Demo video: Vietnam - Account Assets Sales

Problem

When liquidating asset, businesses create invoices to record in the system and send to buyers.

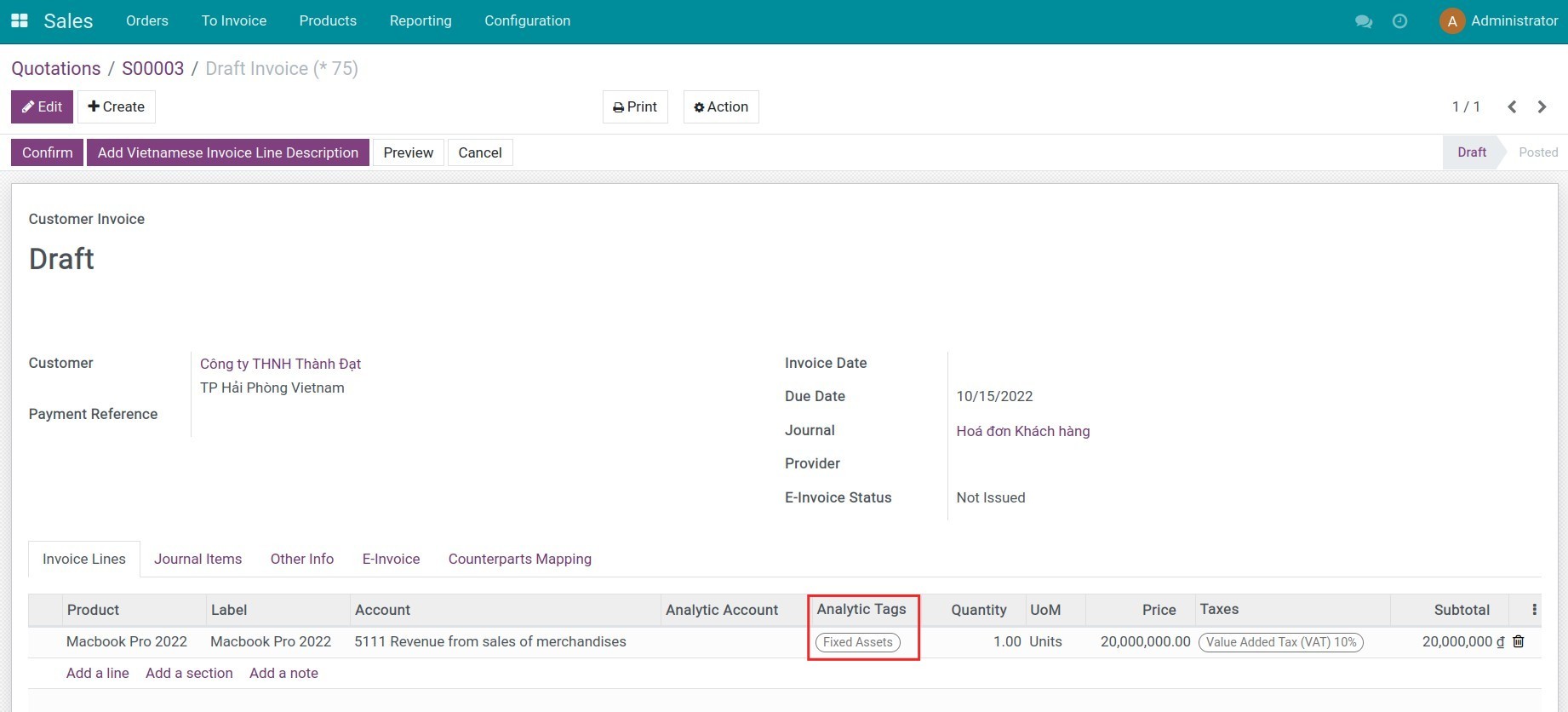

However, on the invoice view, the system cannot automatically fill the analytic tag for the product to be sold. (The analytic tag was configured on the asset category. For example: tangible fixed assets, trading securities, etc.).

