Demo video: Vietnam - Meal Order Payroll with Accounting

Problem

Many businesses support part of the meal order expense for their employees. However, keeping track of those expenses can make mistakes, especially when done manually.

The accounting needs to sort out the amount the employee has to pay (deduction from the salary), and the amount the company has to pay (becoming the company's expense).

Solution

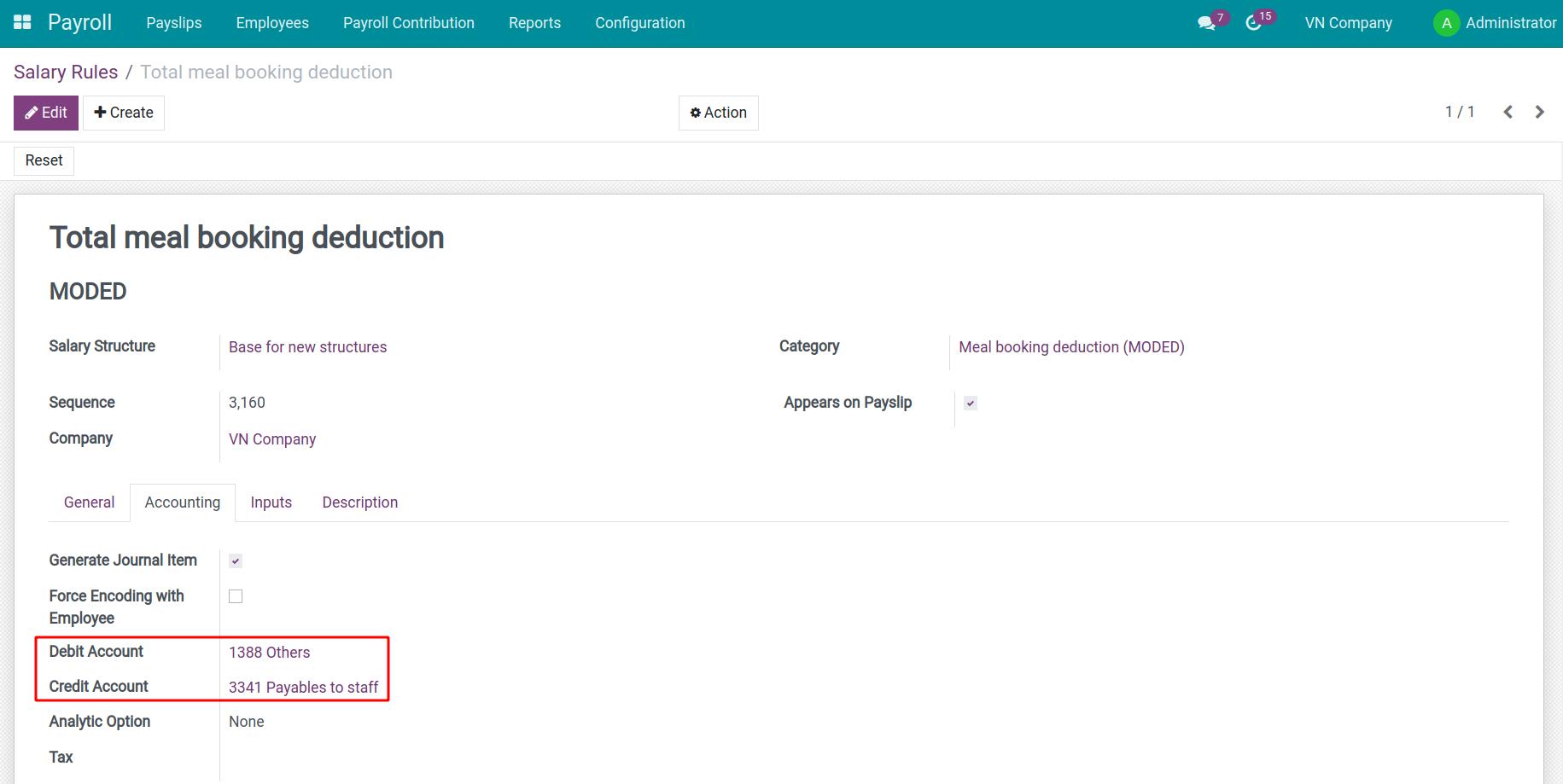

This module sets the default accounting account for the salary rule Total deduction for meal orders according to Vietnamese accounting standards.

