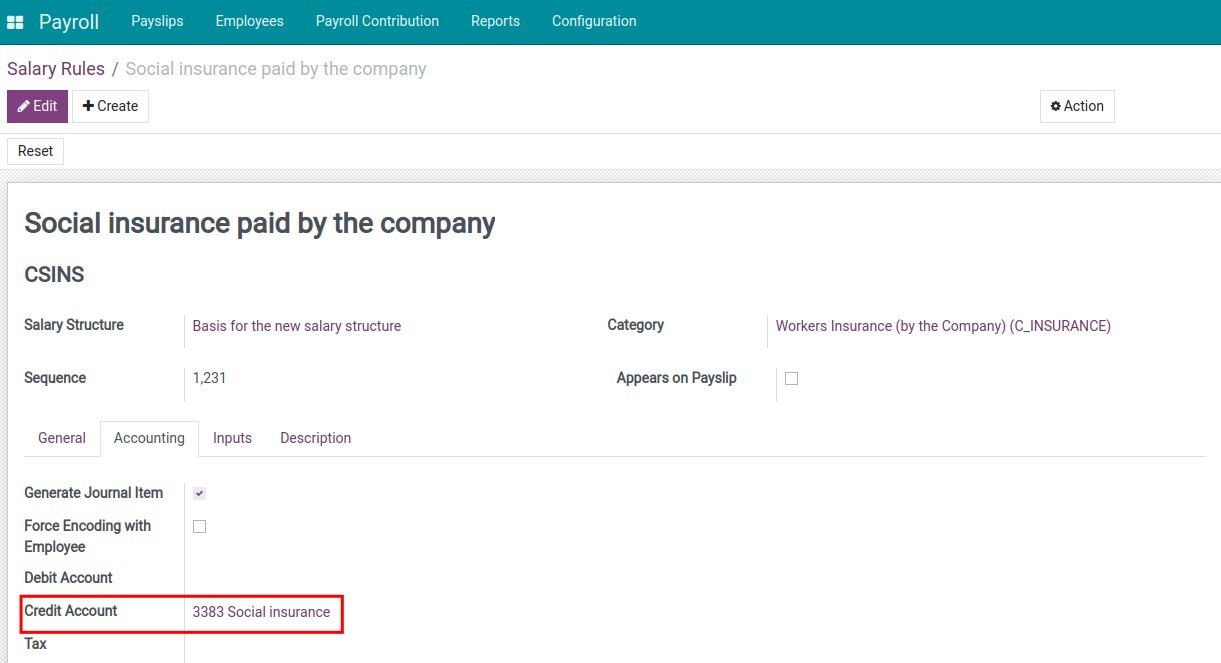

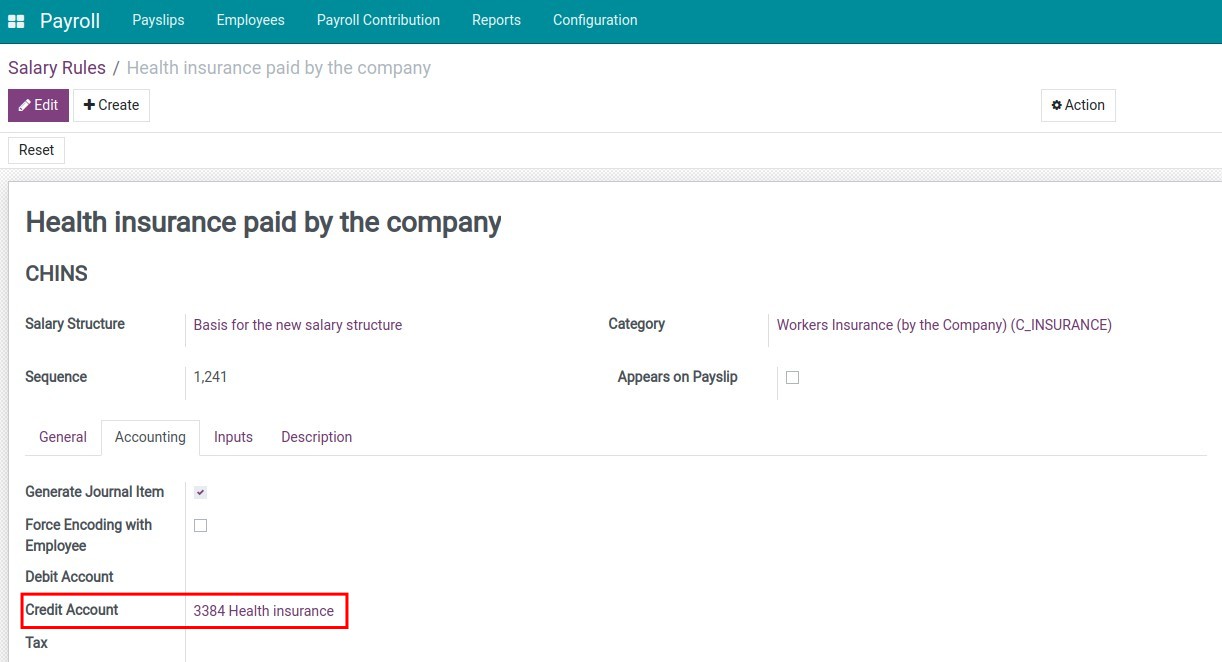

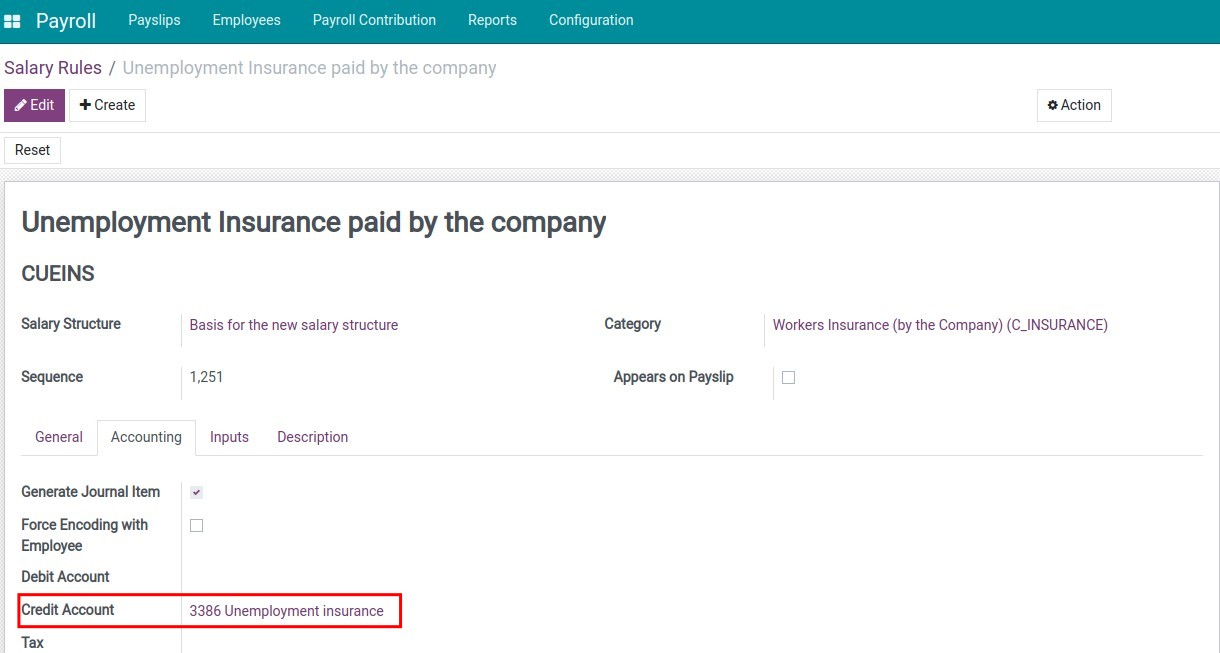