At this point, users have to manually fill the product's analytic tag when creating invoices or make additional edits later to complete financial statements. This can cause omission, confusion or unnecessary waste of time in the accounting process.

Solution

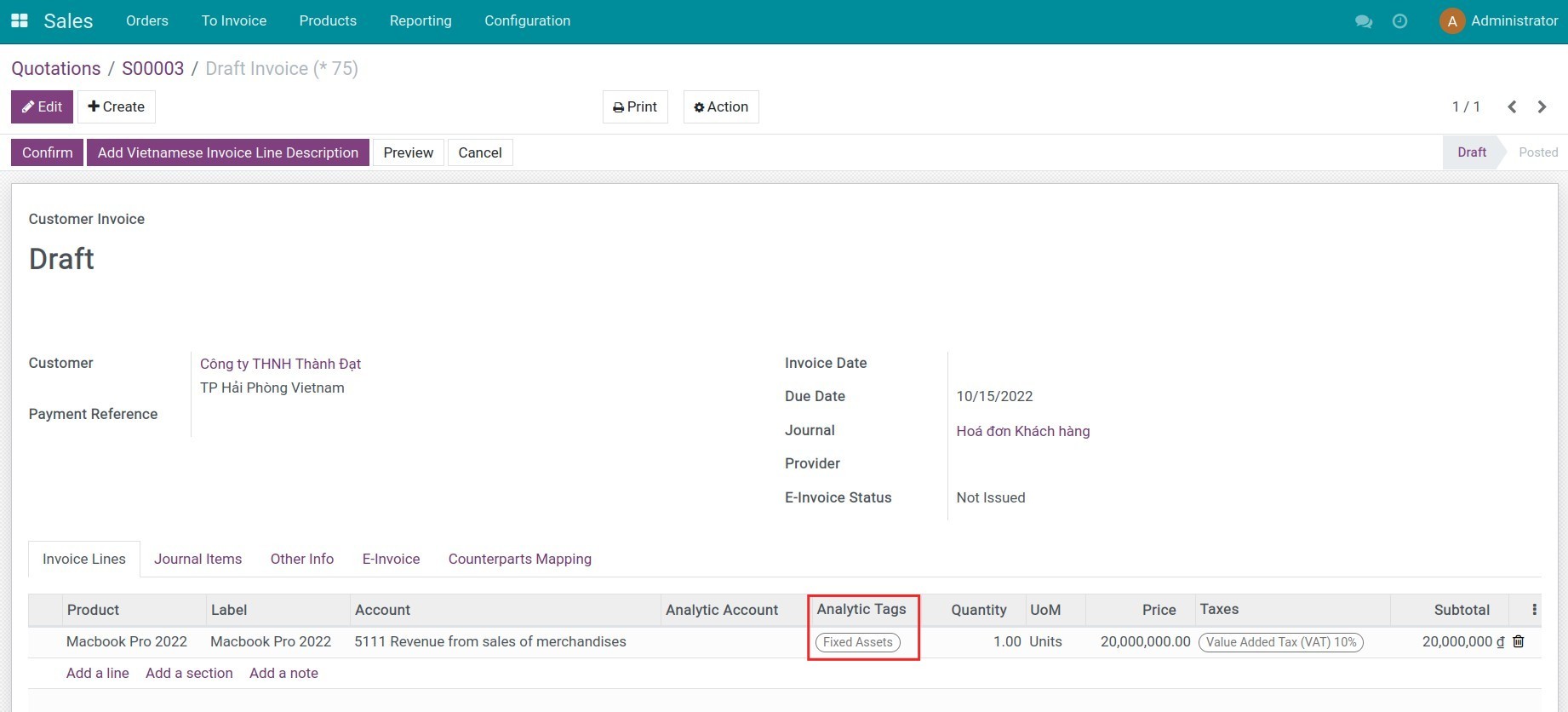

Module l10n_vn_viin_account_asset_sale provides the feature to fill automatically the analytic tag configured on asset categories set on the product when creating customer invoices from the sales order.