Key features

In the salary rule Total deduction for meal orders form, at the Accounting tab, the system will automatically display more default information including

- Debit Account: 3341 Payables to staff

- Credit Account: 1388 Others

Editions Supported

- Community Edition

Installation

- Navigate to Apps.

- Search with keyword l10n_vn_viin_hr_payroll_meal_account.

- Press Install.

Instruction

Instruction video: Vietnam - Meal Order Payroll with Accounting

General Settings

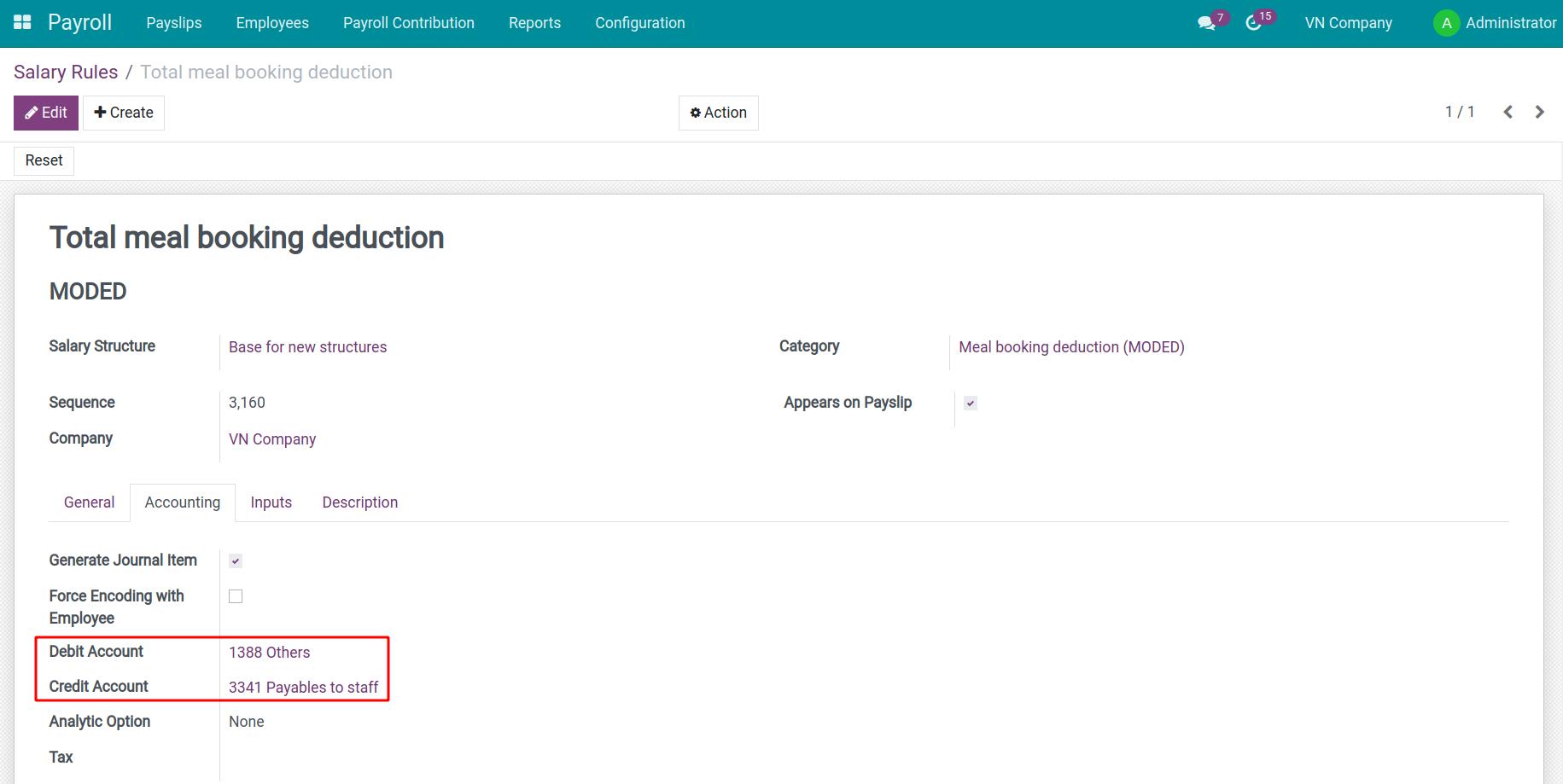

After installing, the Payroll app will set the default accounting information for the salary rule Total deduction for meal orders according to Vietnamese Accounting Standards.

