Demo video: Legal Invoice Number

The Legal Invoice Number Module is a versatile solution designed to enhance invoice management by adding the ability to manage and track legal VAT invoice numbers. This module is particularly useful for businesses operating in countries where VAT invoice numbers are required to comply with electronic invoicing regulations.

Why is Legal Invoice Number Important?

In many countries, electronic invoices must include a unique legal VAT invoice number to meet tax compliance requirements. This number is essential for:

- Ensuring the authenticity and validity of invoices.

- Facilitating tax reporting and audits.

- Enhancing transparency and communication between businesses and tax authorities.

Without proper handling of VAT invoice numbers, businesses may face compliance risks, including penalties or delays in tax filings. This module provides a robust solution to ensure your invoicing system meets these requirements efficiently.

Key Features

- Legal Number Field for Invoices:

Add a dedicated field for legal VAT invoice numbers, allowing businesses to input, track, and manage them accurately.

- Seamless Integration with Accounting:

Fully integrates with the accounting module, ensuring a smooth workflow without disruptions.

- Search and Retrieve Invoices:

Quickly locate invoices using their legal VAT numbers for reporting, audits, or customer inquiries.

- Flexibility Across Regions:

Designed to support businesses in multiple countries, enabling compliance with local VAT regulations.

- Designed for Electronic Invoicing:

Ideal for integration with electronic invoicing systems where legal invoice numbers are mandatory.

Benefits

- Regulatory Compliance:

Ensure adherence to tax laws in regions requiring legal VAT invoice numbers.

- Improved Efficiency:

Simplify invoice management and retrieval processes, saving time and reducing errors.

- Enhanced Transparency:

Provide clear and traceable invoicing records for internal and external stakeholders.

- Scalability:

Ideal for integration with advanced e-invoicing systems as your business grows.

- Global Applicability:

Tailored to meet the requirements of businesses operating in various countries with legal VAT invoice number regulations.

Who Should Use This Module?

This module is ideal for:

- Businesses operating in regions with VAT invoice number requirements.

- Accounting teams managing invoices and requiring streamlined compliance with tax regulations.

- Organizations looking to enhance their invoicing systems for better transparency and efficiency.

Editions Supported

- Community Edition

- Enterprise Edition

Installation

- Navigate to Apps.

- Search with keyword to_legal_invoice_number.

- Press Install.