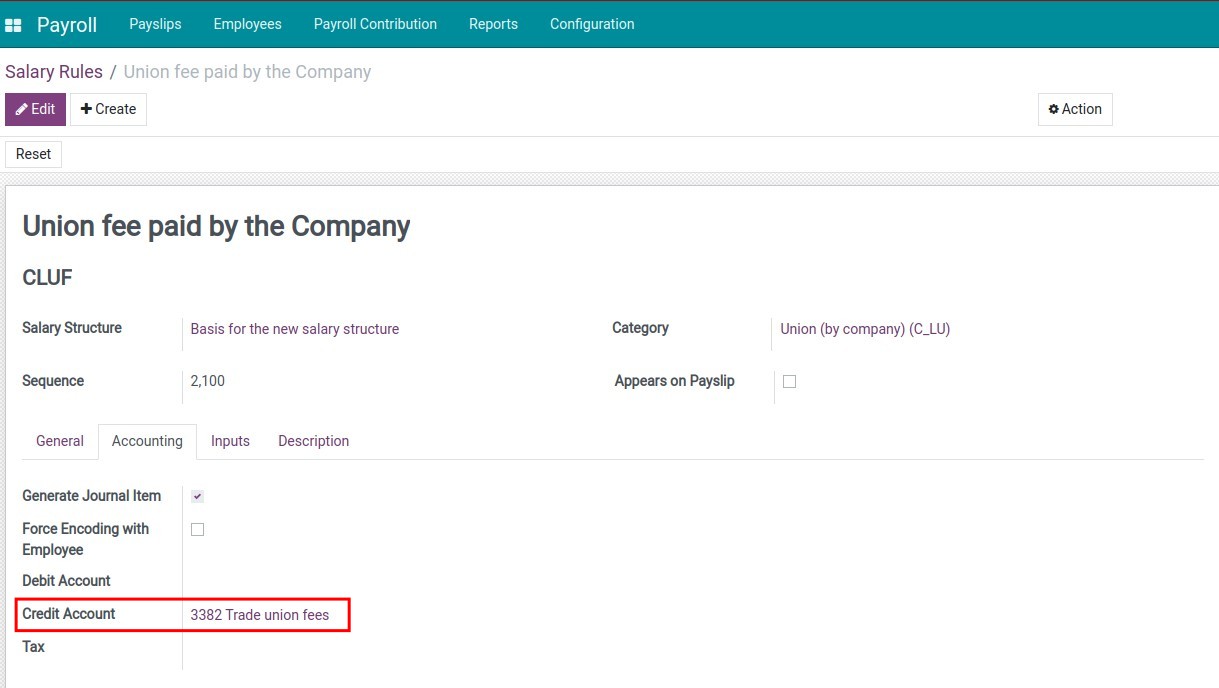

- Social Insurance, Health Insurance, Unemployment Insurance, Labor Union Fee paid by the company for Office Employee:

- Debit Account: 642

- Credit Account: 3383

- Credit Account: 3384

- Credit Account: 3386

- Credit Account: 3382

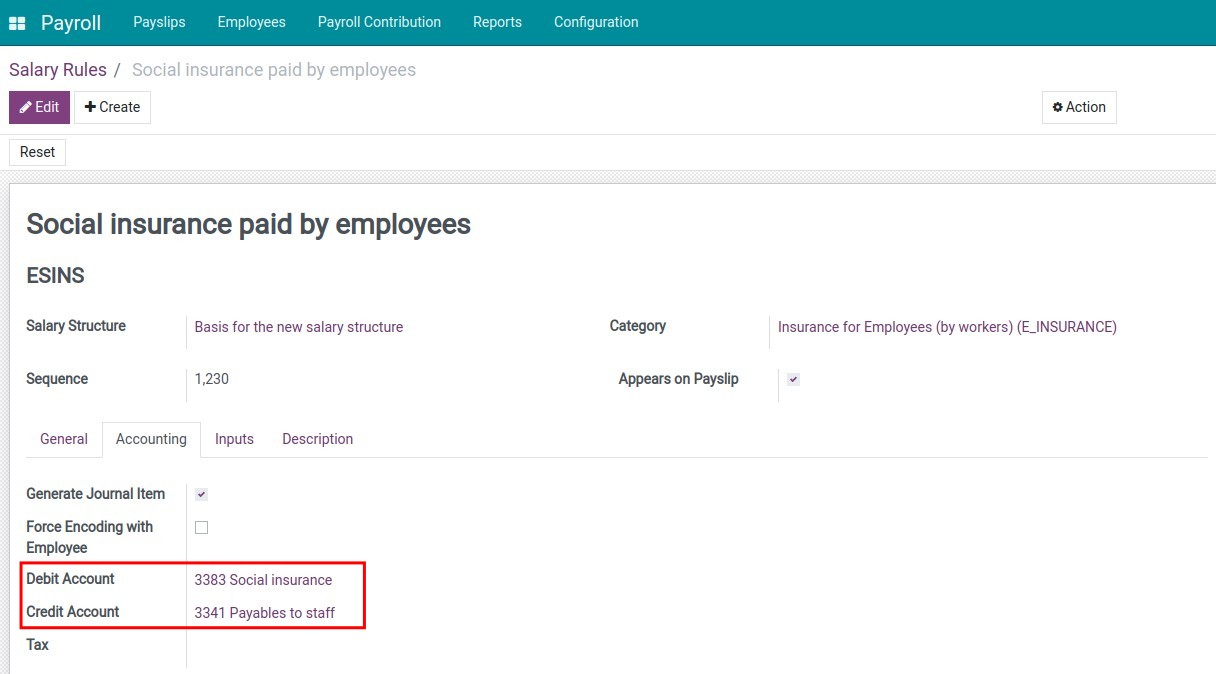