Navigate to Payroll > Configuration > Salary Rules, remove the default filter, select the salary rule Total deduction for meal orders and navigate to tab Accounting, check Generate Journal Item will show more default information including:

- Debit account: 1388 - Others;

- Credit account: 3341 - Payables to staff.

Usages

Accounting occurrences

Assuming, the enterprise organizes meals together but only supports employees with part of the price, at the end of the month the company will pay off the debt to the meal vendor and the employee will have to refund a part to the company by deduction from salary.

For example:

1 day employee salary: 200.000đ

Meal: 50.000đ ( Company pays: 30:000đ, employee pay: 20.000đ)

Accounts payable to vendors and receivables from employees:

- Debit 642: 30.000 VND

- Debit 1388: 20.000 VND

- Credit 331: 50.000 VND

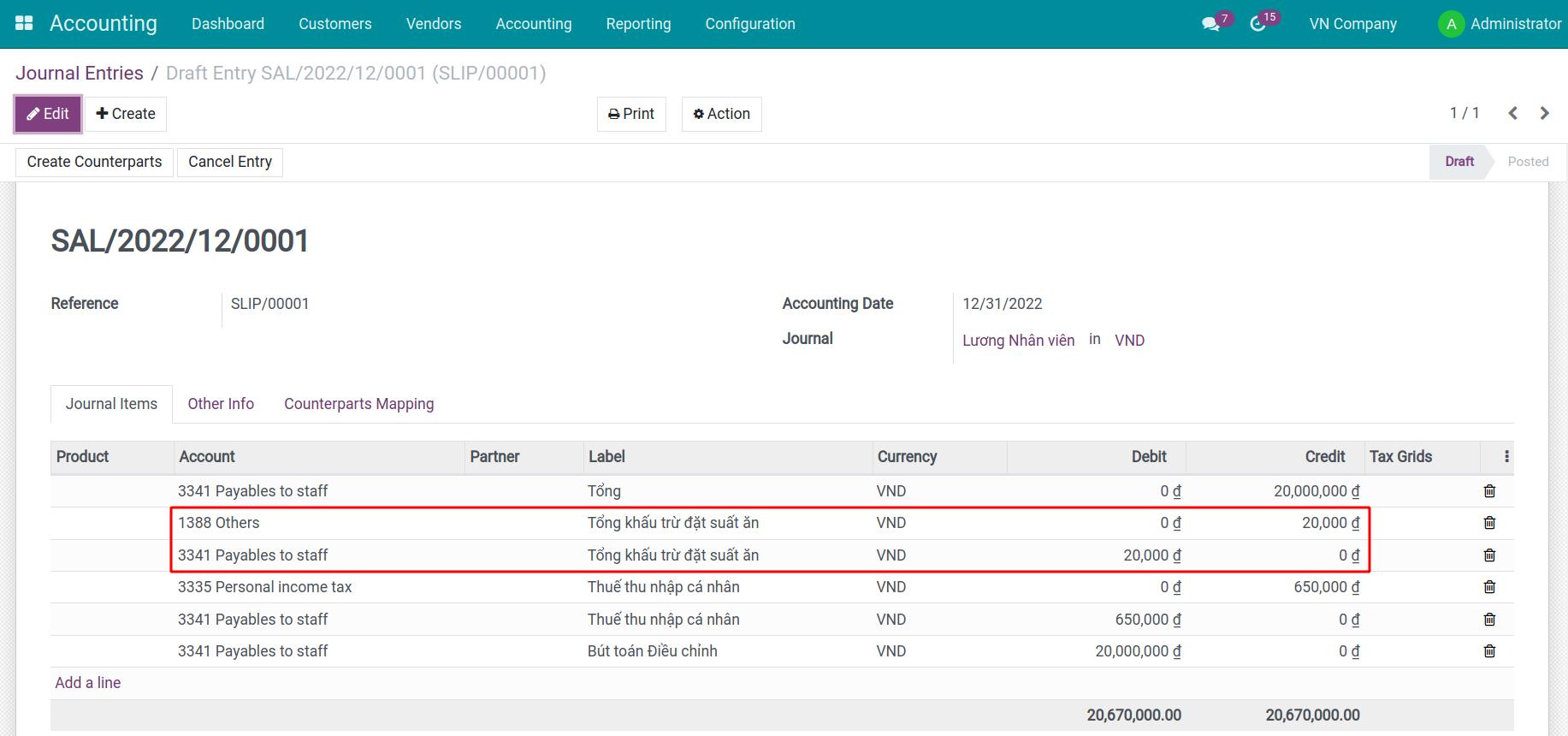

Accounts meal deductions:

- Debit TK 3341: 20.000 VND

- Credit TK 1388: 20.000 VND

Steps to operate on the software

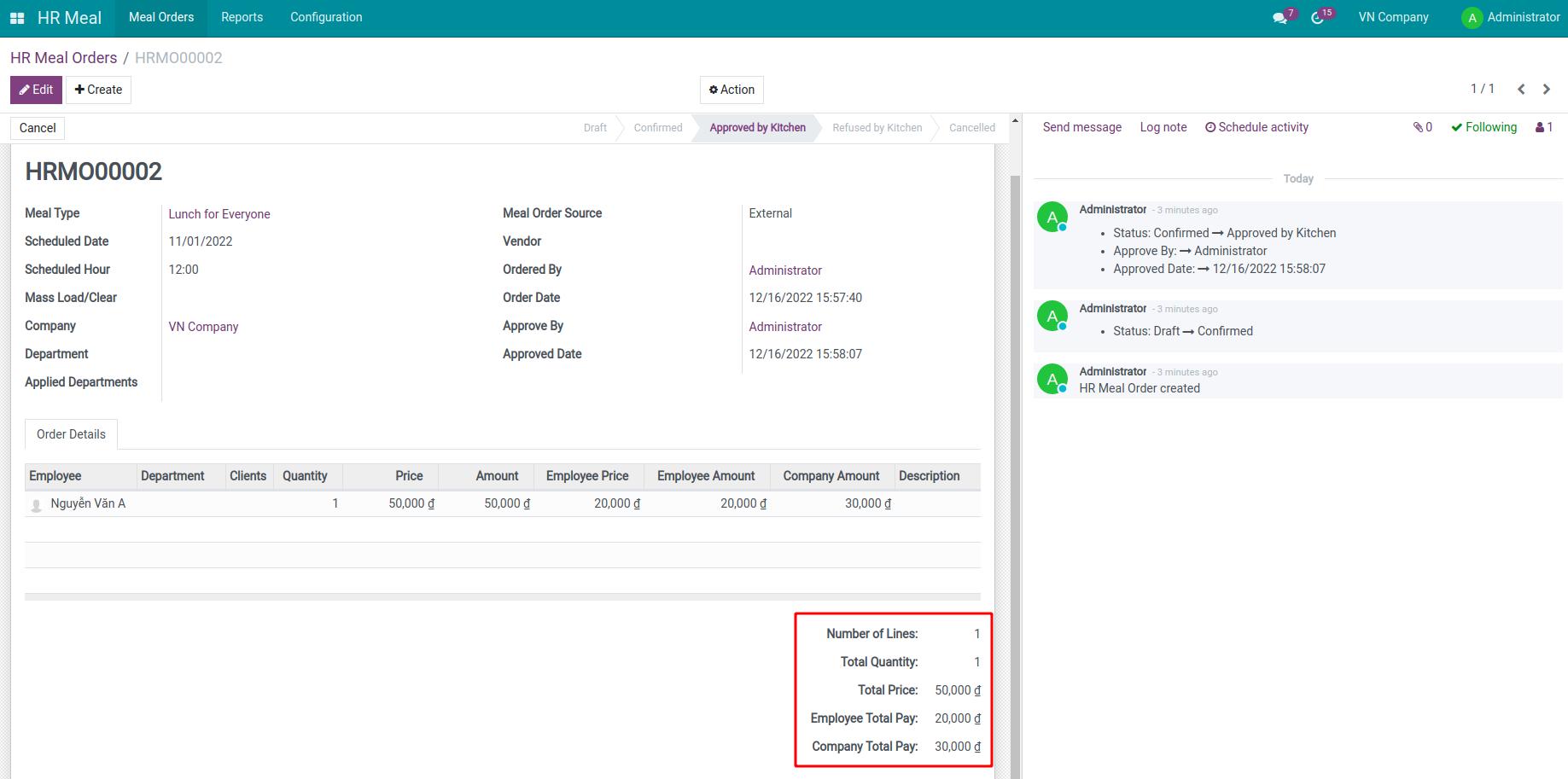

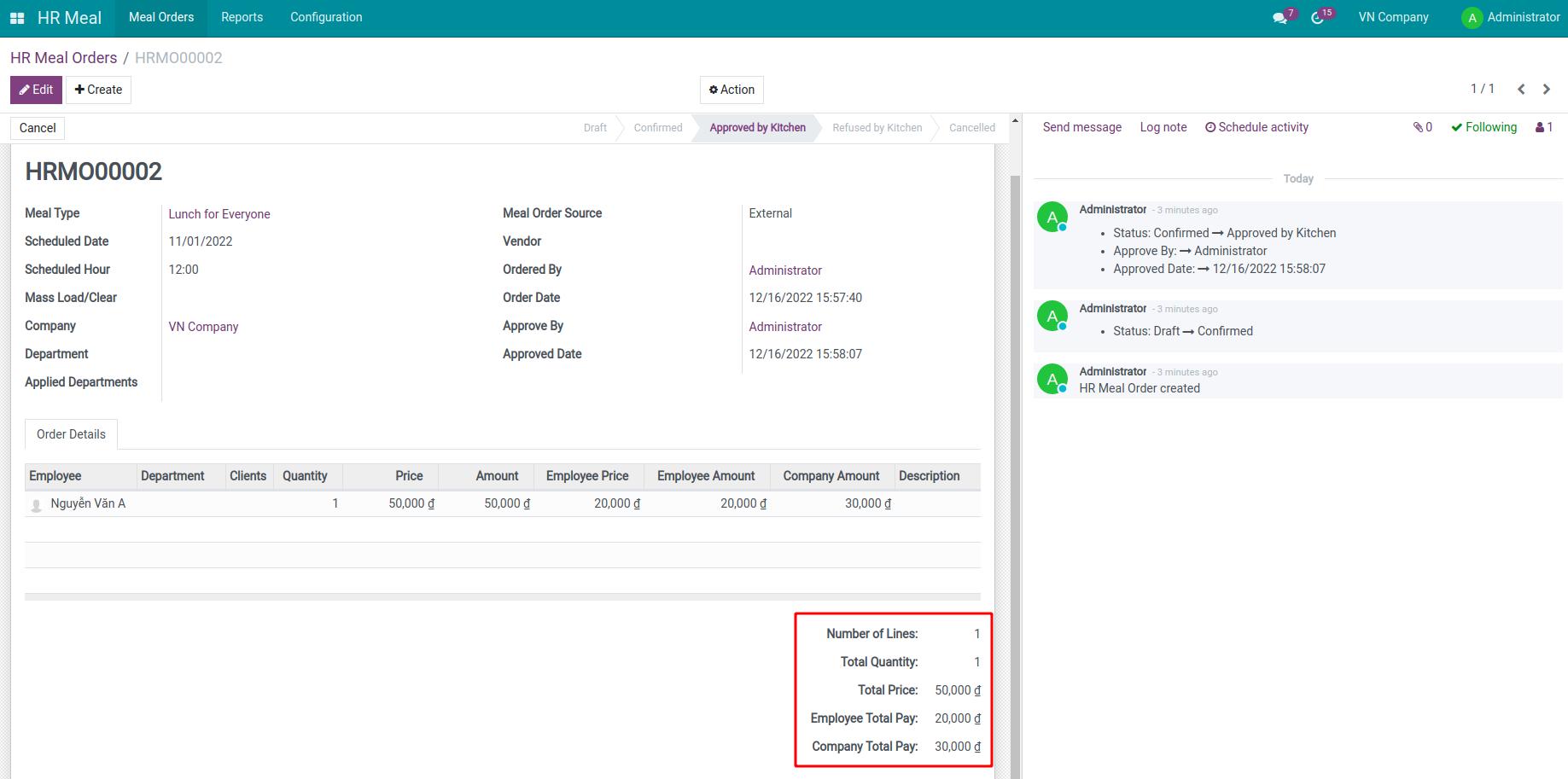

Create a meal order

The person in charge of the meal will navigate to HR Meal > Meal Orders > Create to create Meal Orders , at Order Details tab, you declare the amount the employee will pay.

After completing the information click Confirm. The meal manager checks the information and proceeds Approve meal orders to finalize the number of meals delivered to the supplier.