The ERP system will summarize the data according to the analytic tags to display on the financial statements. Therefore, accountants save time and increase accuracy in the accounting process.

Editions Supported

- Community Edition

- Enterprise Edition

Installation

- Navigate to Apps.

- Search with keyword l10n_vn_viin_account_asset_sale.

- Press Install.

Instruction

Instruction video: Vietnam - Account Assets Sales

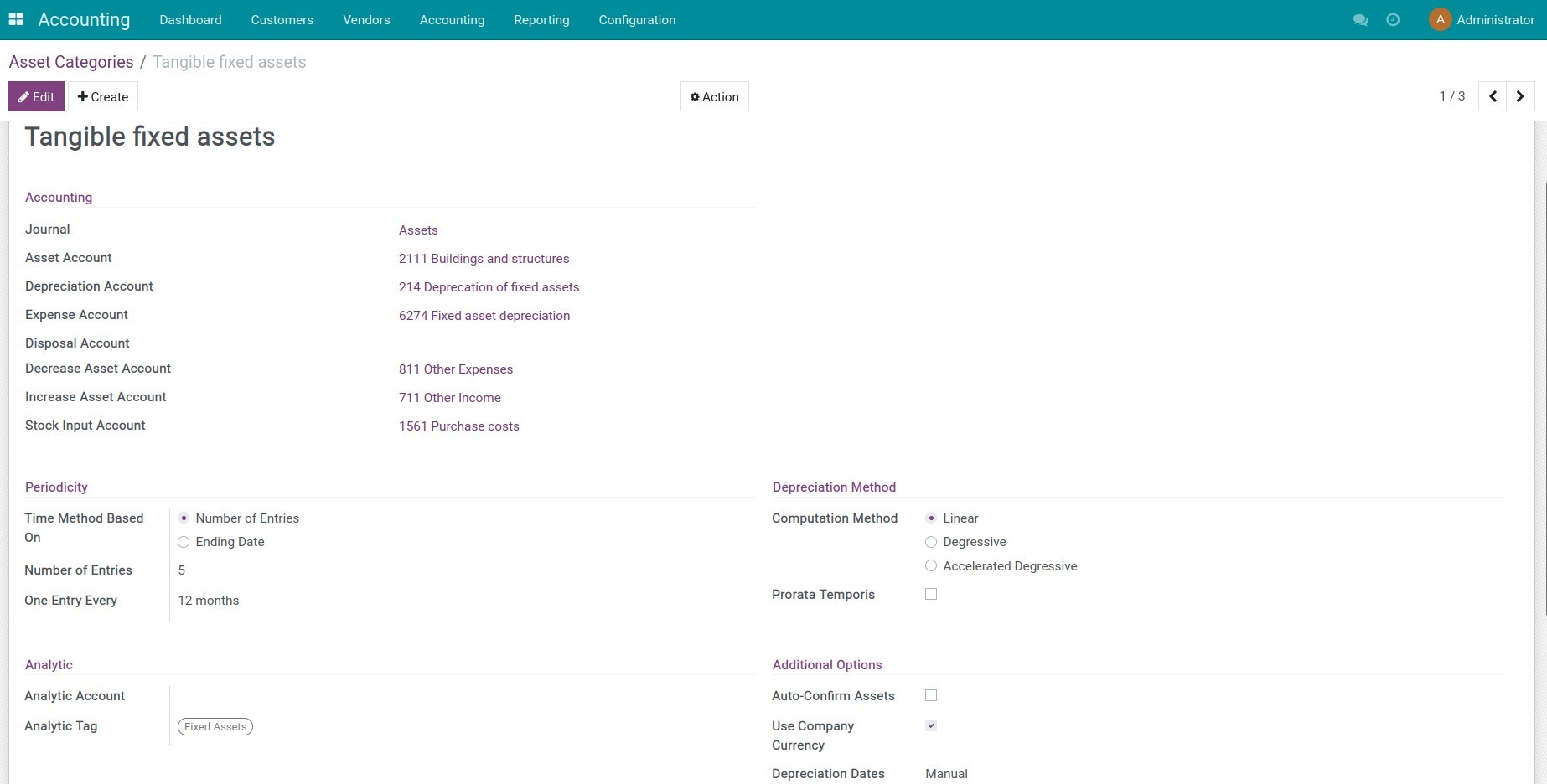

