Demo video: Account Delegation Partner

Problems

In daily operations, there will be situations where your company is delegated by a partner to pay for some expenses, or you need to delegate another partner to receive certain revenues. As a company owner, you want to register and follow these payments related to that exact delegated partner.

Example: Each month, a company pays expenses such as phone fees, transportation fees, etc. on behalf of their employees since they have a better deal. The company then needs to register these expenses for each employee and deduct it from their employees' payslips for the corresponding month.

Solutions

This module provides the Delegation Partner field which helps users to select a partner on each invoice/receipt line.

Editions Supported

- Community Edition

- Enterprise Edition

Note

This module is outdated and may be subject to removal in the future.

Installation

- Navigate to Apps.

- Search with keyword to_account_delegation_partner.

- Press Install.

Instructions

Instruction video: Account Delegation Partner

Example:

- Company pays the phone fee on behalf of its employees.

- The payment will be debited from the corresponding employee's payable account in the payslip.

Initial settings

- Create an accounting account in the Current Asset type. E.g: 13881 - Other Receivables (in Vietnam Accounting).

- Create the Employee mobile phone fees product with the 13881 - Other Receivables as the dedicated expenses account.

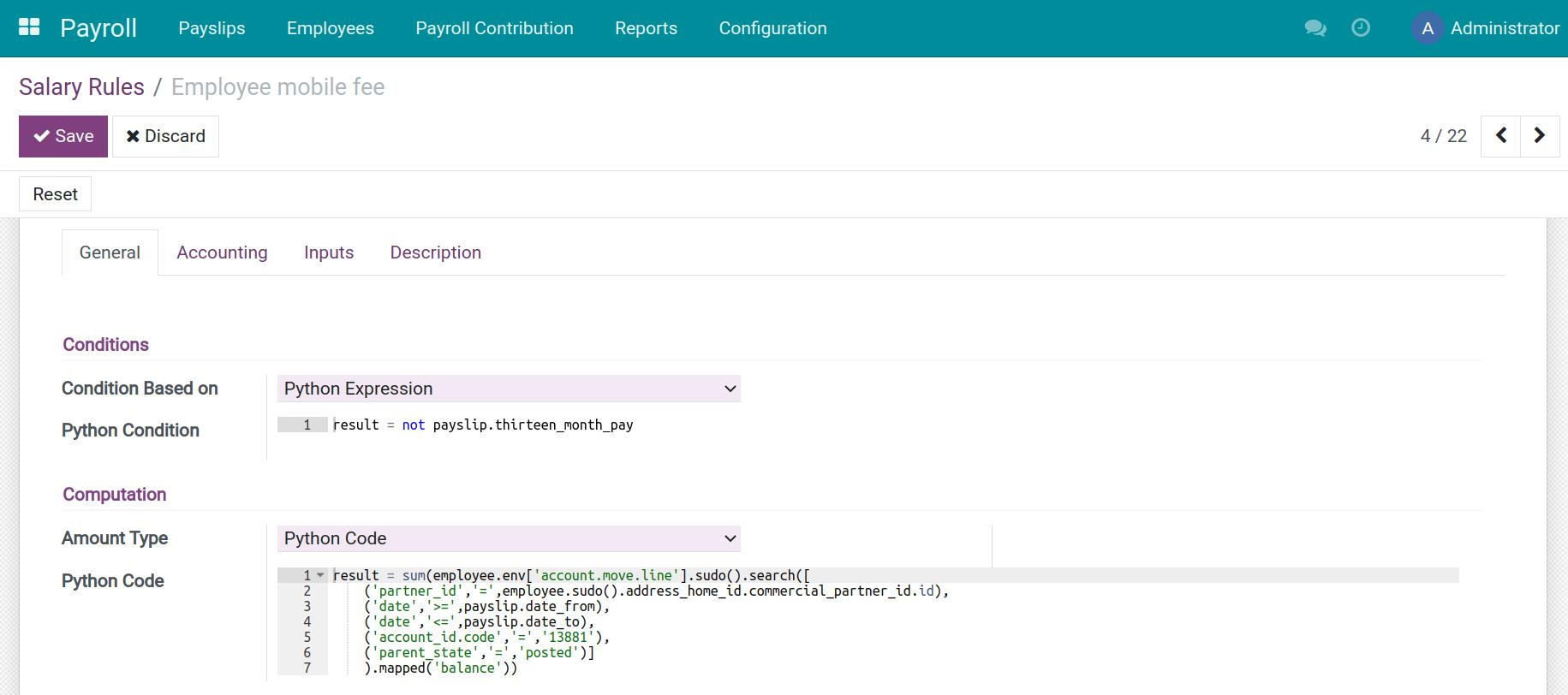

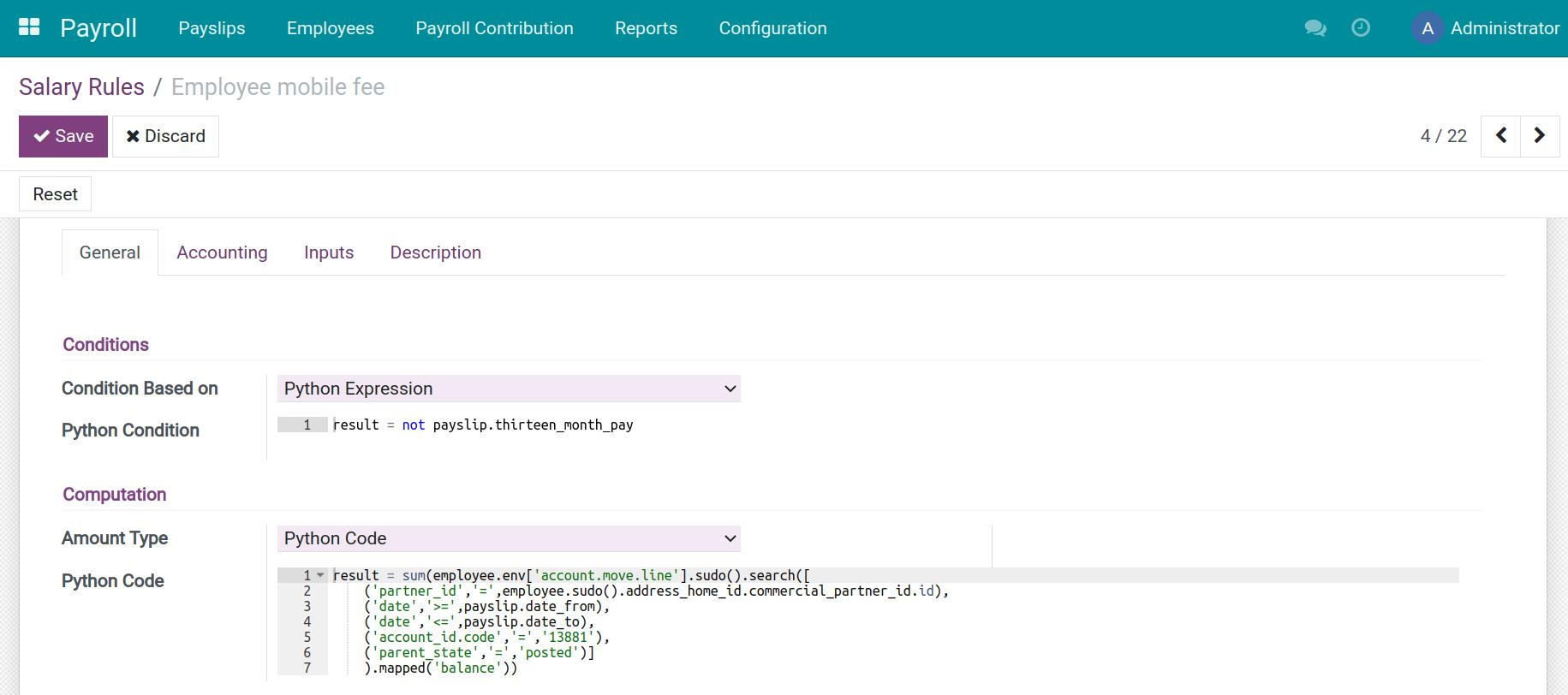

- Create a salary rule with the following configuration:

- Debit Account: Employee payables account (E.g: 334 - Employee Payables according to the Vietnam Accounting Standard).

- Credit Account: The current asset account created in the first step (E.g: 13881 - Other Receivables).