Instruction

Instruction video: Legal Invoice Number

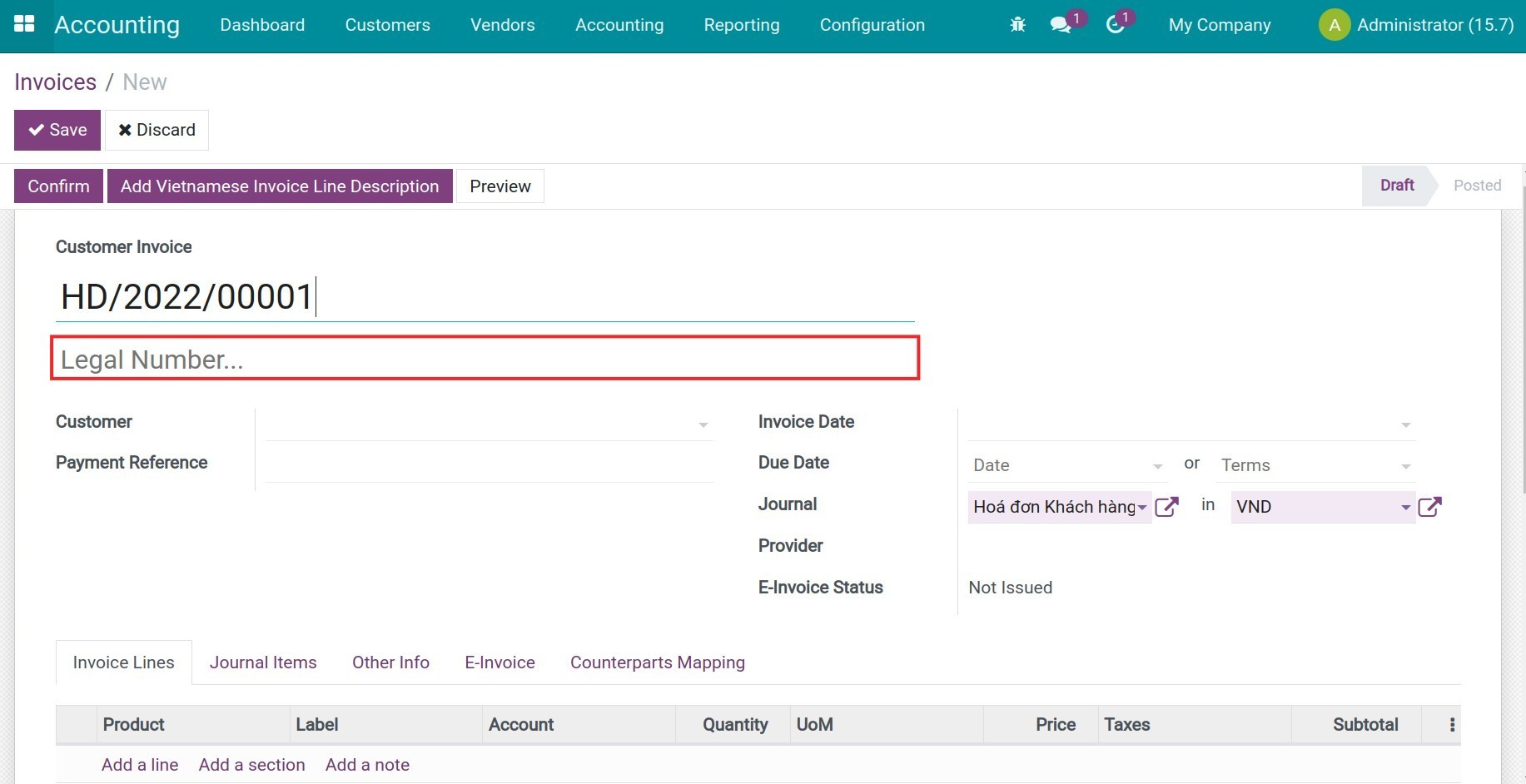