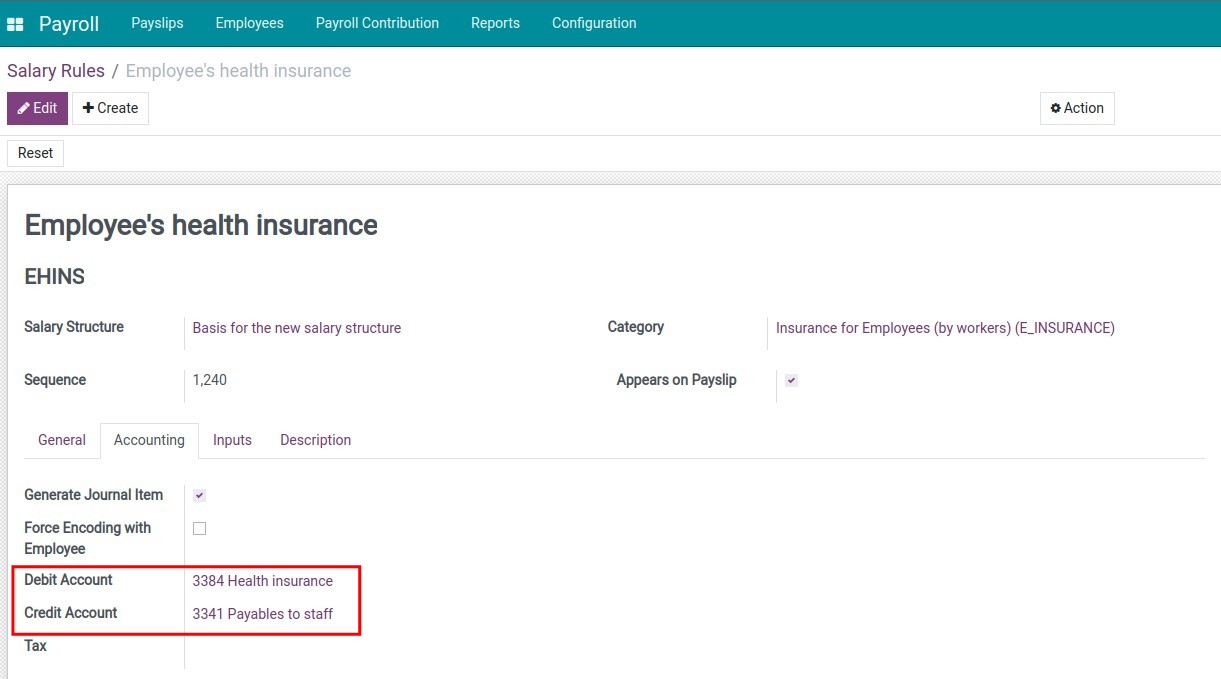

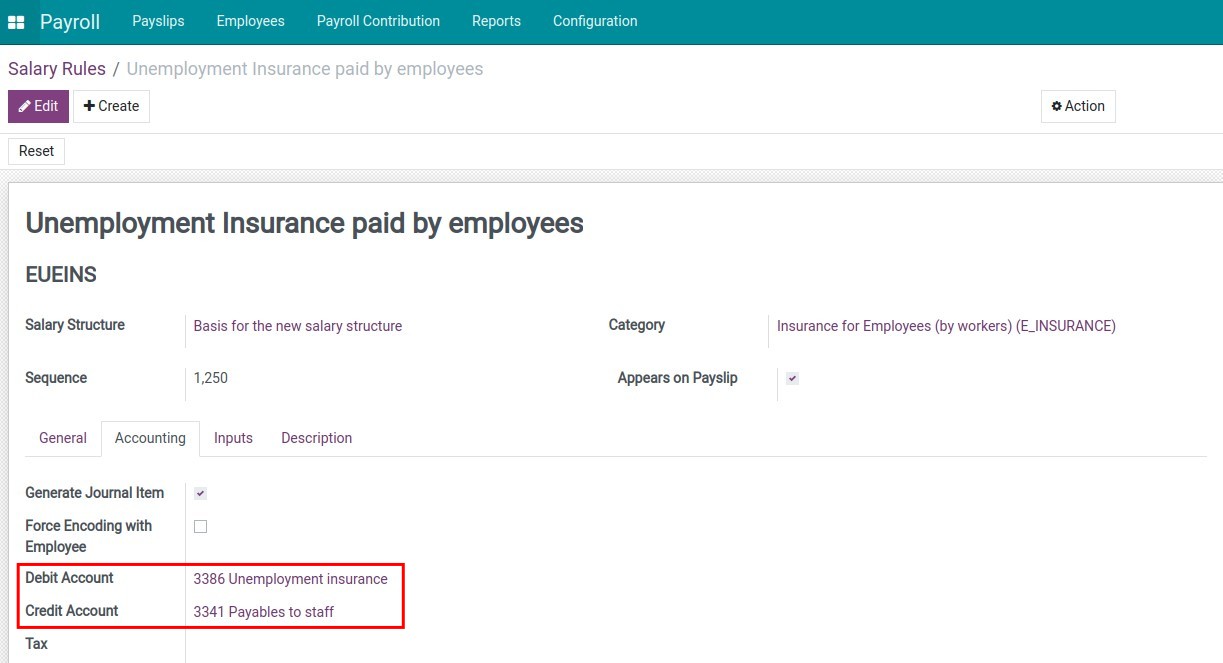

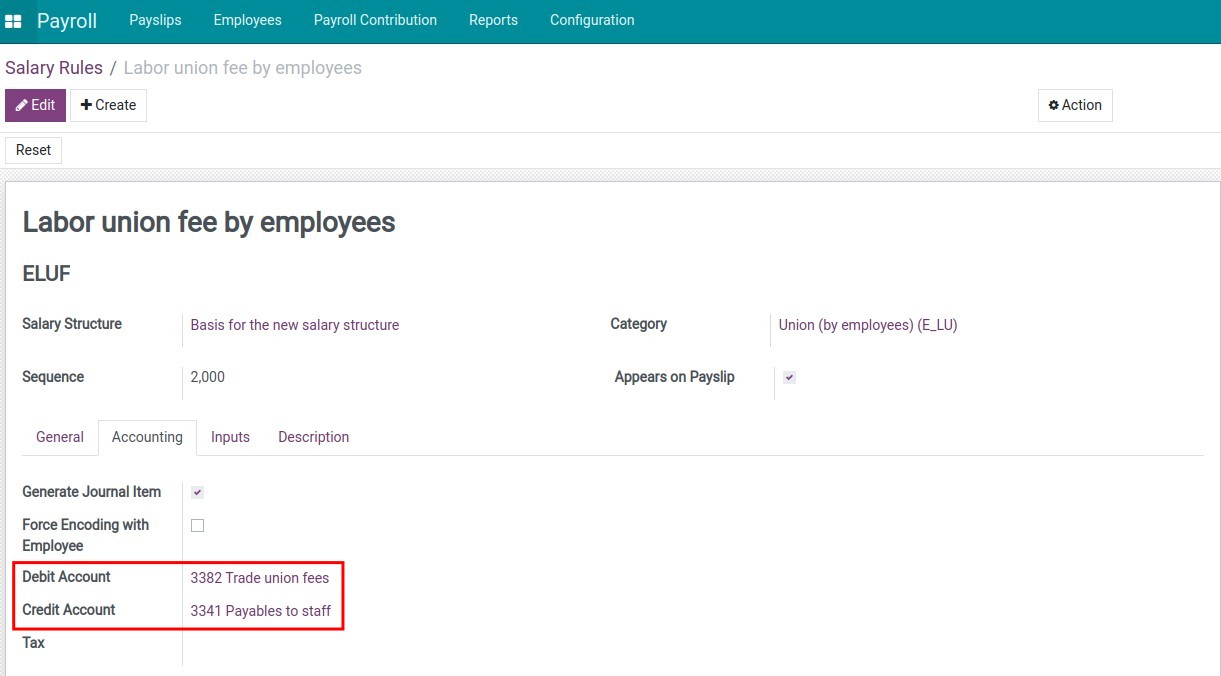

- Social Insurance, Health Insurance, Unemployment Insurance, Labor Union Fee paid by employees:

- Debit Account: 3341

- Credit Account: 3383

- Credit Account: 3384

- Credit Account: 3386

- Credit Account: 3382

- Etc.