- Python code for the salary computation:

result = sum(employee.env['account.move.line'].sudo().search([

('partner_id','=',employee.sudo().address_home_id.commercial_partner_id.id),

('date','>=',payslip.date_from),

('date','<=',payslip.date_to),

('account_id.code','=','13881'),

('parent_state','=','posted')]

).mapped('balance'))

Note: You need to install the Viindoo Payroll app or use the Odoo Enterprise version to have this whole workflow works properly.

Usage

Following are steps to use this feature in receipts but they also can be applied to the invoicing process.

1. Activate the Purchase Receipts feature

You need to activate the Purchase Receipts feature and configure access rights for each user to use this feature.

2. Create and confirm a receipt

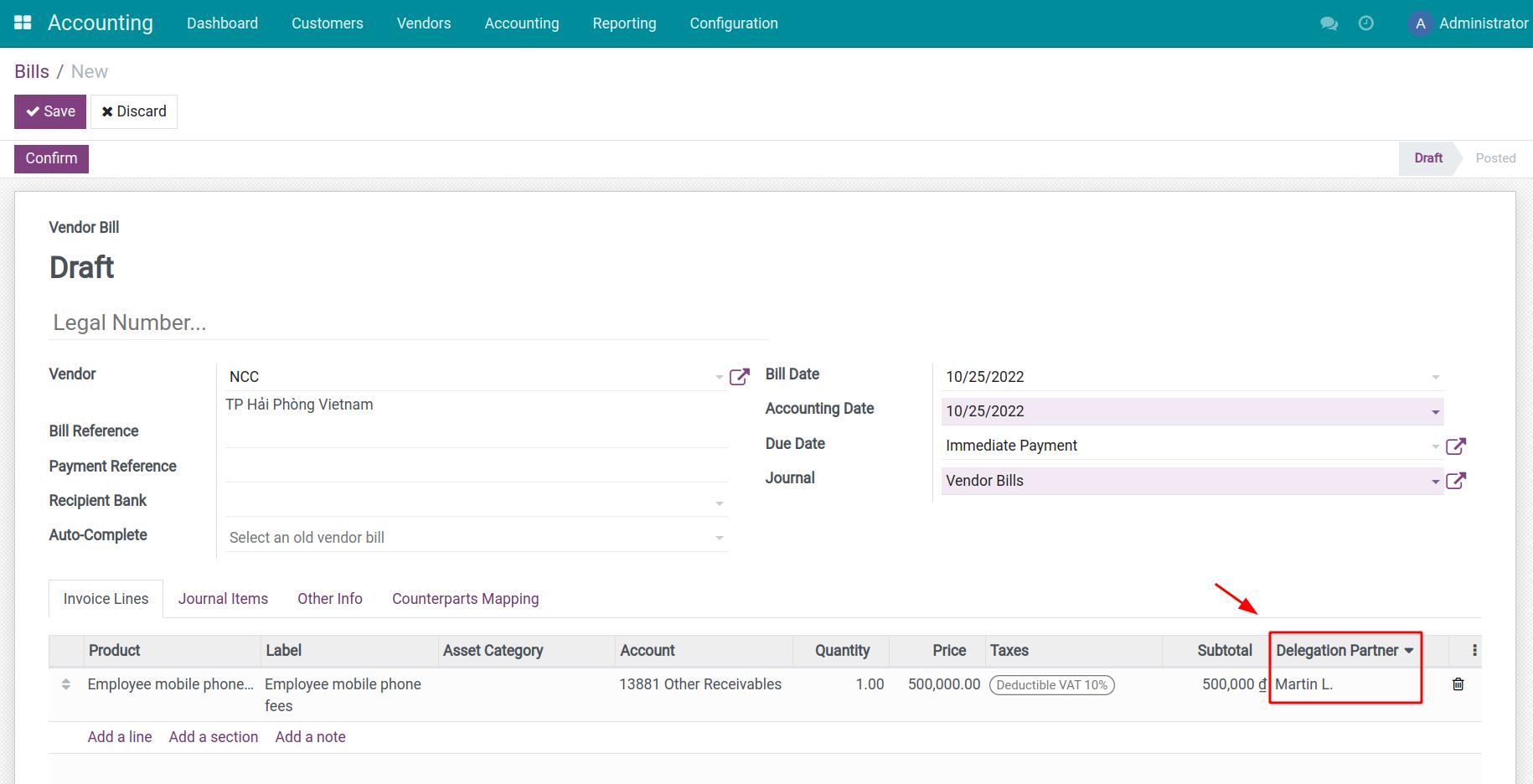

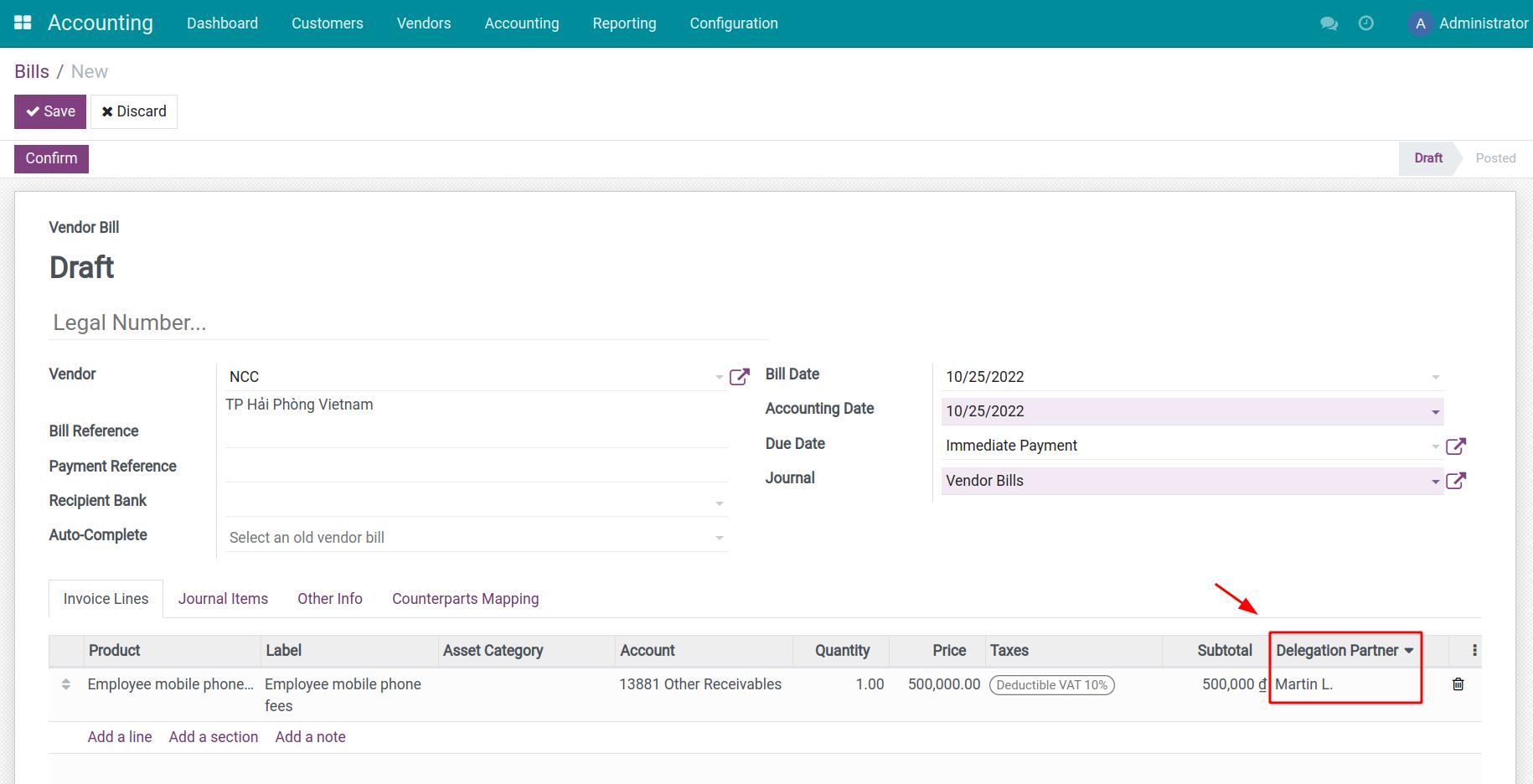

Navigate to Accounting > Vendors > Receipts to create a purchase receipt with the following information:

- Vendor: Vendor 1.

- Create an invoice line:

- Product: Employee mobile phone fees.