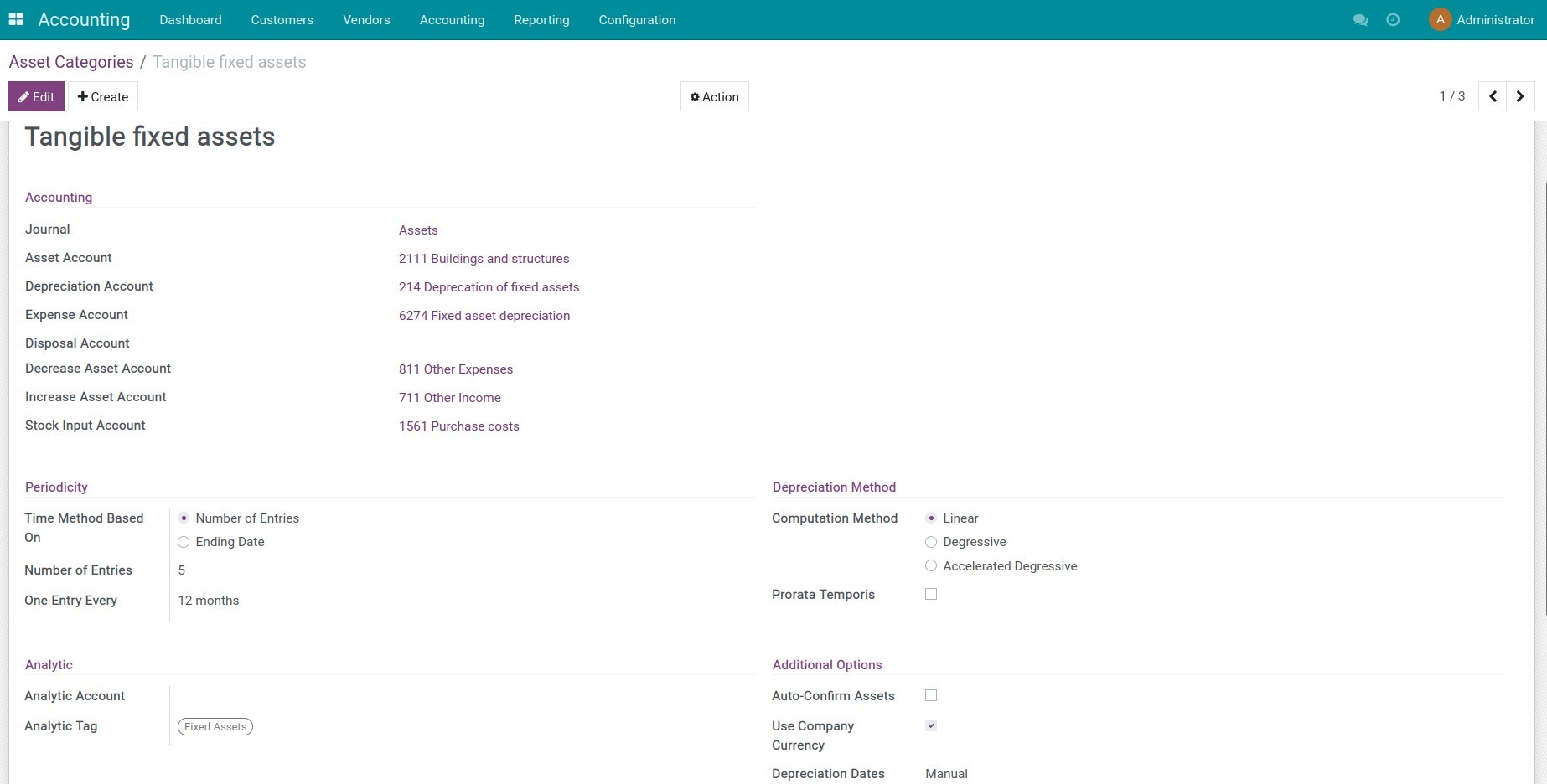

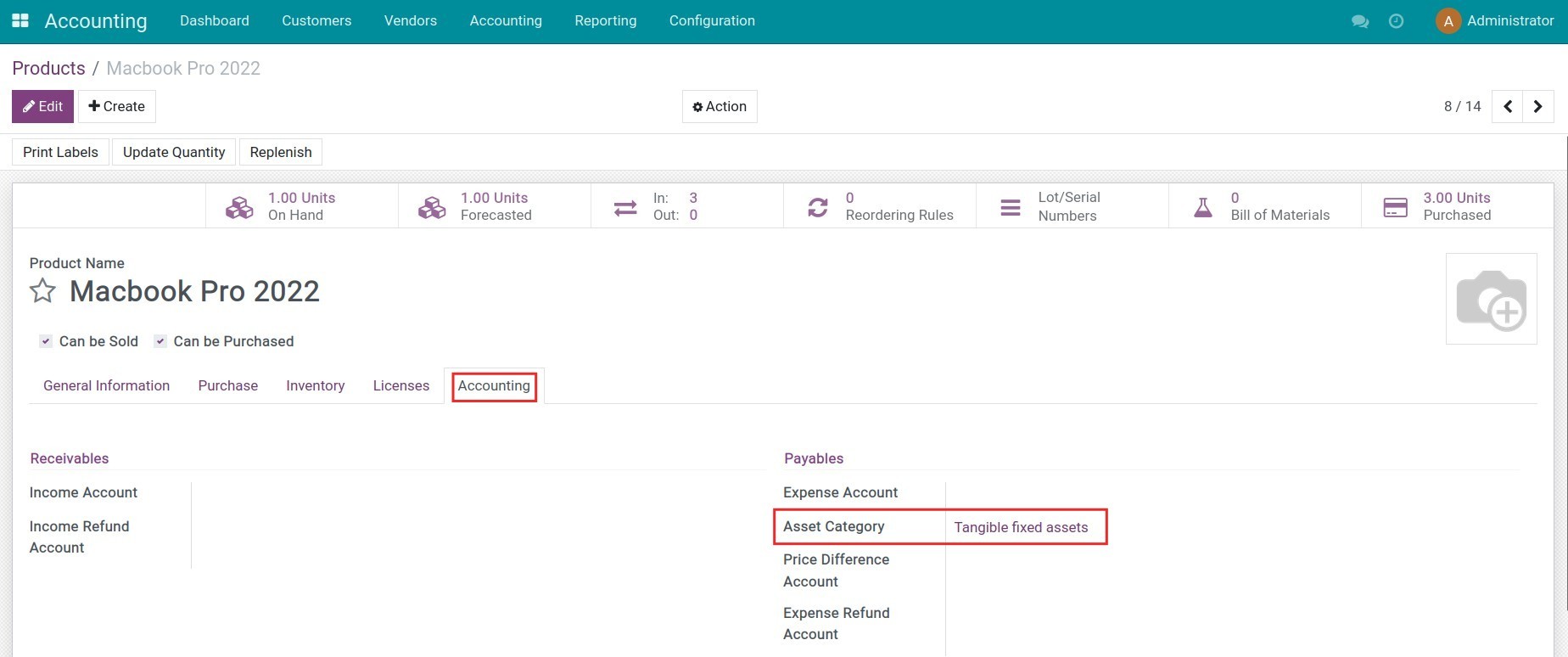

1. Create asset category and link with a product

Navigate to Accounting > Configuration > Asset Categories, press Create to create a new asset category.