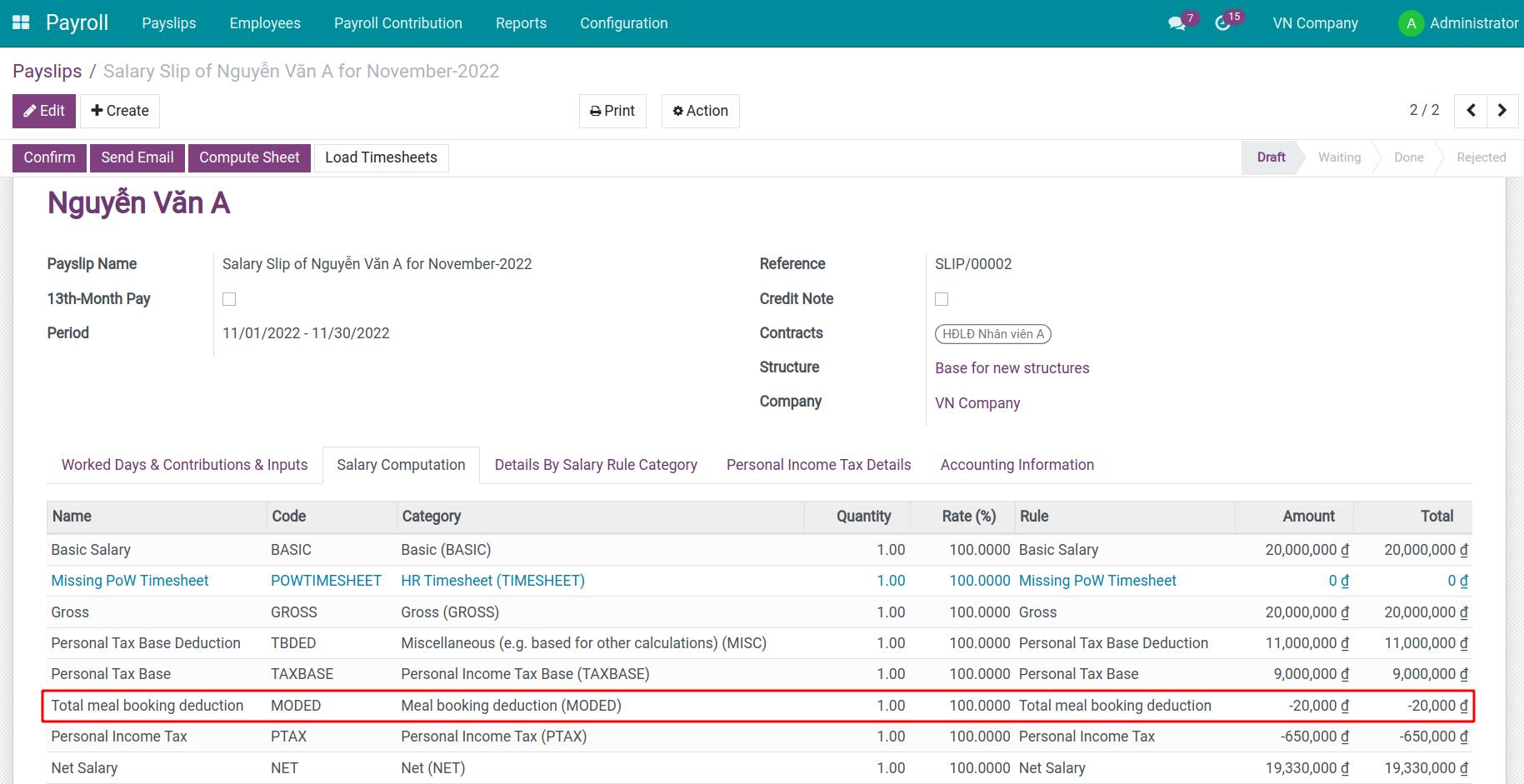

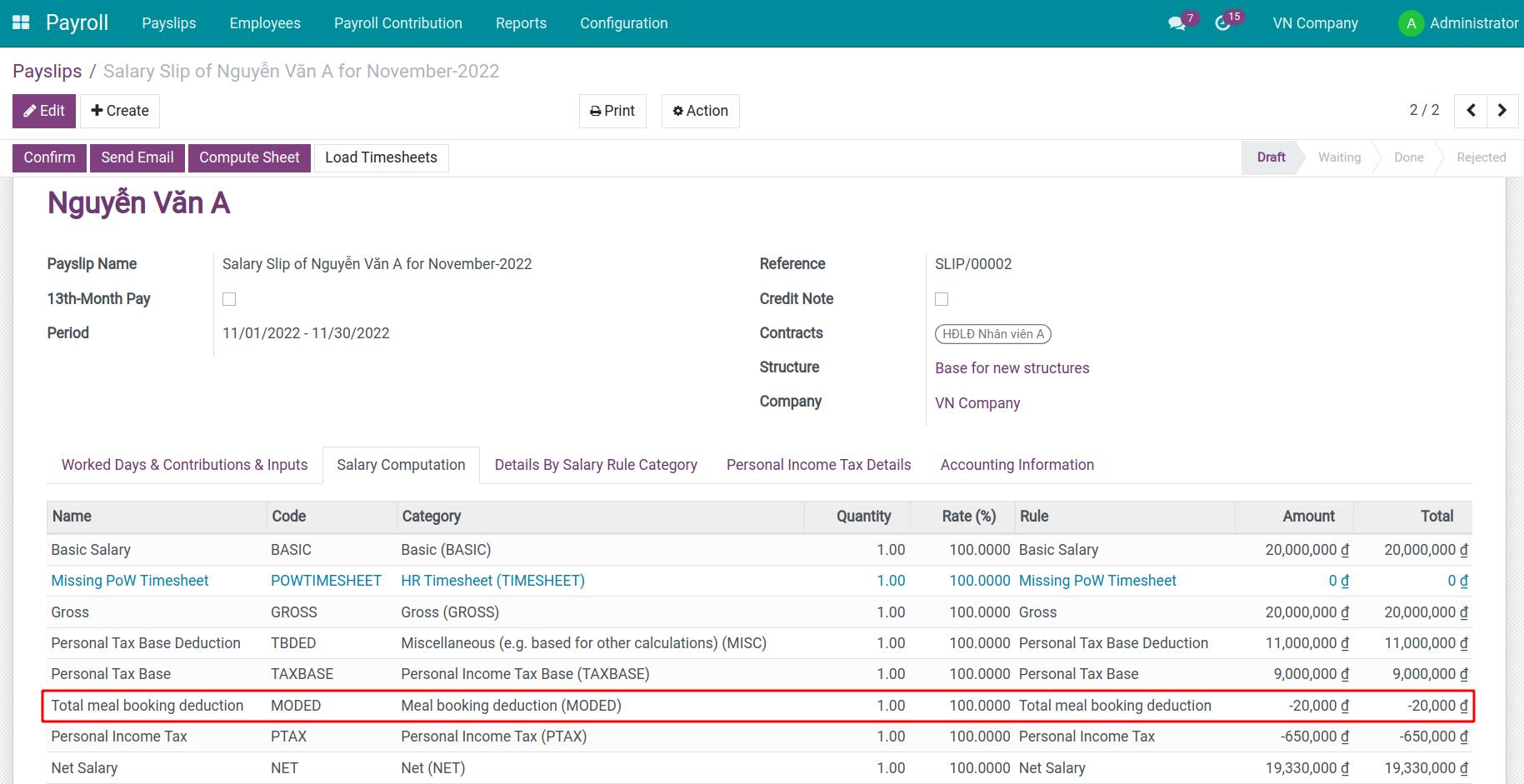

Create a payslip and confirm

After checking the information on the payslip and confirming it, the employee will have the meal deducted right on the payslip.