- Price: A value bigger than 0.

- Delegation Partner: Select the partner linked with the employee's private address.

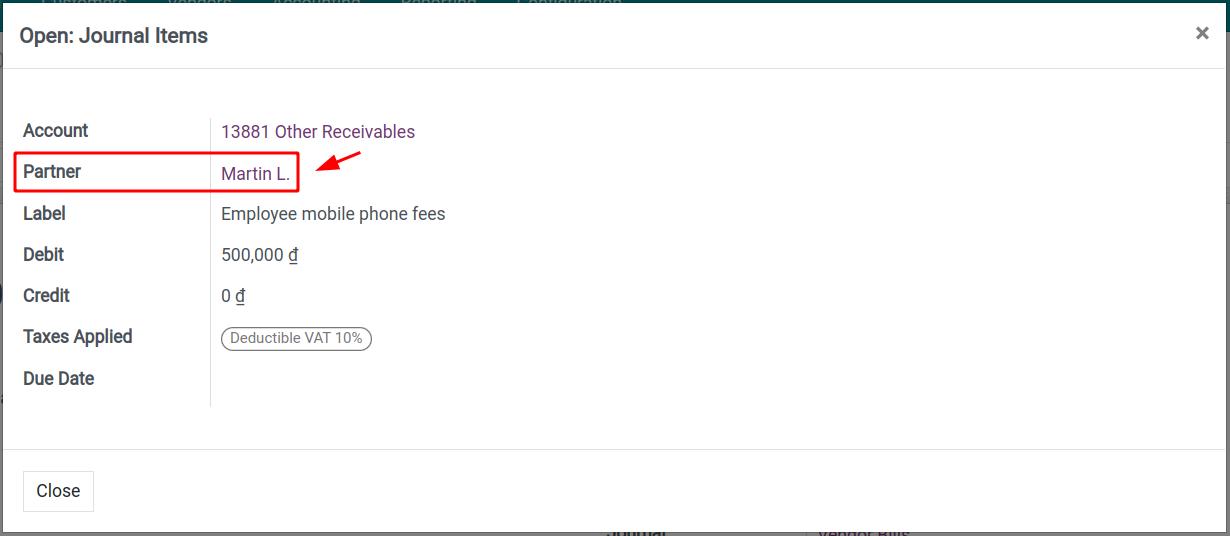

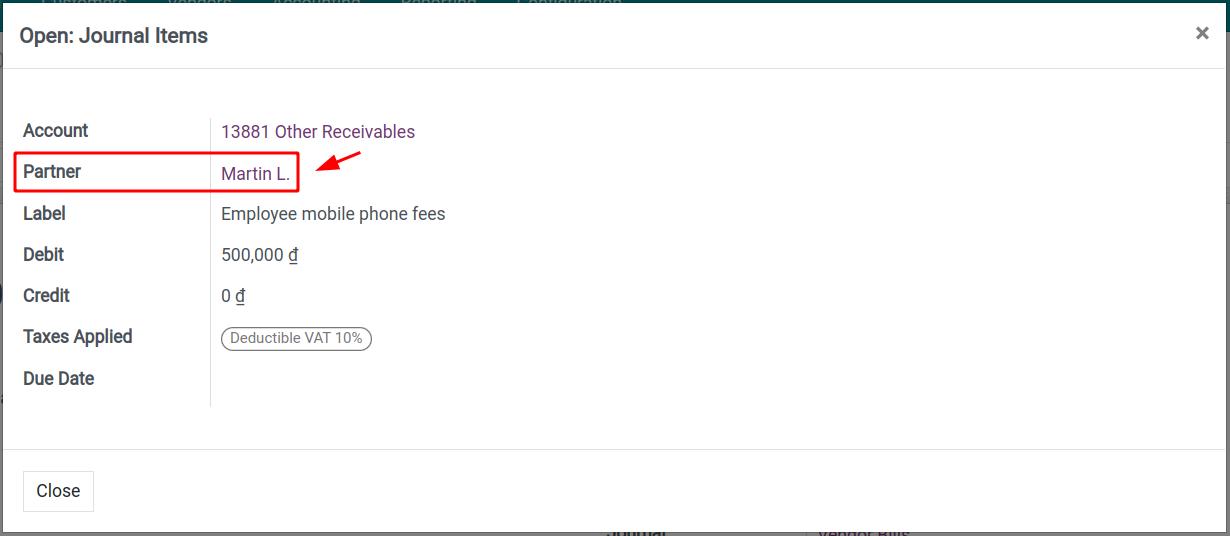

After pressing Confirm this receipt, the following journal items will be created automatically:

- Debit: 13881 - Other Receivables, linked with the delegation partner.