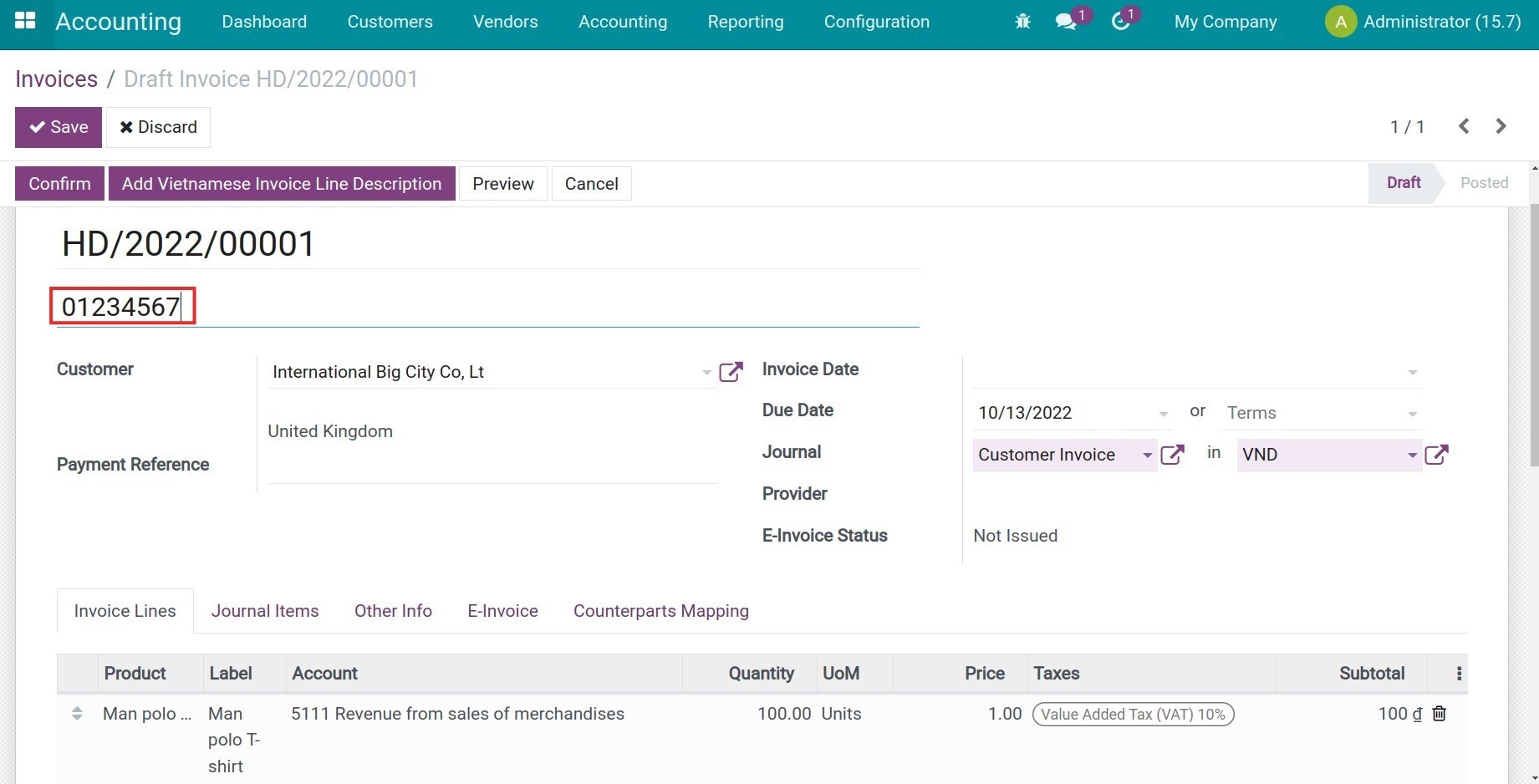

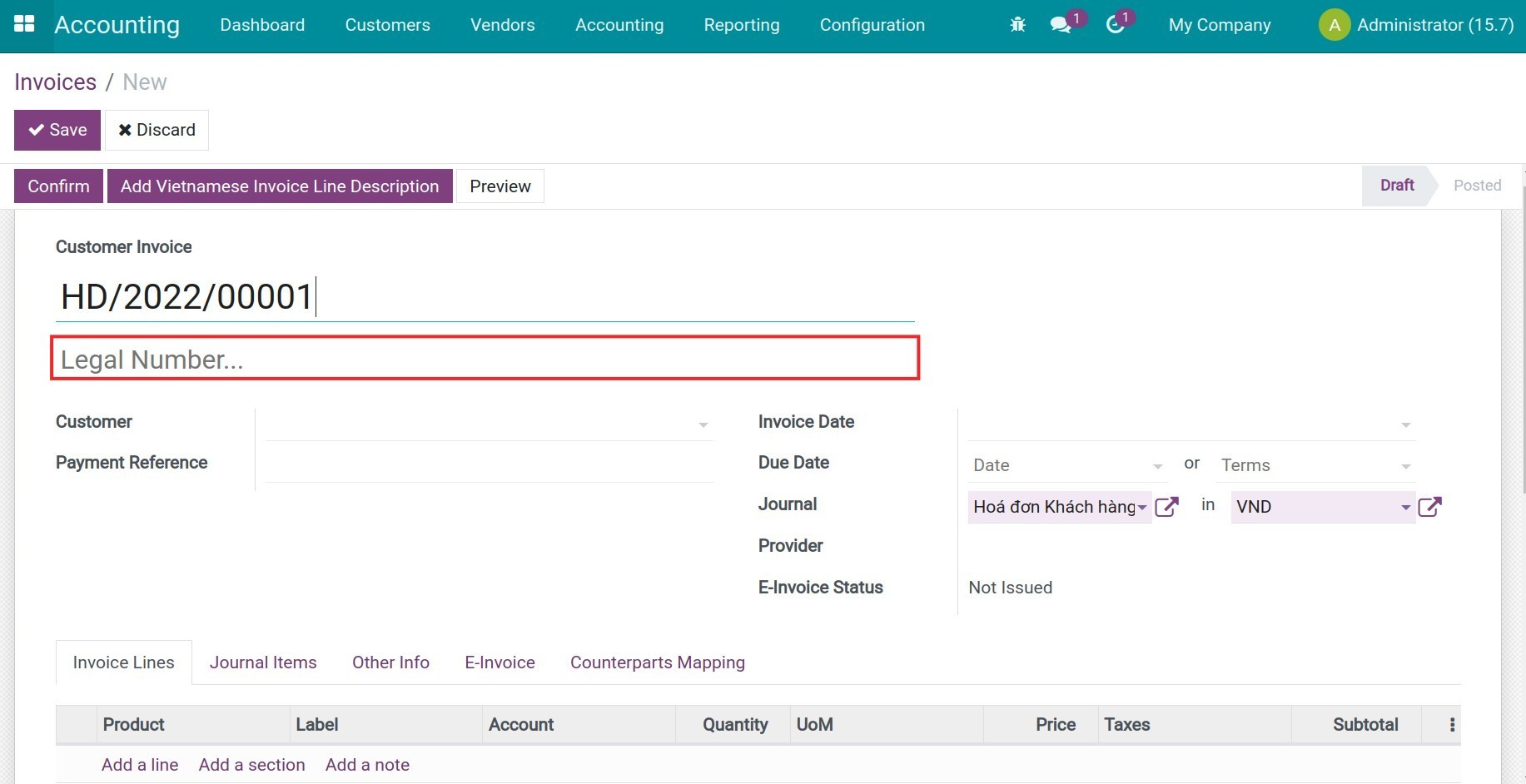