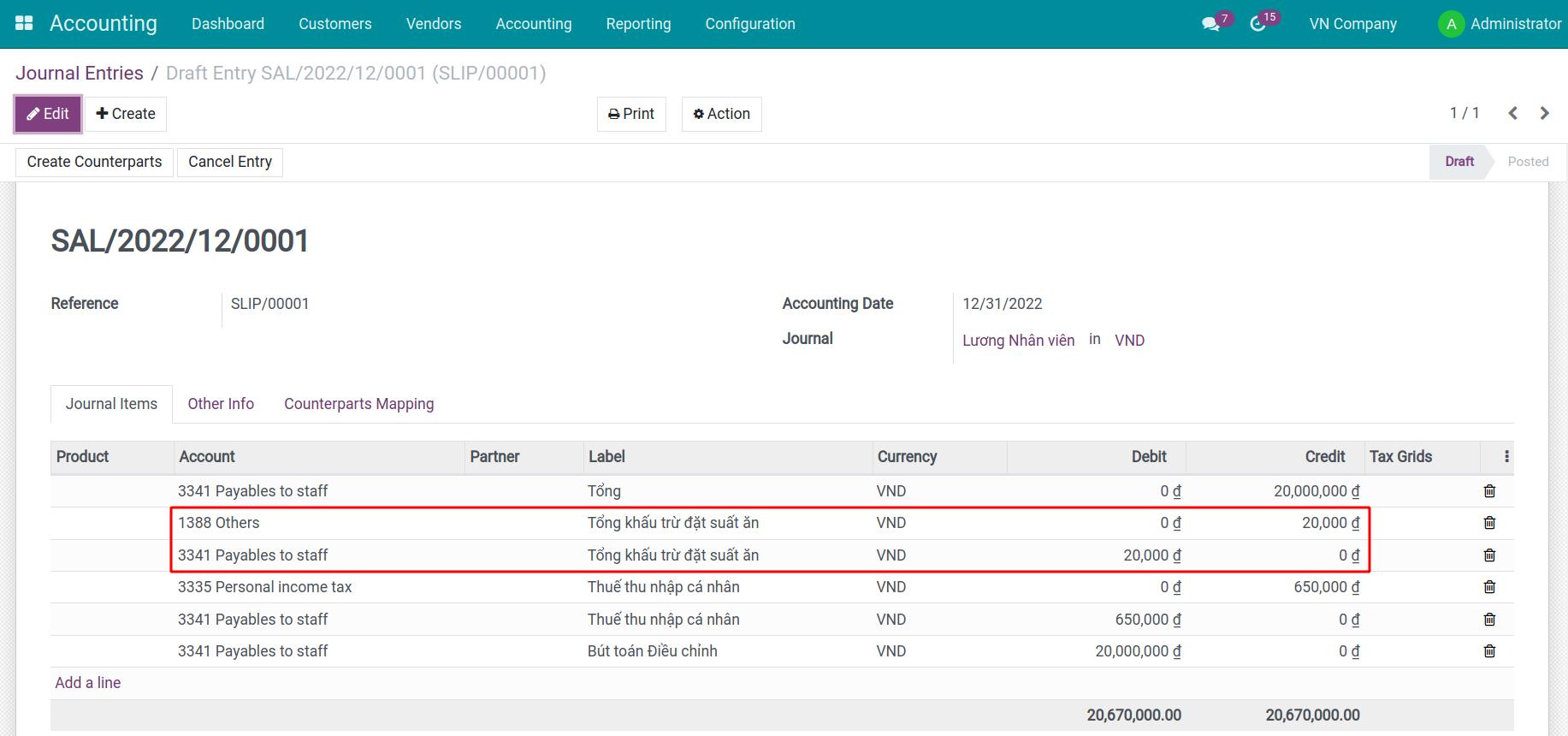

At the same time, the system will generate a draft accounting entry for this payslip. Switch to Accounting Information tab, select Journal Items to view details.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.