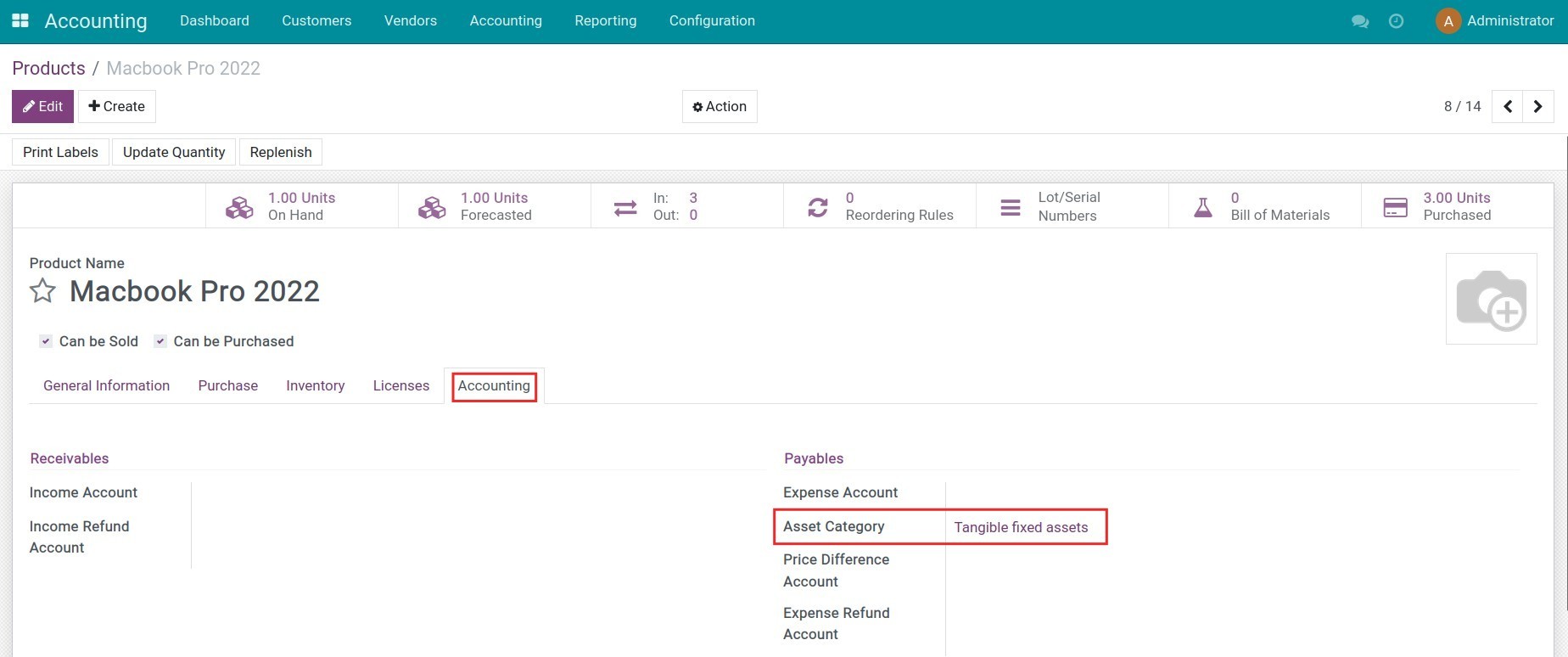

On the product view, select the suitable asset category for the product in the Accounting tab.