Business Value

- Localized Accounting Compliance:

- Automatically maps accounting entries based on Vietnamese Accounting Standards (VAS), ensuring compliance with local regulations.

- Reduces the risk of accounting discrepancies, especially for payroll-related journal entries.

- Efficiency in Payroll Management:

- Streamlines the process of setting up and managing payroll accounting, saving time and reducing manual errors.

- Automatically integrates salary rules with department-wise cost allocation.

- Enhanced Financial Planning:

- Provides accurate and detailed journal entries, enabling better cost analysis and budget management.

- Ensures transparency and consistency in financial reporting.

Who Should Use This Module

- Vietnamese Enterprises:

- Ideal for businesses in Vietnam that require accounting integration aligned with Vietnamese standards.

- Suitable for companies needing department-wise payroll accounting.

- Accounting and HR Teams:

- Designed for accounting professionals who need precise and automated journal entries for payroll.

- Beneficial for HR teams handling complex salary rules linked to accounting.

- Enterprises of All Sizes:

- Supports SMEs and large corporations looking for compliance and efficiency in payroll and accounting integration.

Editions Supported

- Community Edition

Installation

- Navigate to Apps.

- Search with keyword l10n_vn_viin_hr_payroll_account.

- Press Install.

Instruction

Instruction video: Vietnam - Payroll with Accounting

Usages

Besides installing the module, to create and accounting payslips/payslips batches, you need to install additional modules including:

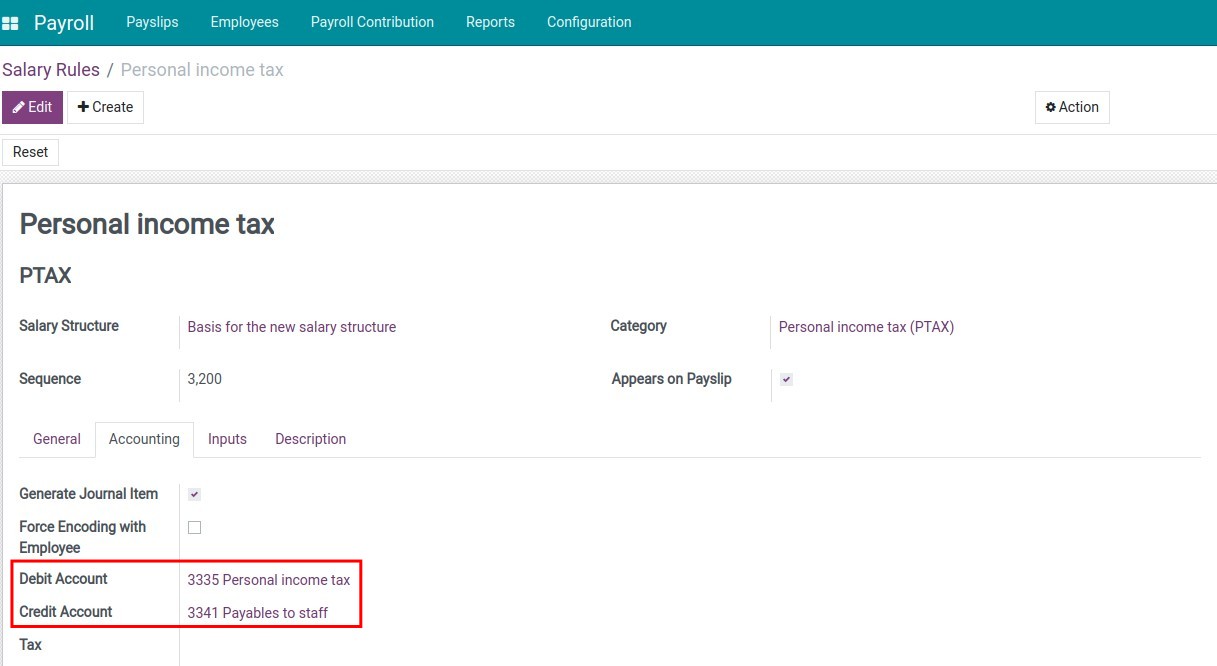

After installing the module, the Payroll app will be set the default accounting information for each salary rule according to Vietnamese Accounting Standards. Navigate to Payroll > Configuration > Salary Rules, remove the default filter, choose a salary rule and navigate to tab Accounting, check Generate Journal Item to show 2 more fields: debit account and credit account. Details of the information set by default include:

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.