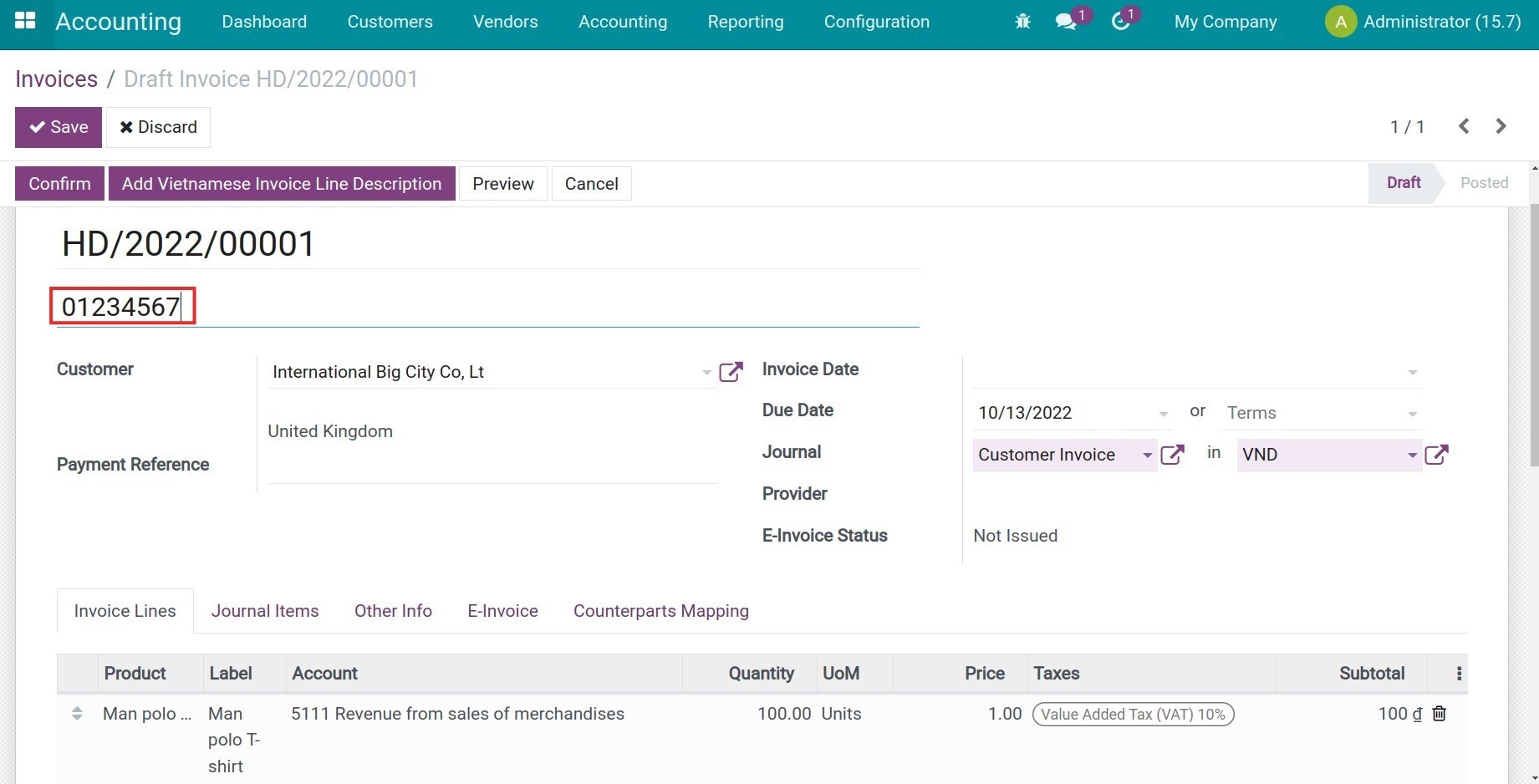

Add a Legal Number

After installing this module, the Legal Number field will be displayed on the invoice interface.

Add a Legal Number for this invoice and save it.