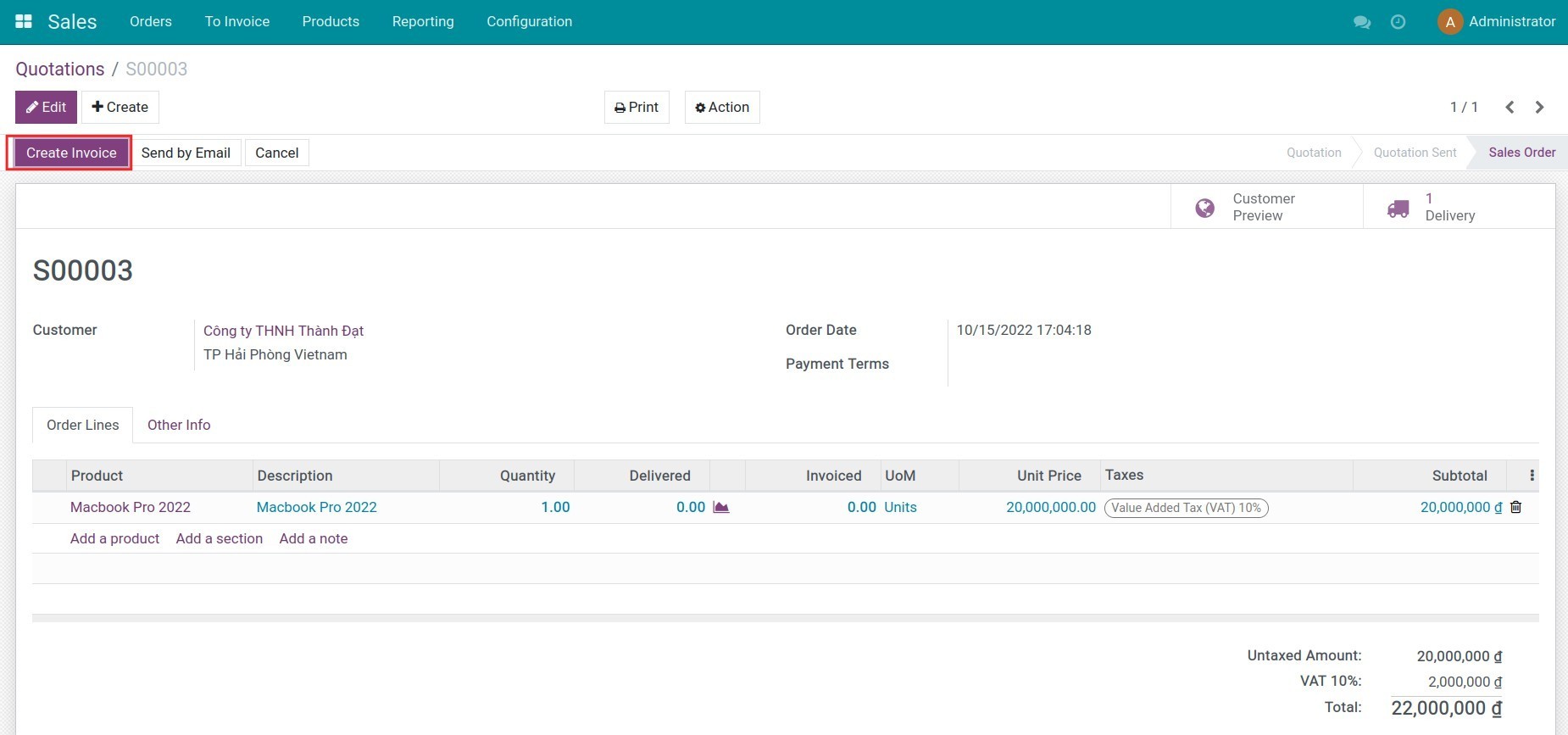

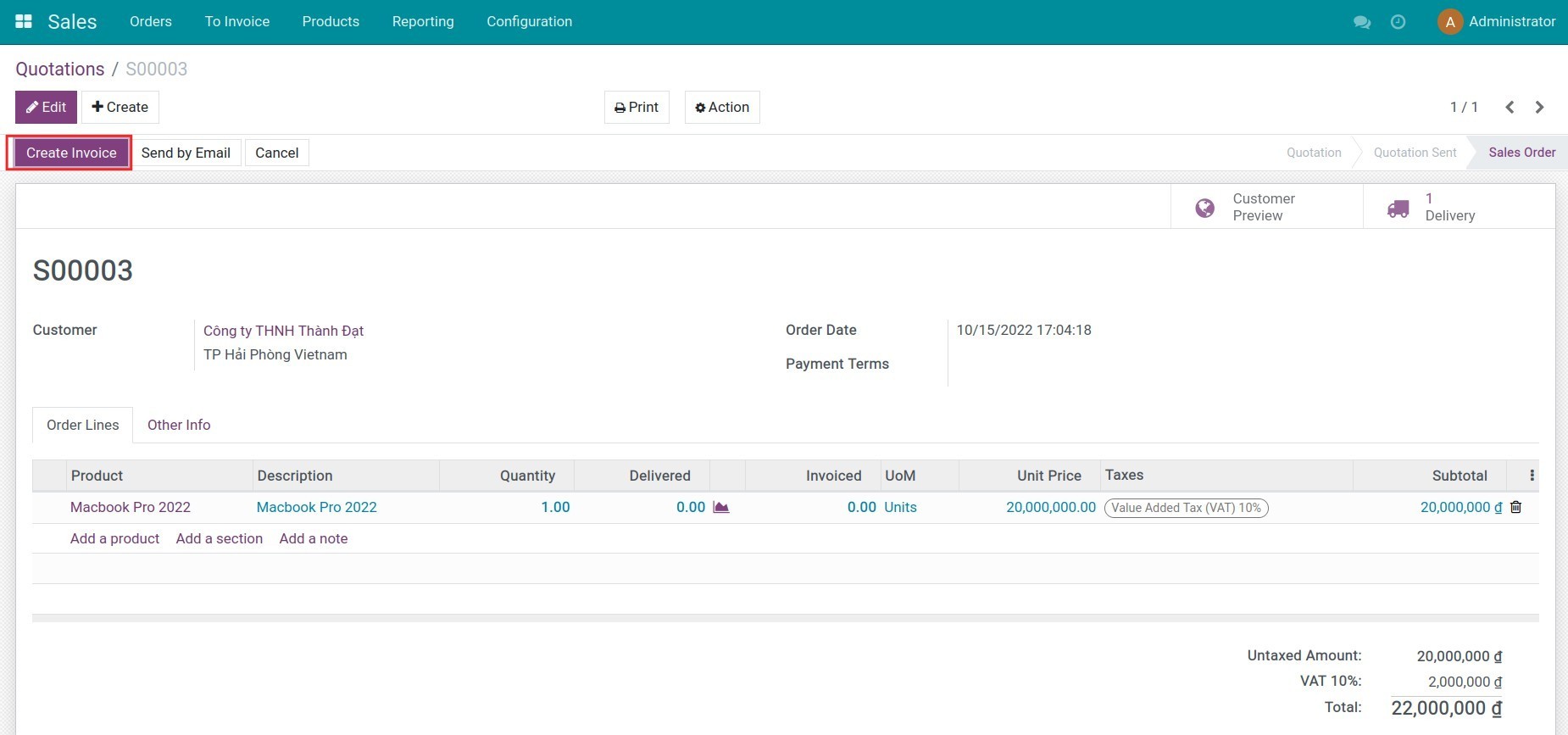

2. Create an invoice for the asset sales order

Create a sales order. On the purchase order view, press Create Invoice to create a customer invoice. On the invoice line, the analytic tags configured on the asset category will be automatically recognized and displayed accordingly.

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.