- Credit: 331 - Accounts Payables, linked with the vendor.

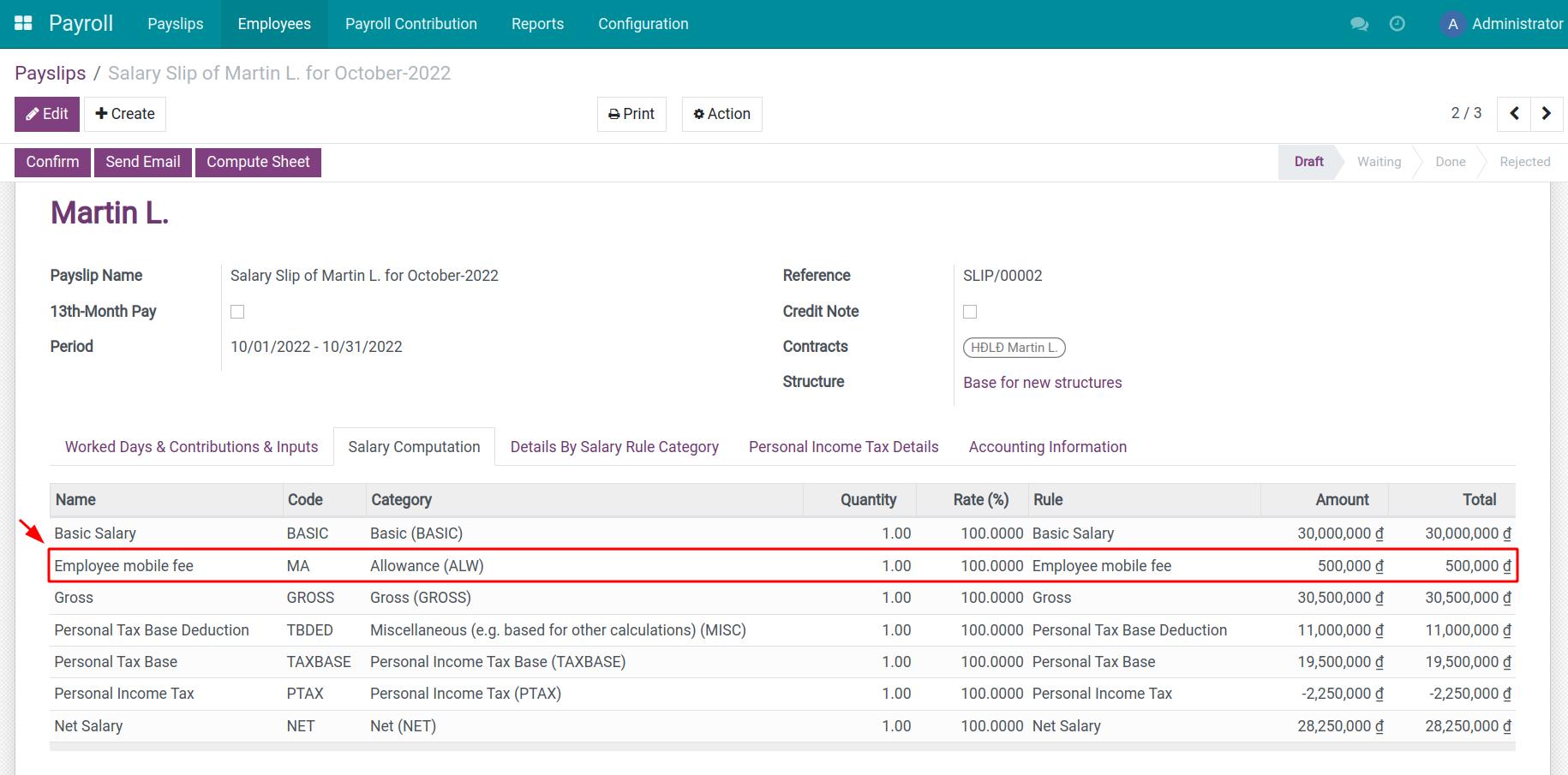

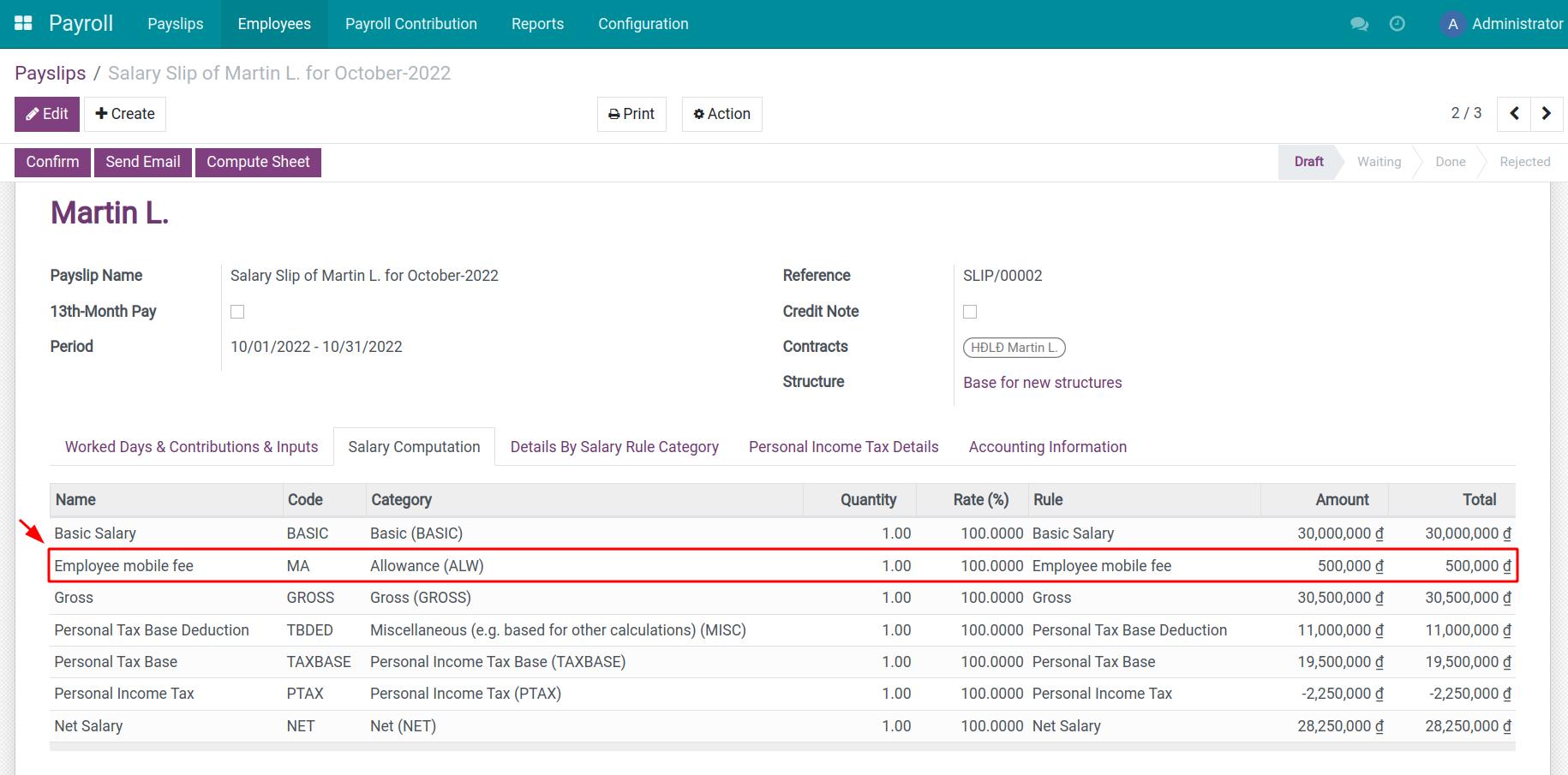

3. Register the expenses on a payslip

Create a payslip for the corresponding period and validate it to see the following journal entry:

- Debit: 334 - Employee Payables

- Credit: 13881 - Other Receivables

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.