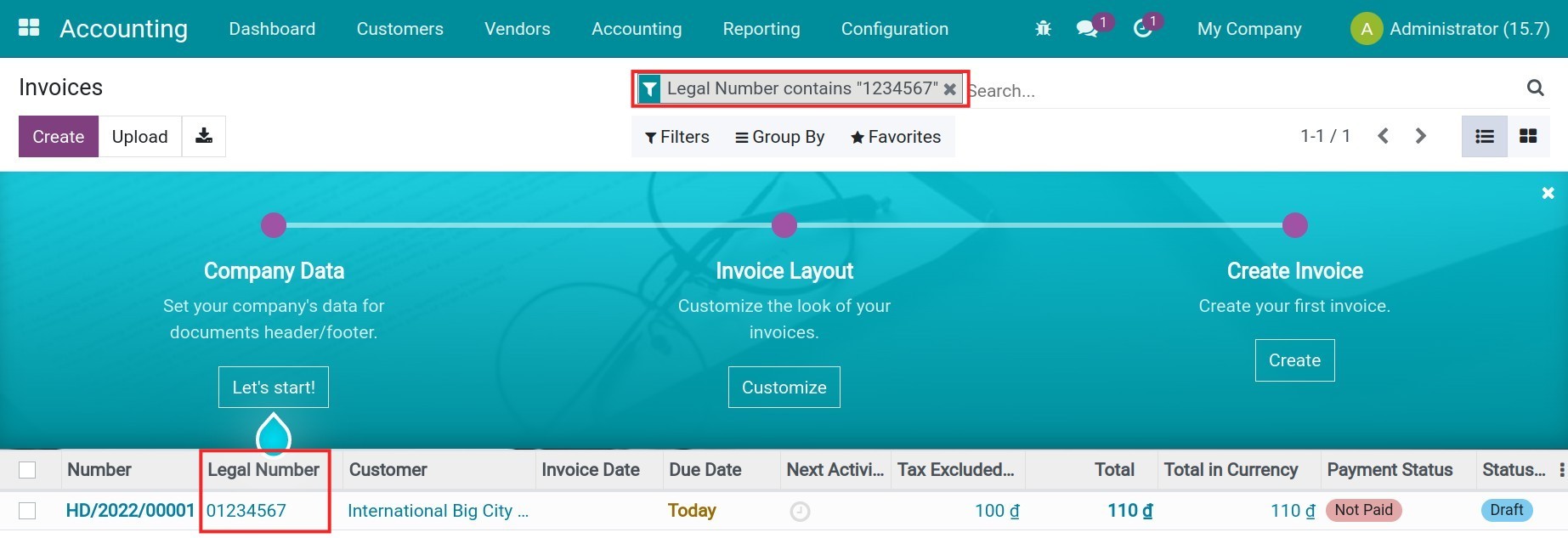

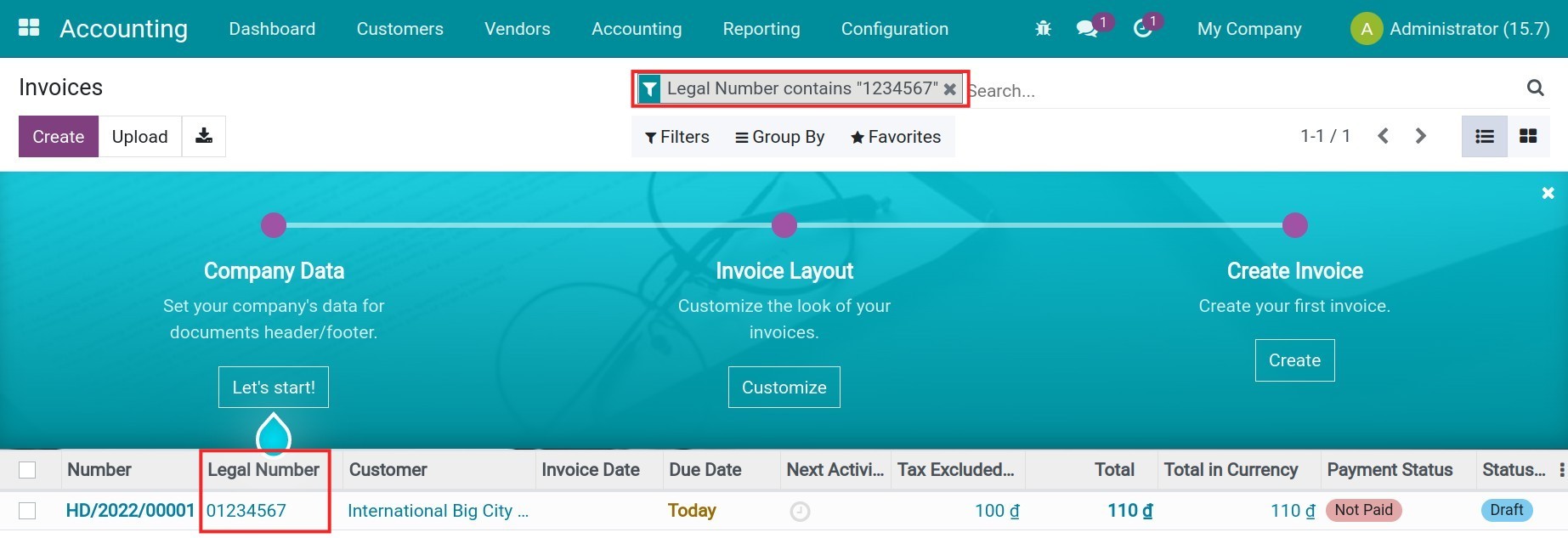

Manage invoices by legal number

On the invoices list, use the filter and grouping tool to categorize and search for an invoice using the Legal Number.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.